Palantir Technologies (PLTR) soared in trading, catching the attention of investors as it emerged as one of the S&P 500’s top performers. The ascent was triggered by Ark Invest’s bullish outlook on software companies specializing in artificial intelligence. The investment firm suggested that companies like Palantir could potentially disrupt the market dominance of tech giants such as Microsoft (MSFT), Amazon (AMZN), and Alphabet (GOOGL) in the realm of cloud services and AI.

Ark Invest Europe’s Rahul Bhushan highlighted the evolving dynamics within the AI sector, noting a significant shift towards software as the key driver of AI-related value. The focus has now shifted to software-as-a-service (SaaS) and platform-as-a-service (PaaS) models, creating opportunities for companies like Palantir to leverage their expertise in delivering tailored AI and data solutions to clients.

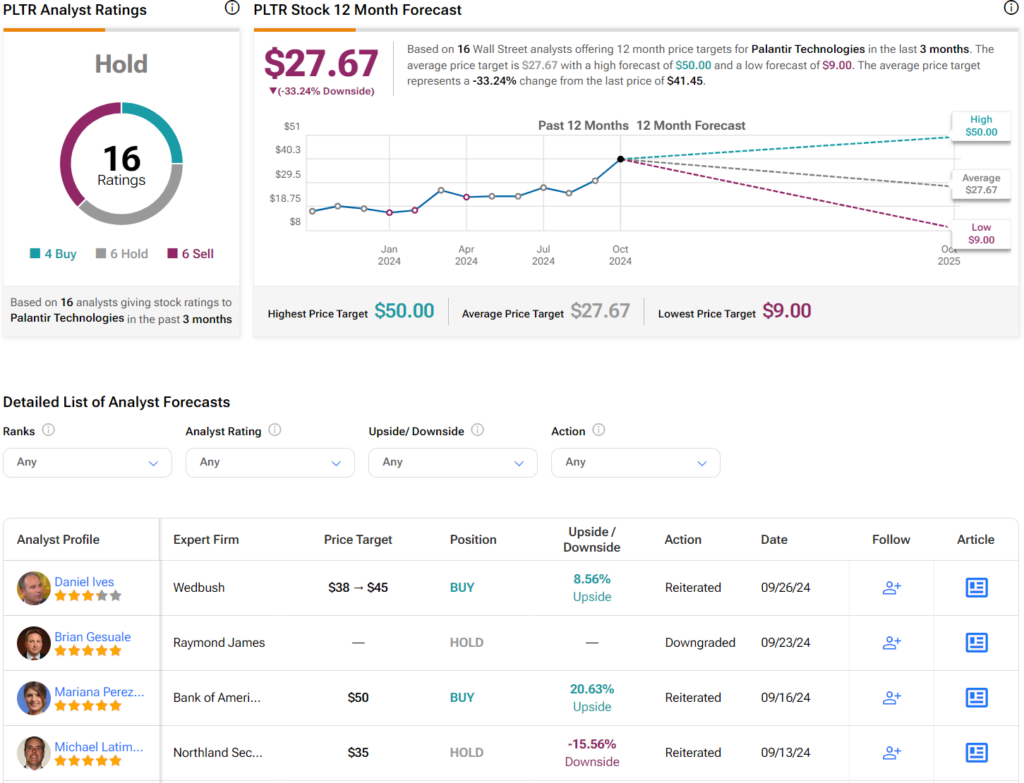

Palantir’s remarkable performance this year, with a staggering 140% surge in share value to $41.45, marks a remarkable turnaround for the company. Long-term investors who weathered the storm of single-digit share prices earlier in the year are now reaping the rewards of their steadfastness.

A New Approach to Palantir Investments

YieldMax unveiled a novel investment avenue with the launch of the YieldMax PLTR Option Income Strategy ETF (PLTY). This innovative ETF aims to provide investors with income while indirectly exposing them to Palantir stock. Operating with an active management strategy and a 0.99% expense ratio, the fund utilizes a synthetic covered call approach, trading options based on Palantir’s performance instead of direct stock ownership.

PLTY enables investors to partake in Palantir’s price movements while constraining potential gains due to its strategic nature. In a departure from traditional covered calls, PLTY diversifies by selling credit call spreads and offers monthly income through cash distributions.

Market Analysts’ Sentiment on PLTR Stock

Wall Street analysts hold a neutral stance on PLTR stock, represented by a consensus Hold rating derived from four Buy, six Hold, and six Sell recommendations over the past quarter. The average price target for PLTR stands at $27.67 per share, indicating a downside risk of 33.24%, according to recent data.