Bill Gates, a luminary in the tech world and philanthropic circles, has steered Microsoft to a position of industry esteem. Fondly reminiscing over Microsoft’s emergence from a Harvard dormitory nearly five decades ago evokes the spirited journey of a phoenix rising above societal norms.

This tech behemoth’s advancements have been palpable, diversifying its portfolio with strategic acquisitions like LinkedIn and Activision Blizzard. In the realms of workplace productivity, Microsoft’s Office Suite reigns supreme, encompassing essential applications like Excel and PowerPoint.

Moreover, the company’s venture into cloud computing has bolstered its resolute standing in a competitive landscape marked by Amazon and Alphabet. Microsoft’s Azure cloud unit has emerged as a robust source of growth, offering a tantalizing peek into a future steeped in artificial intelligence (AI) integration, fortified by a substantial investment in OpenAI’s ChatGPT technology.

Image Source: Getty Images.

The Grandeur of Long-Term Microsoft Investing

The trajectory of a $1,000 Microsoft investment since its IPO paints a picture of resounding success and financial acumen. While such a commitment requires unwavering discipline, the payoff for steadfast shareholders attests to Microsoft’s cyclic dependability.

MSFT Total Return Price data by YCharts.

Decoding Microsoft’s Investment Viability

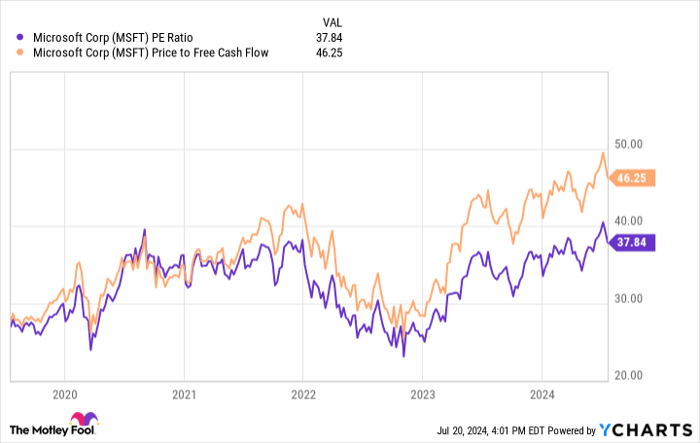

Microsoft’s current P/E ratio of 37.8 outshines the broader market average of 27.5, signifying its premium valuation. Nonetheless, this premium seems justifiable, given Microsoft’s consistent innovation and across-demography appeal. The undisputed royalty of the tech world, Microsoft, shall continue its supremacy for eons to come, especially in the AI domain.

MSFT PE Ratio data by YCharts.

Amidst a somewhat lofty valuation, Microsoft’s growth trajectory remains unwavering. This tech titan, known for its transformative disruptions in personal computing and cloud infrastructure, is poised to ride the AI wave brilliantly across various sectors – a strategic move that promises a grand narrative for shareholders.

While the initial investment might seem steep, Microsoft’s fortitude in the face of evolving landscapes assures its place as a prospective investment gem. Seizing the moment to dive into Microsoft shares now could pave the way for prosperous returns in the future as the AI saga unfolds.

Unlocking the Potential of a $1,000 Investment in Microsoft

Consider this before taking the plunge into Microsoft stock: