The “Magnificent Seven” group of stocks is a phrase coined by CNBC’s Jim Cramer to describe the group of stocks that has led the market in recent years. It is made up of:

- Nvidia (NASDAQ: NVDA)

- Apple (NASDAQ: AAPL)

- Microsoft (NASDAQ: MSFT)

- Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL)

- Amazon (NASDAQ: AMZN)

- Meta Platforms (NASDAQ: META)

- Tesla (NASDAQ: TSLA)

If you invested in this group of stocks a couple of years ago, your returns would have been outstanding and market-crushing. However, alongside that run-up has come with increased valuations, and many of the “Magnificent Seven” cohort have gotten pricey on a valuation basis.

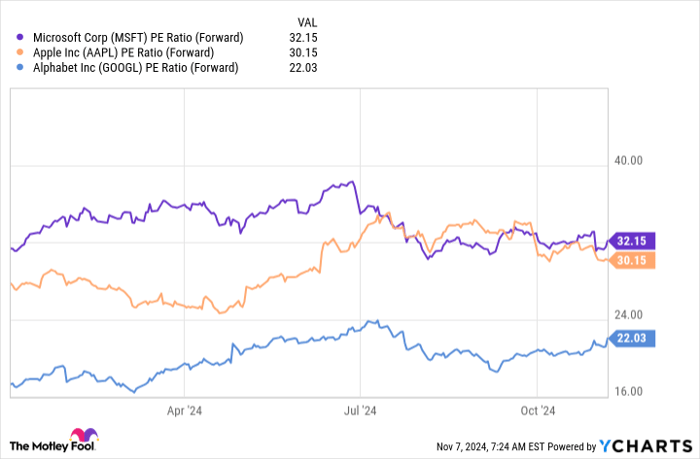

One stock that hasn’t received an ultra-premium valuation is Alphabet. In fact, it’s the cheapest member of the “Magnificent Seven” when the price-to-forward-earnings ratio is used. At just 22 times forward earnings, Alphabet is actually cheaper than the broader market (measured by the S&P 500 (SNPINDEX: GSPC)), which trades at 23.8 times forward earnings.

So, is Alphabet stock a screaming buy, or is it a value trap?

Alphabet just posted a strong Q3

Alphabet is likely better known as Google’s parent company. Although Alphabet does many things, its most important business segment by far is advertising, as 75% of its revenue comes from ad-related sources. The biggest source is the Google search engine, but YouTube ads also play a sizable role.

Advertising isn’t a huge growth driver for the business; it’s what keeps the lights on. However, in Q3, it did fairly well, with ad revenue rising 10.4% year over year. This strong baseline performance in its largest segment allows it to invest in other areas to drive growth. One of the most successful ancillary segments is Google Cloud, its cloud computing wing.

According to Synergy Research Group, Google Cloud is third place in market share in the cloud computing market. However, it’s also growing the fastest, as it grew revenue by 35% year over year. It also delivered strong operating margins of 17%, which is a massive improvement over last year’s 3.2% margin. While it still has a ways to go to catch the industry-leading margins of its top competitor, Amazon Web Services (AWS), (which posted 38% operating margins in Q3) it shows Google Cloud can still vastly improve its profitability.

Google Cloud’s strength can be traced directly to artificial intelligence (AI) demand, as its platform has quickly become one of the top choices for building AI models. Google Cloud’s industry-leading tools allow customers to cut costs to run AI models, thanks to the combination of GPUs and TPUs (tensor processing units, Google’s custom AI chip that provides far superior performance to GPUs).

If Alphabet had the same valuation as its peers, it would be vying for a spot as the world’s largest company

Alphabet’s Q3 was phenomenal companywide, with revenue rising 15% year over year, compared to 11% growth in 2023. However, thanks to various efficiency measures, Alphabet’s operating margin improved by four percentage points to 32%, which boosted earnings per share (EPS) from $1.55 last year to $2.12 this year — a 37% gain.

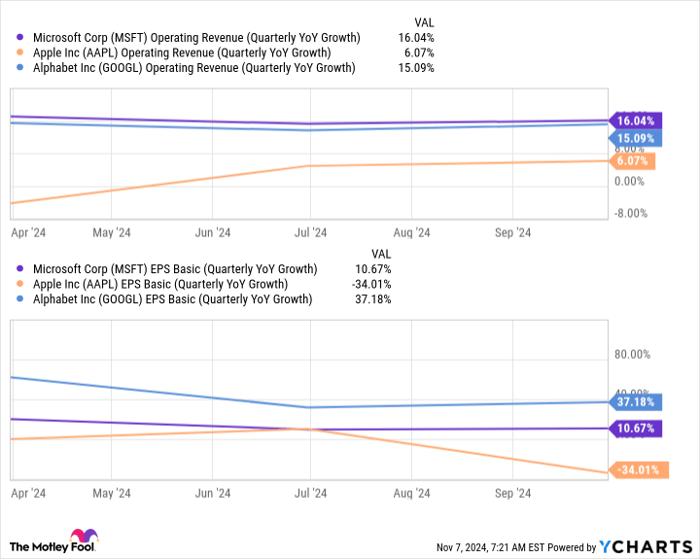

This performance far outclasses other “Magnificent Seven” stocks like Microsoft and Apple, which each posted smaller earnings growth than Alphabet did (Apple was hit with a one-time tax charge during its last quarter; without that effect, it would have grown EPS by 12%).

MSFT Operating Revenue (Quarterly YoY Growth) data by YCharts

If you look at the chart, it’s clear that Alphabet has also been outperforming these two for the whole year, yet Alphabet’s stock trades at a significant discount to these two.

MSFT PE Ratio (Forward) data by YCharts

If Alphabet traded for Microsoft’s valuation, it would be worth $3.17 trillion — more valuable than Microsoft, which had a market cap of $3.12 trillion at the time of writing.

Despite its dominance, Alphabet doesn’t get the same respect as other big tech companies. As a result, I think it makes it a great stock to buy, as the valuation risk for owning Alphabet stock isn’t there (unlike its peers). With its cheap stock price and strong growth potential, Alphabet is well positioned to crush the market over the next few years. As a result, I think it’s the top “Magnificent Seven” stock to buy right now.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $904,692!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of November 11, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet, Amazon, Meta Platforms, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.