- The rally in the stock market is showing no signs of slowing down due to the ongoing AI boom.

- Identifying strong-buy momentum stocks with solid growth prospects and significant upside potential becomes paramount in the current environment.

- As such, investors should consider adding Zoom Video Technologies and Twilio to their portfolio.

- Looking for more actionable trade ideas? Subscribe here for up 55% off as part of our Early Bird Black Friday sale!

As Nvidia (NASDAQ:) continues to dominate headlines, it’s worth considering other companies making significant strides in artificial intelligence (AI).

Two promising contenders are Zoom Video Communications (NASDAQ:) and Twilio (NYSE:), which leverage AI to expand their offerings and unlock future growth. Both companies have demonstrated impressive market performance, rallying sharply in recent months and nearing 52-week highs.

Source: Investing.com

Source: Investing.com

Moreover, they remain undervalued, with InvestingPro models indicating significant double-digit upside potential for both Zoom and Twilio.

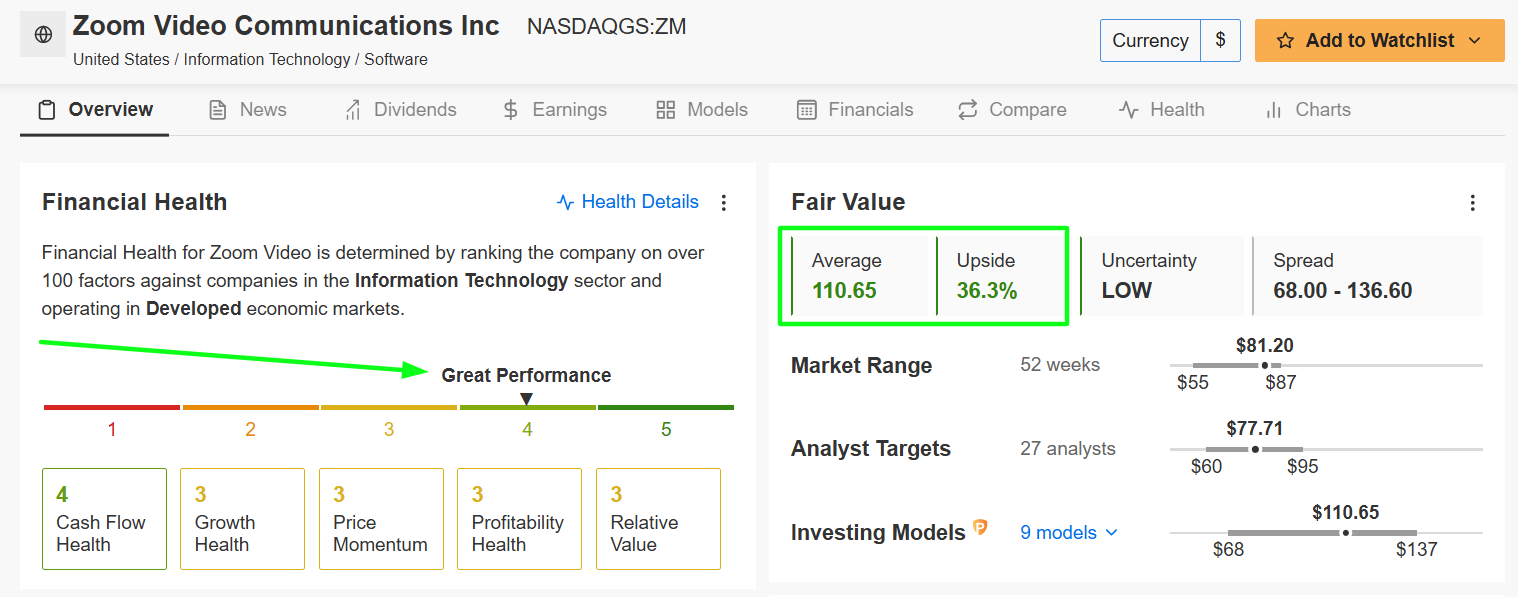

1. Zoom Video Communications

- Current Price: $81.20

- Fair Value Price Target (NYSE:): $110.65 (+36.3% Upside)

- Market Cap: $25 Billion

Zoom, widely recognized for its video conferencing platform, has evolved into a comprehensive communication ecosystem. Its AI-driven tools, such as real-time transcription, meeting summaries, and noise cancellation, have enhanced productivity for users.

The company has also launched AI Companion, an intelligent assistant designed to automate tasks, offer insights, and improve meeting efficiency.

