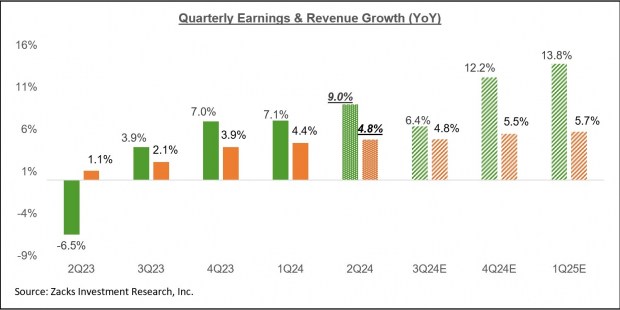

Amidst the ebb and flow of financial markets, a glimmer of hope shines through as total S&P 500 earnings are poised to surge by an extraordinary +9% from the preceding year. Coupled with a robust +4.8% increase in revenues, this upcoming profit boom heralds the most impressive quarterly growth stride since the illustrious +10% expansion in the Q1 of 2022.

A Triumph of Numbers

Diving deeper into the statistical abyss, a panoramic view reveals that the anticipated Q2 earnings and revenue growth for 2024 promises to be nothing short of exceptional. Plotting these figures against the backdrop of the past four periods and forthcoming trimesters unfurls a narrative of resilience and prosperity.

Image Source: Zacks Investment Research

The landscape of the Q2 earnings season amazes, with estimates surpassing expectations. The expanse of hope carved by a favorable revision trend stands distinguished against the fleeting shadows of uncertainty. Noteworthy is the resilience of Q2 estimates which wavered the least during the quarter, akin to a sturdy vessel navigating turbulent waves.

Enrapturing our expectations further is the astounding zenith of Q2 earnings growth, transcending past landmarks akin to a soaring eagle claiming its place in the sunlit sky. The forecasted aggregate earnings for this period sparkle as a new all-time quarterly record in the vast firmament of financial statistics.

A Legacy of Prosperity

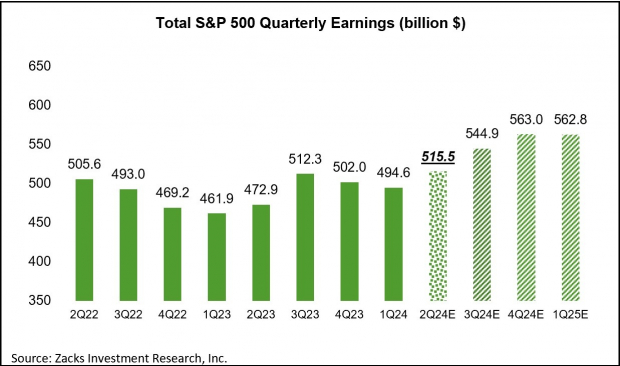

The narrative continues to unfold as the $515.5 billion aggregate S&P 500 earnings for Q2 outshines the previous milestone set in the 2023 Q3, echoing a voice of triumph in the halls of finance.

Image Source: Zacks Investment Research

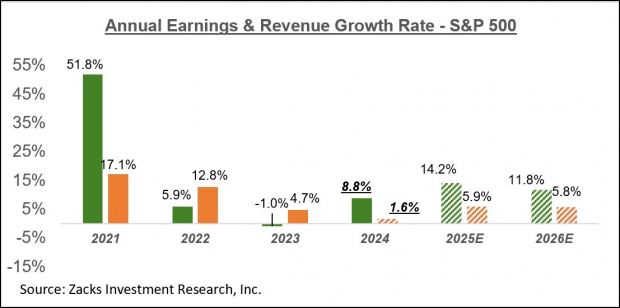

Peering into the future, the expectations for 2024 S&P 500 earnings stand tall at +8.8%, accompanied by a commendable +1.6% growth in revenue. Once Finance takes its bow, the revenue growth pace elevates to a remarkable +3.9%, while the index’s aggregate earnings, sans Finance, portray a modest dip to +8.7%, in what can only be described as a dance of numbers across the financial skyline.

Image Source: Zacks Investment Research

To delve deeper into the enigmatic world of earnings projections and the shimmering possibilities lying ahead, the curious investor is urged to explore the weekly Earnings Trends report for a more profound understanding of the financial vista that unfurls below.

Brace yourself for the undiscovered, as the faint glimmers of the present promise a dawn of prosperity on the horizon. The journey through the nuances of financial forecasts is not just one of numbers but a story of resilience, hope, and triumph portrayed through the prism of the S&P 500 earnings spectacle.