The cryptocurrency market is brimming with anticipation as the next Bitcoin halving approaches. This event cuts the amount of Bitcoin rewarded to miners for successfully mining blocks. Investors must grasp the mechanics and implications of the Bitcoin halving to make informed decisions and manage portfolios effectively.

Through delving into the historical impact of previous halvings and scrutinizing current market trends, investors can gear up for the impending halving and navigate the ever-changing cryptocurrency terrain.

In collaboration with crypto expert Peter Eberle, the Investing News Network (INN) ventures into the intricacies of the halving process and examines potential market volatility.

The Essence of the Bitcoin Halving

Bitcoin’s creation involves a mining process where miners vie to solve an algorithmic puzzle. Upon solving the puzzle, a new block is appended to the blockchain, and the successful miner is rewarded with a specific amount of freshly minted Bitcoin. In Bitcoin’s nascent days in 2009, the reward stood at 50 Bitcoin per block.

Bitcoin halvings occur approximately every four years or after mining 210,000 blocks. The halving timing is not tied to a set duration; slight fluctuations in the mining difficulty and network hash rate can alter the actual halving schedule. The upcoming halving, expected around April 20, 2024, will further reduce the reward rate to 3.125 Bitcoin per block, down from 6.25 Bitcoin after the previous halving in 2020. This deliberate reduction in block rewards aims to check inflation so that Bitcoin sustains its value over time as the total supply gradually reaches 21 million.

The Impact on Bitcoin Miners

Bitcoin’s halving casts a substantial influence on mining activity and supply in the realm of cryptocurrency due to the inherent nature of Bitcoin mining.

The mining process, or block time, typically lasts around 10 minutes. To uphold a consistent block time, the Bitcoin network adjusts mining difficulty based on the hash rate—a gauge of computational power utilized for mining and transaction processing. An upsurge in power indicates heightened competition among miners, rendering the puzzle more challenging. Conversely, diminished competition eases the difficulty. This mechanism ensures a steady pace of new block creation irrespective of miner numbers.

Preceding halving events, the hash rate has surged, only to decline post-halving as inefficient miners exit the scene. Eberle remarked, “Miners with outdated or energy-intensive equipment are forced out of the business as they can’t sustain operations under reduced mining rewards.” Presently, there’s an uptick in hash rates driven by major mining entities rolling out new, quicker, and more efficient hardware while still utilizing older setups that might become obsolete in the near future.

Bitcoin Price and the Halving

Bitcoin often experiences rallies leading up to halving events, although given the limited number of halvings in history (only three to date), identifying definite price trends is challenging.

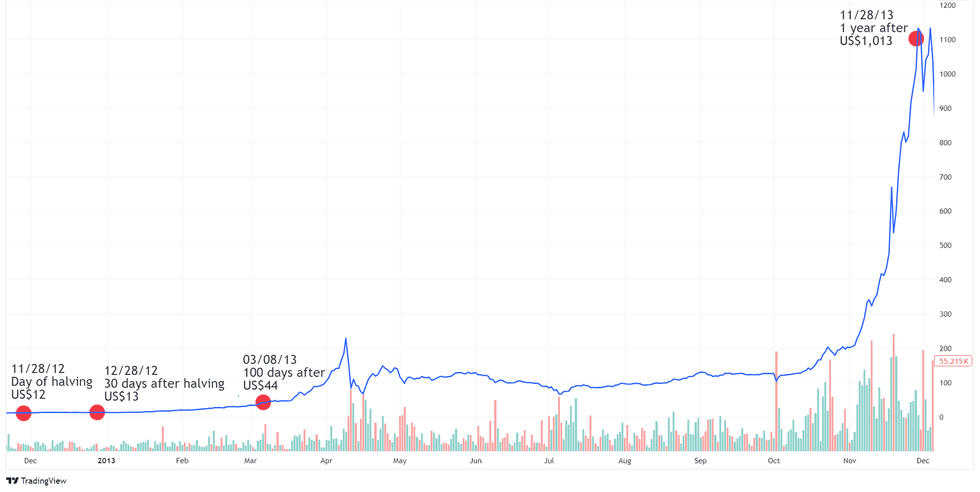

Chart via TradingView

Bitcoin USD price chart 11/21/2012 to 12/05/2013

The initial Bitcoin halving on November 28, 2012, saw the mining reward decrease from 50 to 25 Bitcoins. While Bitcoin operated in a niche sphere then, it had begun attracting mainstream attention influenced in part by economic uncertainty in Europe. Bitcoin’s value surged from around US$5.50.