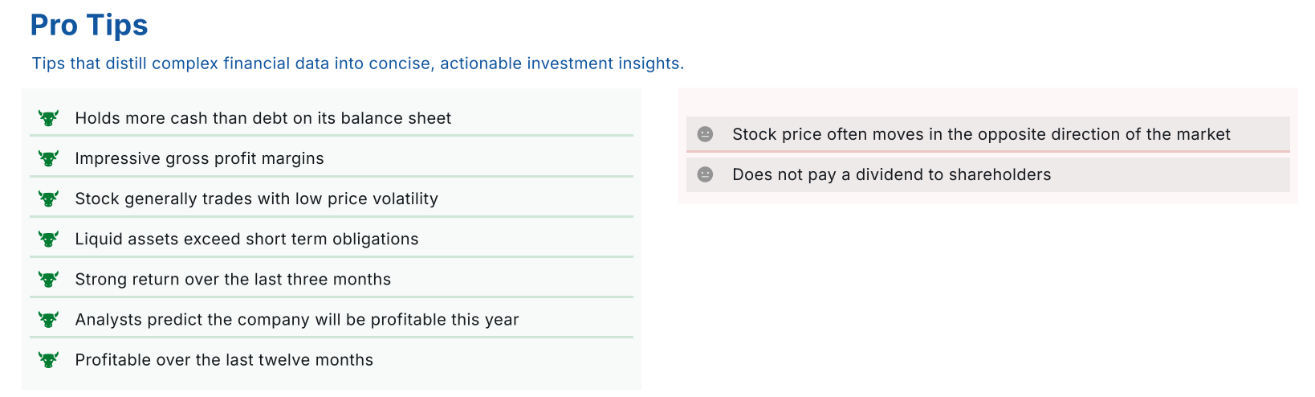

As InvestingPro Research points out, Zoom has several tailwinds that are expected to drive its stock higher in the coming months, with highlights including a healthy balance sheet, impressive gross profit margins, and consistently increasing earnings per share.

Source: InvestingPro

Furthermore, its valuation metrics remain appealing, with the stock offering considerable upside potential as businesses increasingly adopt AI-driven collaboration solutions.

Taking that into consideration, now could be a good time to snap up shares as ZM trades at a bargain valuation, according to the InvestingPro model, which implies potential upside of 36.3%. Such a move would take Zoom’s stock to $110.65 from last night’s closing price of $81.20.

Source: InvestingPro

At current valuations, the San Jose, California-based video-conferencing specialist has a market cap of $25 billion. Shares have gained 12.9% year-to-date.

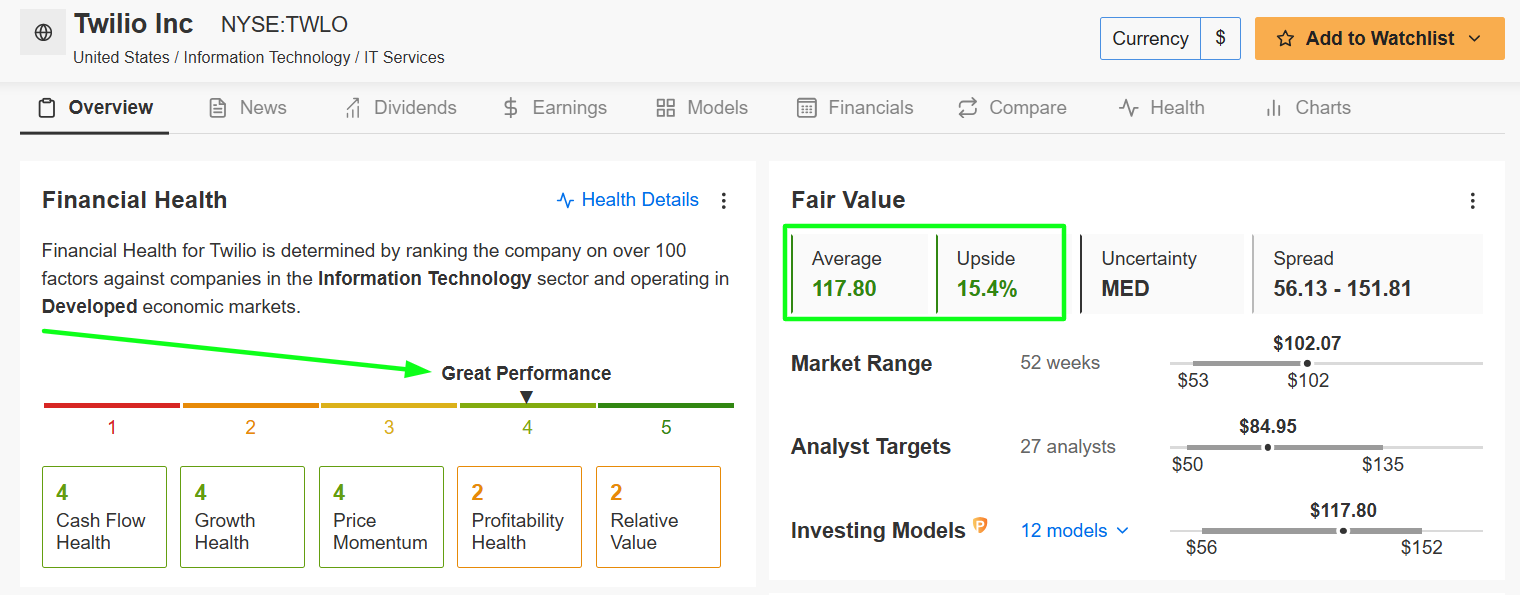

2. Twilio

- Current Price: $102.07

- Fair Value Price Target: $117.80 (+15.4% Upside)

