Back in history, on Sept. 7, a monumental event occurred in the annals of Apple Inc.‘s legacy. The incomparable Steve Jobs, the luminary co-founder of the tech behemoth, unfurled a disruptive innovation that not only reshaped the music domain but paved Cupertino’s trajectory towards tech supremacy.

Enter the iPod Nano – a dainty, cutting-edge music player that captivated the imagination of both consumers and investors alike, emerging four years after the iconic flagship, the original iPod.

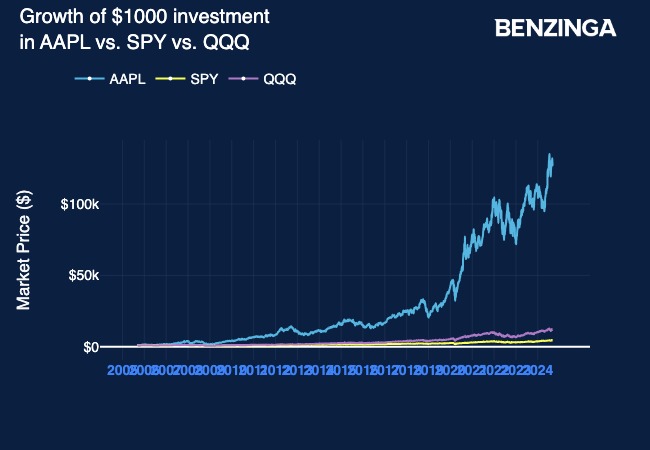

Now, let’s engage in a speculative exercise. Imagine, instead of hastily acquiring the latest gizmo, you had opted to invest in Apple stock. Let’s embark on a mathematical odyssey to see the transformation that a $1000 investment could have undergone.

Let’s delve into the remarkable journey of the iPod Nano:

Arriving as a successor to the iPod Mini, the iPod Nano flaunted flash storage, rendering it more petite and durable compared to its predecessors. Available in 2GB and 4GB models, it boasted capacities of storing up to 500 and 1000 songs, respectively, while tipping the scales at a mere 1.5 ounces.

Iconically introduced by Jobs, who intriguingly pointed to the minuscule watch pocket in his jeans while questioning, “Ever wonder what this pocket is for?” before unveiling the device.

As reflected in an official Apple statement, Jobs dubbed the iPod Nano as the “biggest revolution since the original iPod,” prophesizing that it would metamorphose the portable music market with its full array of features and impossibly diminutive dimensions.

On July 27, 2017, Apple discretely bid adieu to two legendary iPods, the iPod Nano and iPod Shuffle, microcosms of innovation that had remained in their product ensemble for close to 12 years, traversing through seven distinct facelifts.

The iPod Nano’s design underwent a metamorphosis over the years, with iterations flaunting a spectrum of colors, a built-in video camera, and even a clip that oscillated in and out of its appearances. The form-factor oscillated from being lanky and sleek one year to being stubby and compact the subsequent year.

That said, let’s flip the coin and ponder over how your $1,000 dalliance with Apple stock would have transmuted by the time of the iPod Nano’s inception:

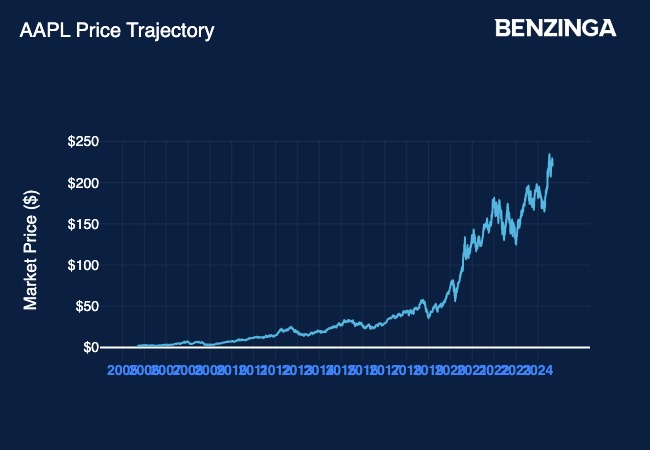

Glancing through the lens of financial history, Apple’s stock value, accounting for stock splits and corporate maneuvers, nestled at $1.7385 on Sept. 7, 2005.

The present-day valuation stands at $220.82, marking a meteoric surge of 12,601% over this transitional span.

A $1,000 plunge into Apple stock on Sept. 7, 2005, would have burgeoned into $120,017 by the present era.

