Earnings season kicked off last month and will continue into May, giving Wall Street a fresh batch of numbers to analyze and agonize over. As is usually the case with new earnings, there’s been a lot of fluctuation in the market in recent weeks.

Some standouts are Amazon (NASDAQ: AMZN) and Apple (NASDAQ: AAPL), with Amazon’s shares up 8% since its earnings release on April 30 and Apple’s up 5% since posting its report on May 2. These companies dominate their respective industries, with one the biggest name in e-commerce and the other ruling consumer tech. As a result, their stocks are attractive investment options to hold over the long term.

Amazon and Apple have both delivered promising earnings reports, suggesting they could have much to offer new investors in the coming years. So, let’s look at these companies’ potent businesses and determine whether Amazon or Apple is the better stock to buy right now.

Amazon’s Growth Trajectory

In its first quarter of 2024, Amazon reported revenue growth of 13% year over year, outperforming analysts’ estimates by $750 million. The company continued to see solid gains in its retail business, with revenue rising 12% year over year between its North American and international segments.

However, it was Amazon’s digital businesses that won the quarter. The tech giant enjoyed a 24% increase in advertising sales, primarily thanks to the recent introduction of ads on its Prime Video streaming service. Amazon’s digital ad business isn’t as developed as companies like Alphabet or Meta Platforms. However, advertising has further diversified Amazon’s earnings and could remain a lucrative area in the coming years.

Another bright spot during the quarter was Amazon Web Services (AWS), the company’s dominant cloud platform. AWS reported sales growth of 17% year over year, with operating income soaring 84%.

The company may be best known for its retail site, but cloud computing is likely its biggest growth catalyst over the next decade. Increased interest in AI has led to a surge in demand for cloud services, with businesses using the platforms to boost efficiency. AWS has added a range of AI tools over the last year and announced a venture into chip development.

Amazon is home to a highly diverse business that grows more varied by the year. The company is on a promising growth trajectory that you probably won’t want to miss.

Apple’s Strategic Moves

Apple has hit more than a few roadblocks since the start of 2023. Macroeconomic headwinds caught up with its business, leading to multiple quarters of missing Wall Street expectations last year. However, the first quarter of 2024 brought earnings in line with analysts’ forecasts, with Q2 finally surpassing them.

In its Q2 2024 (ended March 2024), Apple posted a revenue decline of 4% year over year to $91 billion, yet outperformed expectations by $190 million. The company suffered a 10% decline in its iPhone sales, which it attributes to an unfair comparison to the year before when COVID-19-based supply issues saw Apple realize $5 billion in delayed iPhone 14 sales.

CEO Tim Cook reasoned, “If you remove that $5 billion from last year’s results, we would have grown this quarter on a year-over-year basis.”

As has been the case for well over a year, the bright spot of Apple’s business remains its digital services segment, which includes income from the App Store and platforms like Apple TV+, Music, Fitness+, and more. Services revenue rose 14% in Q2 2024.

The company’s rally primarily came from its announcement to buy back $110 billion in stock, a 22% increase from last year’s $90 billion buyback. It is the largest buyback in history and comes alongside a dividend bump, with its cash amount rising from $0.24 to $0.25.

Determining the Better Investment

Amazon and Apple have become household names worldwide thanks to their respective businesses. However, recent headwinds on Apple’s side suggest that Amazon’s stock is the more reliable buy.

Amazon has a thoroughly diverse business model, which includes leading the e-commerce and cloud markets, a popular streaming platform, a grocery division, and an expanding position in AI. Apple is investing in multiple markets and has a lucrative services business that could take it far, but it still relies too heavily on the iPhone.

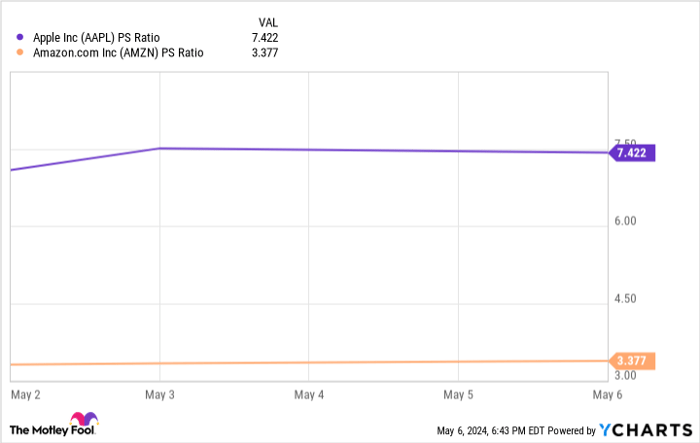

Data by YCharts

Moreover, this chart shows Amazon’s price-to-sales ratio is significantly lower than Apple’s, indicating the retail giant’s stock is trading at a better value.

Amazon has consistently outperformed earnings estimates over the last year and is on a promising growth path. The company’s shares are a screaming buy right now and a better option than Apple.

Considering Investment in Amazon

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $543,758!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024