Bitcoin Price Resurgence Sparks Crypto Market Growth

Entering this week, the crypto domain underwent a remarkable revival, rebounding from the tremors caused by $800 million in outflows from Bitcoin ETFs the previous week.

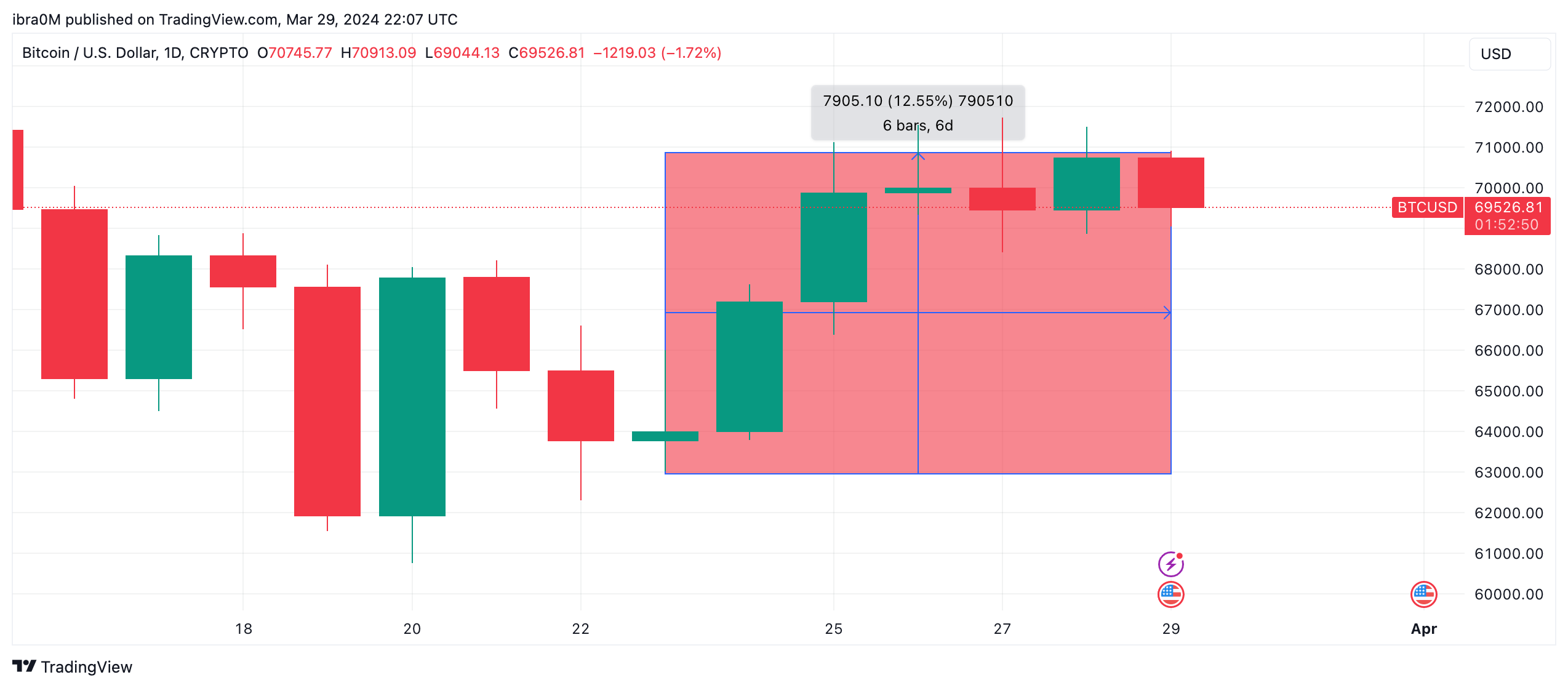

Bitcoin surged, reaching a peak of $71,726 for the week, an impressive 13% jump as reported by TradingView data.

Buoyed by rising ETF demand and a decreasing sell-pressure from Bitcoin miners, who opted to amass their holdings in preparation for the halving, the stage was set for a compelling revival within the crypto space.

Surveying the broader cryptoverse panorama, bulls reigned supreme throughout the week.

As the week commenced on March 24, the global crypto market capitalization rested at $2.5 trillion. By the conclusion of trading on Friday, March 29, the market cap had surged past $2.78 trillion per Coingecko data.

Effectively, there was an astounding $265 billion growth in the global crypto market cap between March 23 and March 29.

Other prominent altcoins like Ethereum (ETH), Binance Coin (BNB), Dogecoin (DOGE), and Litecoin (LTC) also shone brightly on the list of top performers, reflecting weekly gains of 8.11%, 6.15%, 44.7%, and 25.3%, respectively, by March 29.

Regulatory Fervor Highlights Week of Change

Amidst the price uptrend, the crypto sphere witnessed a flurry of legal and regulatory shifts this week.