In contrast, a similar investment in the Invesco QQQ ETF would have yielded $1,170, while a mirrored sum committed to an S&P 500 indexed fund would stand at $4,361.

The Twilight of iPods

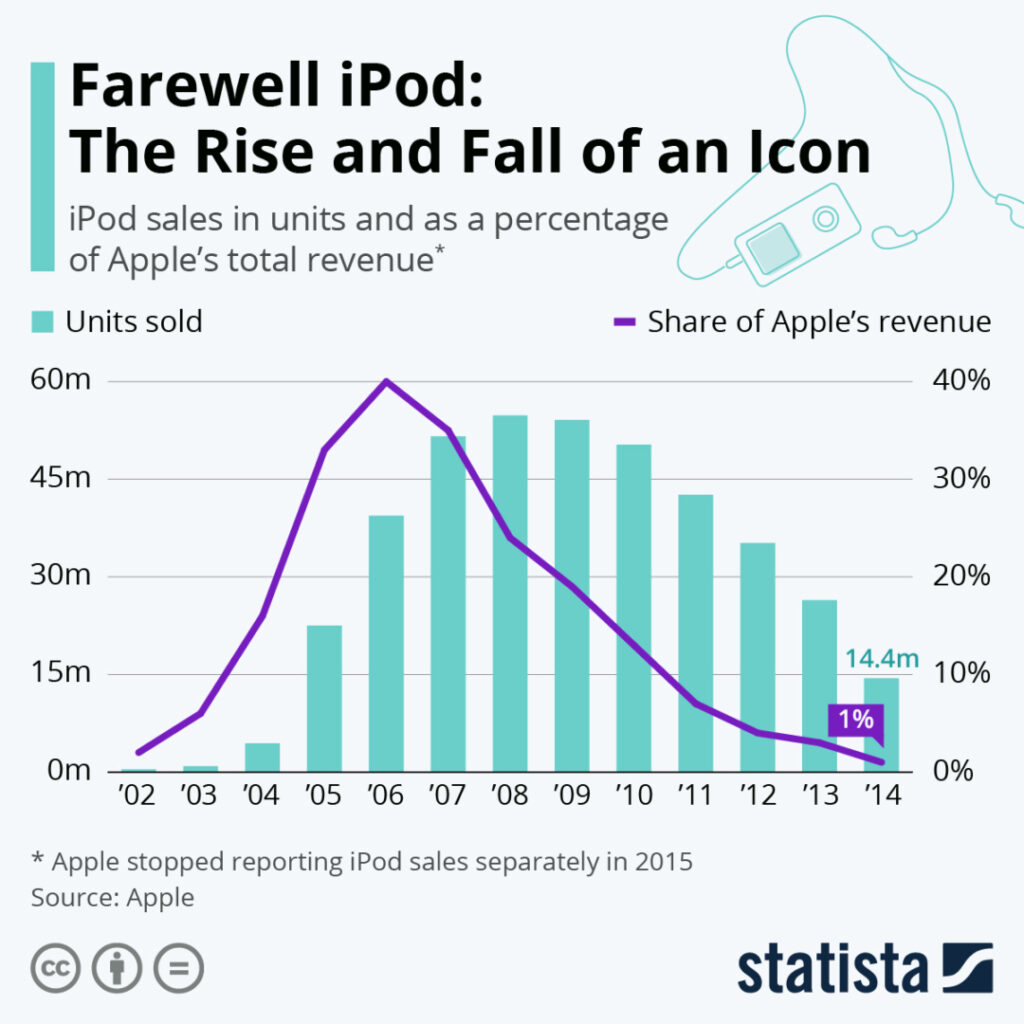

In the bygone days of 2022, spanning over two decades post the inaugural iPod launch, Apple sealed the chapter on its illustrious portable music player lineup.

The curtains closed on the iPod Touch, the single surviving model amidst the iPod repertoire, as the venerable iPod Shuffle and iPod Nano bid their respectful adieus.

While now seeming mundane, during its zenith, the iPod stood as a pivotal revenue generator for Apple, boasting sales figures often surmounting the 50-million mark per annum.

Embark on a deeper dive into Benzinga’s Consumer Tech domain by following the informative link provided.

Endeavor for further insights with these featured pieces.

Disclaimer: This elucidation was harmonized with AI technologies and meticulously scrutinized by discerning Benzinga editors before dissemination.

Photo credits: Wikimedia