When investors dive into the stock market, they often look to the sage advice of Wall Street analysts for guidance. Brokerage recommendations hold significant sway over the buying, selling, and holding decisions made by market players. The question remains: should we put all our chips on the table based on these ratings?

The Brokerage Recommendation Landscape for NVDA

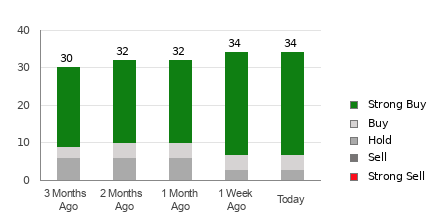

As it stands, Nvidia boasts an average brokerage recommendation (ABR) of 1.21, landing it between the “Strong Buy” and “Buy” categories. A total of 39 brokerage firms contributed to this average, with 87.2% rating it as Strong Buy and 5.1% as Buy.

The ABR paints a rosy picture, but caution is advised. Numerous studies have cast doubt on the efficacy of brokerage recommendations in accurately predicting stock price movements. The crux of the matter lies in the inherent bias of sell-side analysts, whose favorable ratings may be colored by their employers’ vested interests.

Amidst this uncertainty, the Zacks Rank emerges as a beacon of hope. With a track record rooted in solid audits, this proprietary stock rating tool leads investors to the promised land of profitable decisions. Corroborating the ABR against the Zacks Rank might just be the compass needed to navigate the treacherous waters of the stock market.

ABR vs. Zacks Rank: Unraveling the Distinctions

While both metrics employ a 1 to 5 scale, they are galaxies apart in their methodologies. The ABR hinges solely on broker opinions, often influenced by institutional biases, whereas the Zacks Rank leverages concrete data on earnings estimate revisions, offering a more tangible foundation for its ratings.

Analysts’ glass-half-full approach to brokerage recommendations stands in stark contrast to the Zacks Rank’s reliance on empirical evidence. Past research has shown a strong correlation between earnings estimate trends and short-term stock price movements, bolstering the latter’s case as a more reliable gauge of a stock’s trajectory.

Additionally, the Zacks Rank maintains an even-handed approach across all stocks, making it impervious to any institutional sway. Its swift responsiveness to changing market dynamics adds further weight to its credibility, standing in contrast to the potentially outdated nature of ABR data.

NVDA: A Glimpse into the Crystal Ball

Nvidia’s future looks promising, with a 1% increase in the Zacks Consensus Estimate for the current year’s earnings per share, now resting at $12.32. Analysts’ widespread optimism is mirrored in a Zacks Rank #2 (Buy) for Nvidia, hinting at potential growth on the horizon.

With the Zacks Rank providing an anchor of reliability, investors can use the Buy-equivalent ABR for Nvidia as a North Star in their investment journey.