When contemplating stock transactions, investors often heed brokerage guidance. These recommendations, stemming from sell-side analysts, can sway market value, but are they truly enlightening?

Prior to dissecting the reliability of these suggestions and leveraging them to your benefit, let’s delve into the sentiments of the Wall Street magnates on Netflix (NFLX).

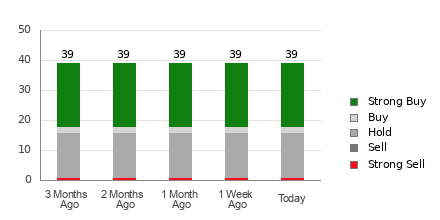

At present, Netflix garners an Average Brokerage Recommendation (ABR) of 1.91, resting between Strong Buy and Buy on a 1-to-5 scale. This metric is formulated from the recommendations (Buy, Hold, Sell, etc.) tendered by 39 brokerage entities. Notably, among these recommendations, 21 stress Strong Buy, with an additional two urging Buy. Together, Strong Buy and Buy encapsulate 59% of the total recommendations.

Understanding NFLX Brokerage Recommendations

Almost unanimous in recommending Netflix, brokerage counsels can provide a useful reference point. However, placing full trust in this data alone might not yield optimal outcomes. Studies reveal that brokerage suggestions have a modest track record in pinpointing stocks poised for significant price surges.

But why is this the case? Driven by inherent biases, analysts working in brokerage firms tend to skew their ratings positively for the stocks they cover. Notably, five “Strong Buy” designations often outstrip every “Strong Sell” label. Consequently, their motivations may not always align with those of typical investors, rendering their insights somewhat inconclusive in projecting stock trends.

In stark contrast, the Zacks Rank, with its stringently verified performance, offers a different vantage point. Categorizing stocks into five classifications, from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), this tool reliably forecasts a stock’s imminent trajectory. Hence, corroborating the ABR with the Zacks Rank could significantly enhance your investment acumen.

Zacks Rank vs. ABR Distinction

Though both Zacks Rank and ABR are rated on a 1-5 scale, they differ fundamentally in their methodologies.

Whereas ABR hinges solely on brokerage endorsements, usually depicted in decimals (e.g., 1.28), Zacks Rank leverages a quantitative model reliant on earnings estimate revisions, reflected in whole numbers from 1 to 5.

Historically, broker-affiliated analysts have displayed a tendency towards unwarranted optimism in their appraisals. Their vested interests often result in inflated recommendations that lack substantive basis, consequently leaving investors adrift rather than guiding them safely.

In sharp contrast, the Zacks Rank is intrinsically linked to earnings estimate adjustments. Statistical evidence suggests a strong correlation between short-term stock price shifts and variations in earnings projections—a testament to the predictive power of this model.

Moreover, unlike the ABR, which may lag in real-time updates, the Zacks Rank remains dynamically responsive. As brokerage analysts continuously tweak their earnings approximations to mirror evolving market dynamics, these alterations are promptly factored into the Zacks Rank, ensuring its predictions are consistently fresh.

Is an Investment in NFLX Justified?

Regarding Netflix’s earnings outlook, the Zacks Consensus Estimate for the ongoing fiscal year has remained static at $19.08 over the past month.

The steadfast nature of analysts’ perspectives on Netflix’s profit horizons, indicated by the unchanging consensus estimate, could merit cautious optimism for the stock’s alignment with broader market trends in the near future.

Based on recent adjustments to the earnings consensus, along with ancillary factors, Netflix secures a Zacks Rank #3 (Hold) designation. For a comprehensive list of today’s Zacks Rank #1 (Strong Buy) entities, refer to this link.

Considering Netflix’s ABR nudging towards Buy-equivalent territory, exercising prudence is advised.

Unlocking Market Potential

Recently revealed: A cadre of experts distill seven top-tier stocks from the existing roster of 220 Zacks Rank #1 Strong Buys. These elite selections are deemed “Most Likely for Early Price Pops.”

Since 1988, this exclusive list has outperformed the market by over twofold, delivering an average annual increase of +23.7%. Do not delay in scrutinizing these meticulously curated picks.