- Market Cap: $15.7 Billion

Twilio specializes in cloud communication services, enabling developers to embed messaging, voice, and video functionality into their applications. The company is widely viewed as one of the leading names in the communication platform-as-a-service (CPaaS) sector and counts big names like Uber (NYSE:), Airbnb, DoorDash (NASDAQ:), eBay (NASDAQ:), and Reddit as customers.

Recently, Twilio has integrated generative AI into its CustomerAI platform, offering businesses enhanced tools for personalized customer engagement. These capabilities include sentiment analysis, chatbots, and predictive insights.

The company’s push into AI-powered customer experience tools aligns with growing demand for personalization in communication. Twilio’s partnerships and expanding enterprise footprint further solidify its long-term growth potential, with the stock trading at an attractive valuation.

Source: InvestingPro

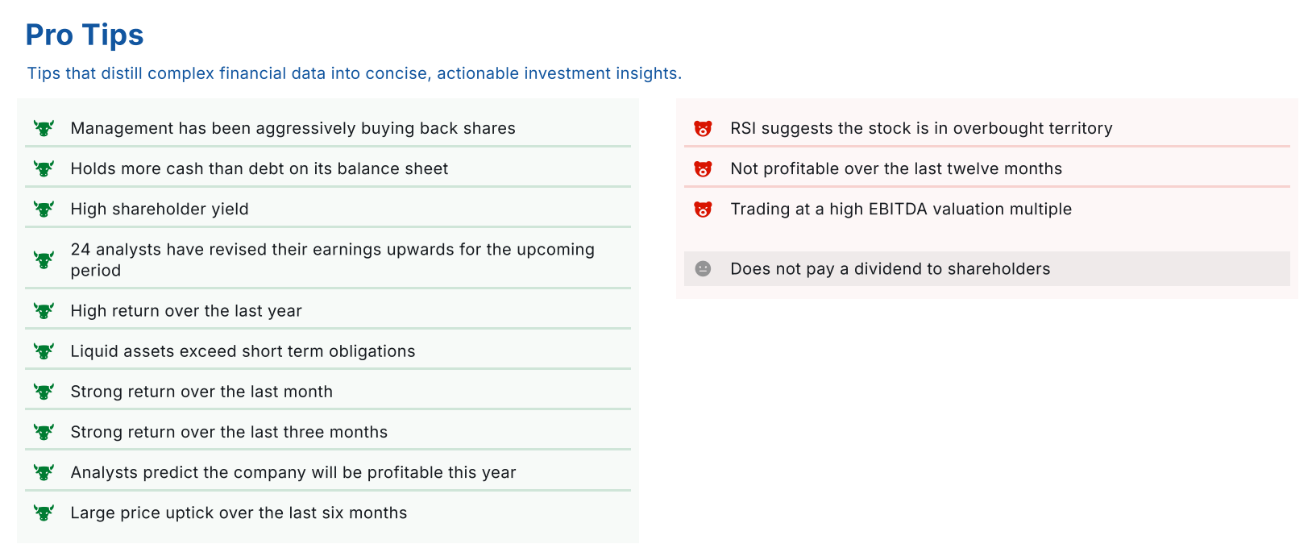

As such, Twilio’s dominant market presence and cheap valuation may present a promising prospect for long-term investors. According to AI-powered Fair Value models from InvestingPro, TWLO has an upside potential of 15.4%.

As noted below, Pro Research underscores numerous favorable factors poised to propel Twilio’s upward trajectory, such as strong profitability prospects and a robust financial position. Additionally, it points out Twilio’s management’s proactive share buyback initiatives in recent months.

Source: InvestingPro

These attributes position Twilio as a resilient player in the tech sector, ready to capitalize on the accelerating demand for AI and communications technology.

At current valuations, the San Francisco, California-based cloud communications software and services provider has a market cap of $15.7 billion. Shares have climbed 34.5% in 2024.

Conclusion

Both Zoom and Twilio are leveraging AI to enhance their core businesses while exploring new growth avenues. Their significant upside potential, according to InvestingPro, coupled with their position near 52-week highs, suggests continued momentum.

As AI adoption accelerates across industries, both Zoom and Twilio are well-positioned to deliver strong returns for investors seeking exposure beyond Nvidia.

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Subscribe now to get up to 55% off all Pro plans and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the via the SPDR® S&P 500 ETF, and the Invesco QQQ Trust ETF. I am also long on the Technology Select Sector SPDR ETF (NYSE:).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.