The Clash of E-Commerce and Entertainment Giants

Amazon.com Inc. (NASDAQ: AMZN) is not just a behemoth in the online retail world; it is also making waves in Hollywood. Amazon Prime Video is challenging traditional entertainment players like Walt Disney Co (NYSE: DIS) head-on.

A Multi-Faceted Powerhouse

While the bulk of Amazon’s revenue still pours in from its retail arm, its streaming service is a hidden gem within its vast ecosystem. With AWS contributing significantly to its revenue stream, Amazon stands as a multi-faceted juggernaut in the business arena.

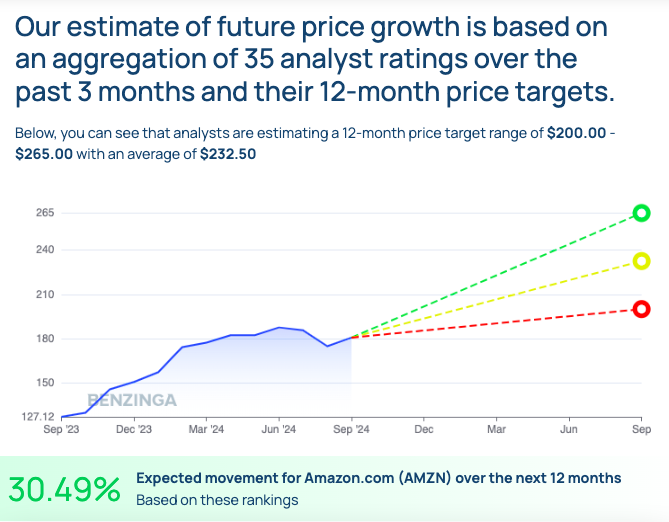

Amazon’s stock has shown impressive growth, with a significant uptick over the past year and year-to-date. Analysts are bullish on Amazon, with price targets forecasting a substantial upside potential.

Amazon’s Resilience and Dominance

Despite some caution in the options market, Amazon’s performance remains robust with a strong Sharpe ratio. Prime Video stands as a trump card, combining retail appeal with enticing content offerings in one subscription.

Disney’s Uphill Battle

On the other hand, Walt Disney has been struggling to keep pace with Amazon’s streaming success and stock market gains. While Disney’s legacy in entertainment is unrivaled, its foray into the streaming world has not been as magical as anticipated by investors.

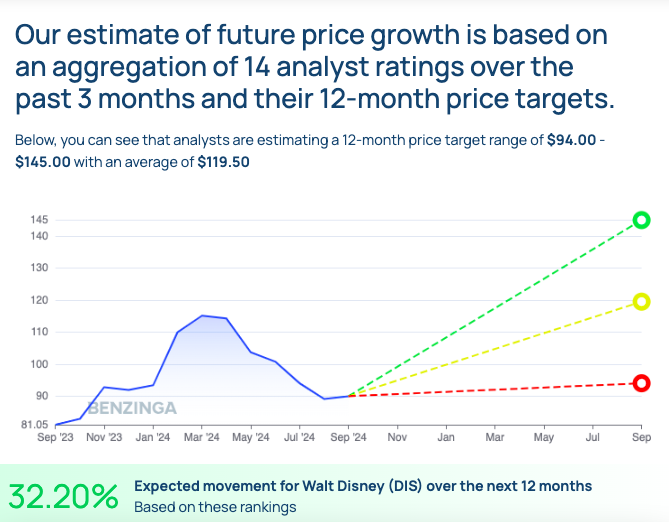

Disney’s stock performance has been lackluster compared to Amazon’s bullish trajectory, reflecting the challenges it faces not just in streaming but also in other revenue streams like theme parks and sports.

Technical Challenges

Disney’s stock struggles are compounded by technical difficulties, with its trading hovering precariously above key moving averages. The options market also signals pessimism, leaving investors uncertain about Disney’s resurgence.

The Battle Continues

In the battle for streaming dominance, Amazon’s Prime Video seems to hold the upper hand in the eyes of investors. Leveraging its diversified portfolio and subscription bundle, Amazon maintains an edge over Disney, which grapples with multiple hurdles to regain its former allure with shareholders.

Disclaimer: All Images Sourced from Shutterstock