Markets React to REITs’ Struggle Amid Rate Cut Fears

It seems the new year has not brought good tidings for Real Estate Investment Trusts (REITs) as their start to 2024 has been marred by disappointment. Markets have been seemingly apprehensive about the likelihood of a rate cut, causing some turbulence in the REIT space. The FTSE Nareit All Equity REITs index, an important benchmark, suffered a 1.59% decline in the week ending Jan. 5, while the Dow Jones Equity All REIT Total Return Index was down 1.57%.

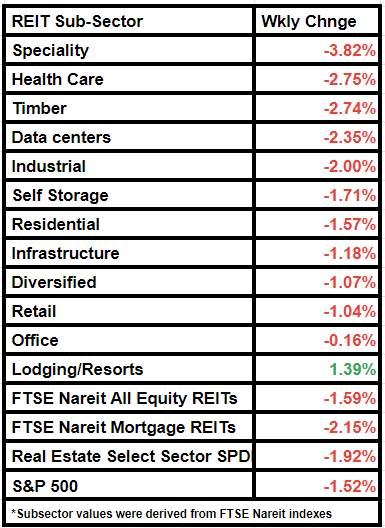

REITs have notably underperformed the broader markets, with the S&P 500 declining by 1.52% in comparison. In addition, the real estate index, Real Estate Select Sector SPDR ETF (NYSEARCA:XLRE), plummeted by 1.92% and mortgage REITs likewise decreased by 2.15% compared to the previous week. The XLRE, in particular, took a significant hit, with a growing skepticism about the potential for near-term rate cuts.

Market Dynamics and Influences

The overarching apprehension about rate cuts has been prompting shifts in market sentiment. At the close of 2023, futures were completely pricing in a Federal Reserve rate cut by March. However, the likelihood has now receded to an 85% probability, reflecting a reduced market confidence. This sentiment shift has been articulated by Deutsche Bank’s Jim Reid, a notable figure in the financial industry.

Notably, there has been a slight increase in mortgage rates for the first time since October 2023, as reported by the Freddie Mac Primary Mortgage Survey. Furthermore, mortgage demand took a dip of 10.7% over the past week, based on information from the Mortgage Bankers Association.

Performance of Specific REITs

Within the REIT space, certain stocks have faced notable challenges. For instance, Medical Properties Trust (MPW) experienced significant losses, with its stock trading at the lowest level since 2009. This was partially attributed to its efforts to recover uncollected rents from a financially troubled tenant, Steward Health Care System, a development that raised concerns among investors.

Another major laggard for the week was Office REIT Peakstone Realty Trust (PKST).

Subsector performance showed the Specialty subsector at the forefront of declines, experiencing a significant drop of 3.82%. Health Care REITs were also notably down, falling by 2.75%. However, Hotel REITs were a rare outlier, managing to gain by 1.39% on a weekly basis despite the challenging market conditions.