Chinese tech behemoths Alibaba and Baidu are setting their sights on a $700 million initial public offering (IPO) orchestrated by Horizon Robotics, a pioneering Chinese smart-driving company, eager to ride the wave of surging demand for autonomous driving technology.

Horizon is looking to unleash 1.36 billion shares into the market, priced enticingly between $4.75 to $5.09 each. With a valuation target of up to $6 billion, Horizon’s IPO is poised to be a marquee event in Hong Kong’s financial landscape.

The lion’s share of the IPO proceeds, nearly 70%, is earmarked for fueling innovation through intensive research and development efforts, with the remaining funds channeled towards sales and marketing initiatives. Major financial powerhouses like Goldman Sachs, Morgan Stanley, and China Securities International are at the helm guiding Horizon through this monumental IPO journey.

A Beacon for Investors: The Horizon IPO Draws Admirers

With its IPO slated for October 24 on the Hong Kong exchange, Horizon has successfully stirred interest across a varied spectrum of investors. Alibaba, Baidu, and state-owned Beijing Financial Holdings have pledged to snap up over 30% of the available shares in this IPO, a strategic move to fortify investor trust and amplify participation in this high-stakes offering.

Additionally, notable industry players like Intel, Volkswagen, BYD, and Contemporary Amperex Technology have also positioned themselves as investors in the IPO, underscoring industry-wide faith in Horizon’s potential.

Unlocking the Potential: Analyzing BABA’s Prospects

Scrutinizing Wall Street chatter, BABA boasts a resounding Strong Buy consensus rating, buoyed by 16 Buy recommendations and three Holds in the past quarter. Currently priced at $123.74, the average Alibaba price target forecasts a promising 21.5% upside potential. Since the year’s onset, Alibaba’s stocks have witnessed an upswing of approximately 34%.

Want to delve deeper into BABA’s financial forecast? Explore additional analyst ratings here.

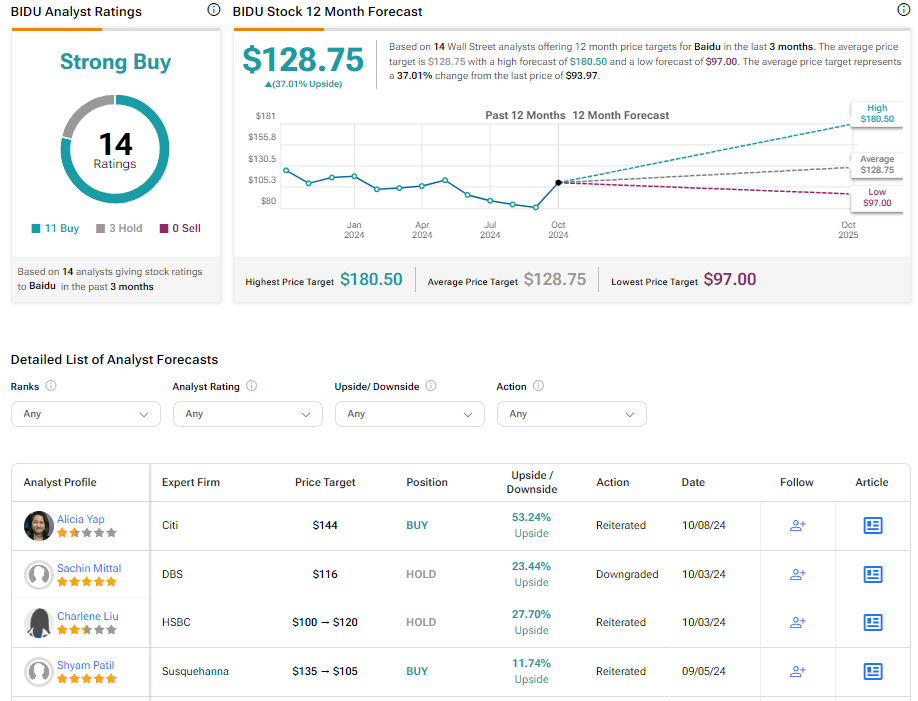

Decoding BIDU’s Trajectory: What Lies Ahead?

On the flip side, BIDU has garnered a compelling Strong Buy consensus rating, underpinned by 11 Buys and three Holds in the previous quarter. Currently valued at $128.75, the average Baidu price target hints at a notable 37% upside potential. Despite a 21% dip in its year-to-date performance, Baidu remains an intriguing proposition for investors.

Curious to learn more about BIDU’s financial outlook? Check out further analyst ratings here.

For additional information or disclosures related to this IPO, kindly refer to the provided link.