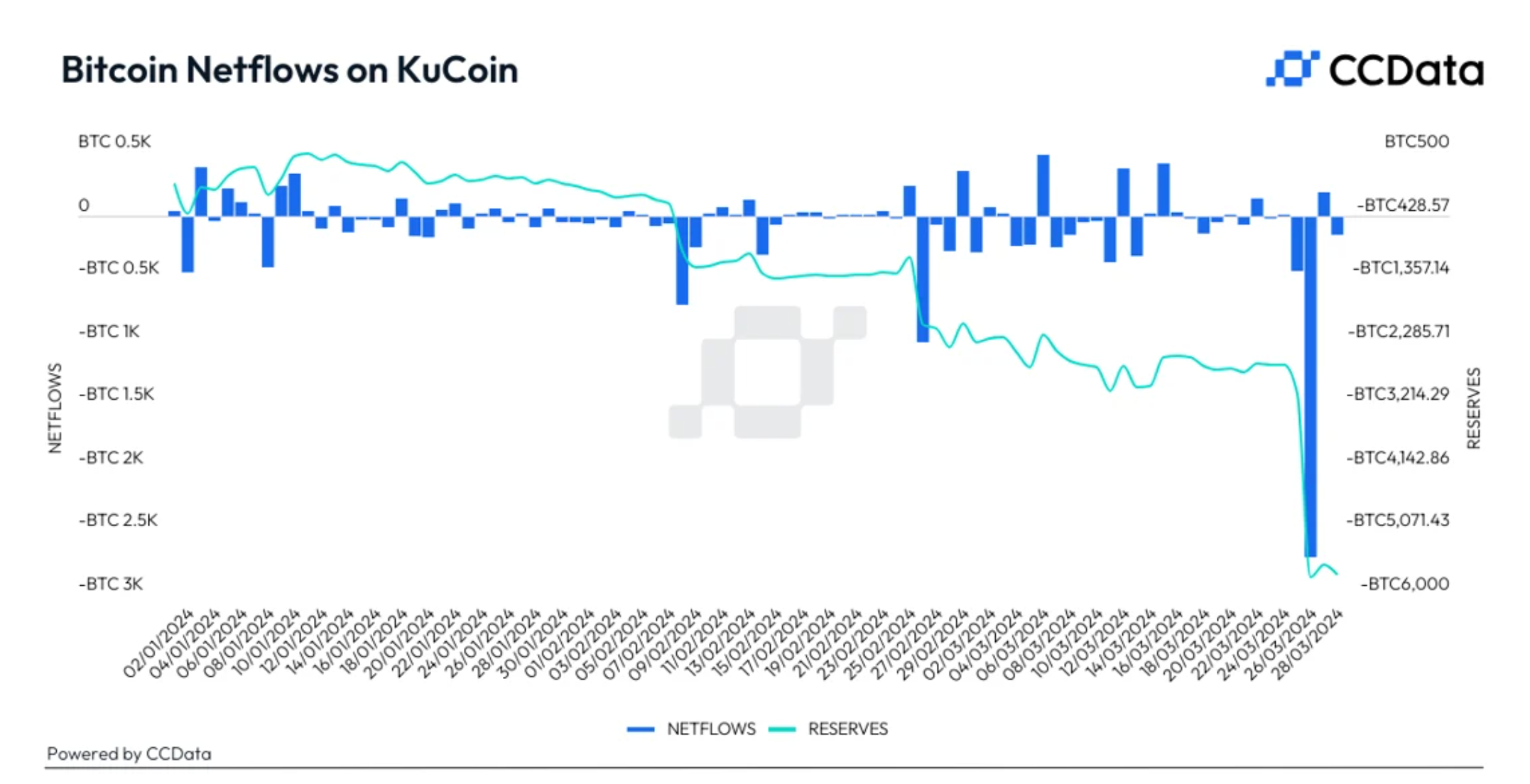

KuCoin, a popular digital asset exchange, became the focal point of investor unease, as withdrawals totaling over $1 billion occurred within just 24 hours.

This sudden mass exodus transpired against the backdrop of escalating legal actions by U.S. authorities, who charged the platform and two of its founders with violating anti-money laundering laws earlier in the week.

KuCoin wasn’t the sole entity under the regulatory microscope, with the SEC securing a significant triumph in its ongoing lawsuit against Coinbase.

The SEC, which initiated legal proceedings in June 2023, alleged that Coinbase had operated as an unregistered broker and exchange, seeking to halt such activities permanently.

Meanwhile, the U.K.’s Financial Conduct Authority (FCA) clarified that social media personalities engaging in crypto content may fall under financial promotion regulations.

This marks an expansive view of financial advice and marketing, particularly in the realm of social media influence, a domain that plays a pivotal role in shaping investor sentiments.