The first quarter of 2024 brought a symphony of movements in the US auto sector as industry stalwarts like Ford, General Motors, Honda, Toyota, and Stellantis shared their respective sales performances. According to GlobalData, US vehicle sales surged by 5.1% to touch 3.75 million units, and March signaled optimism with a seasonally adjusted annual rate projected to exceed 15.5 million units – a noteworthy leap from the previous year’s 15.02 million. J.D. Power and GlobalData’s observations noted a growth in light-vehicle retail inventory to 1.7 million in March, showcasing a 4.2% uptick from February 2024 and a substantial 39% surge from March 2023. This trend contributed to a marked increase in overall inventory, crossing the 2.5 million mark for the first time since 2021. Notably, average vehicle prices in March took a pleasant dip by 3.6% year over year to settle at $44,186, heralding a harmony between inventory and consumer demand.

Exploring the Highlights

Venturing into specific highlights, General Motors maneuvered through the quarter with a slight hiccup, witnessing a 1.5% year-over-year decline in its US deliveries. This minor slump was attributed to reduced fleet deliveries and the anticipated impact of phasing out the Chevrolet Bolt EV. However, the retail sector painted a brighter picture for the legendary automaker, with a commendable 6% year-over-year surge in sales. Retail-wise, GM brands Buick, Chevrolet, Cadillac, and GMC witnessed sales hikes of 10%, 6%, 9%, and 3%, respectively, even as GM envolve faced a downturn of 23%. Meanwhile, across the Pacific, General Motors made waves in China, delivering over 441,000 vehicles in the first quarter, with new energy vehicle sales seeing a remarkable 42.6% annual surge to exceed 128,000 units.

Ford, on the other hand, charted a 7% year-over-year rise in its Q1 US vehicle sales, buoyed by an increasing appetite for hybrid trucks and SUVs that propelled the automaker to its best-ever quarterly hybrid sales figures. The first quarter saw Ford selling 38,421 hybrid vehicles, marking a notable 42% year-over-year uptick, while electric vehicle (EV) sales escalated by a remarkable 86.1% annual growth, totaling 20,223 units. The ICE vehicle segment also saw a healthy growth, climbing by 2.6% year over year. Despite the postponement of its three-row electric SUV launch to 2027, Ford unveiled plans to introduce hybrid variants across its entire internal combustion engine lineup in North America by 2030, showcasing a commitment to a greener future.

The Japanese Giants in Action

Toyota delivered a power-packed performance in Q1, with a robust 20.3% year-over-year surge in US deliveries, reaching 565,098 vehicles. The automaker’s stellar numbers were propelled by the impressive performances of both its namesake and Lexus divisions, which delivered 486,627 units (up 21.3%) and 68,252 units, respectively. Toyota’s prowess in the electric vehicle realm was palpable, with a 74% EV sales surge year over year, contributing significantly to its total sales volume.

Meanwhile, Honda‘s US sales painted a vivid picture of success, clocking a 17.3% year-over-year uptick to 333,824 units. The Honda division spearheaded this growth, boasting record-breaking sales of its CR-V and Accord, with noteworthy sales resilience shown by models like the CR-V, the Accord, and the Pilot. Honda’s foray into electrified vehicles saw an encouraging 25.5% uptick in sales from the corresponding quarter of 2023, showcasing a strong consumer affinity towards its greener offerings.

Embracing Innovation at Stellantis

Stellantis navigated its path through the US market in Q1, witnessing a 10% drop in deliveries compared to the previous year, totaling 332,540 units. Despite this decline, brands like Jeep, Fiat, and Chrysler managed to secure sales hikes, while others like RAM, Dodge, and Alpha Romeo faced a decline in year-over-year sales. Noteworthy was the exponential 82% surge in sales of plug-in hybrid electric vehicles, with models like the Jeep Wrangler 4xe and the Chrysler Pacifica Hybrid capturing top positions in the hierarchy of best-selling hybrids in the US market. Looking ahead, Stellantis is gearing up to introduce an extensive lineup of eight EVs in the US market by the end of 2024, signaling a futuristic approach in line with evolving consumer preferences.

Unveiling the Price Performance

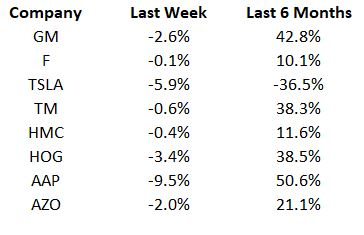

A snapshot of the price movements within the key players in the auto sector over the last week and the preceding six-month period reveals the dynamic nature of the market.

Image Source: Zacks Investment Research

Future Prospects in the Auto Space

The auto sector enthusiasts will eagerly keep their eyes peeled for the unveiling of vehicle sales data from China for both March and the entire first quarter of 2024, which promises to offer a deeper insight into the burgeoning trends shaping the global automotive landscape.