When it comes to navigating the tumultuous waters of the stock market, investor decisions often find guidance in the words of brokerage analyst recommendations. These financial seers, perched in their Wall Street towers, hold sway over stock prices, but should their musings be taken as gospel truth?

Before delving into the esoteric world of brokerage suggestions, let’s cast a discerning eye over the insights they offer regarding TJX TJX. It’s crucial to unravel the enigma of brokerage advice and its practical application for savvy investors.

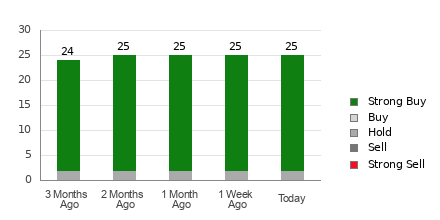

Currently, TJX boasts an average brokerage recommendation (ABR) of 1.16 on a scale from 1 to 5, translating into a blend of Strong Buy and Buy sentiments based on assessments from 25 brokerage firms. Remarkably, a staggering 92% of all recommendations, 23 in total, advocate for a Strong Buy position.

Interpreting the Ever-Shifting Tides of Brokerage Recommendations for TJX

While the ABR may whisper sweet nothings of a TJX investment, investors tread a perilous path if they rely solely on this metric. Studies reveal that brokerage recommendations, tinted by a rose-colored bias, offer scant insight into selecting stocks with the utmost potential for growth.

Curious why? Analysts within brokerage firms, with their vested interests, often bestow a heavy positive spin on the stocks they cover. An intriguing revelation from our investigations showcases a fivefold abundance of “Strong Buy” endorsements compared to “Strong Sell” warnings.

In essence, the motivations of these analysts rarely align with those of retail investors, leaving them adrift in uncertain market currents. Consequently, the prudent approach lies in corroborating such information with personal research or relying on proven indicators that effectively prophesy a stock’s trajectory.

The Zacks Rank, a proprietary stock evaluation tool, stands out as a beacon of hope, boasting a sterling track record openly scrutinized by external auditors. Categorizing stocks across a five-tier spectrum, from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), this tool offers investors a compass pointing towards potential profitability.

Differentiating the Nuances of Zacks Rank from ABR

Despite their shared 1-5 numerical domain, the Zacks Rank and ABR are disparate creatures at heart.

Broker recommendations form the bedrock for ABR calculation, often manifesting in decimal figures (such as 1.28). On the contrary, the Zacks Rank leverages a quantitative model honed to capture the essence of earnings estimate revisions, gracing the numerical spectrum from 1 to 5.

Bearing the torch of optimistic prognostications, analysts in brokerage firms have a penchant for showering stocks with unwarranted praise. Their buoyant ratings, divorced from sound research, more often mislead than illuminate the investor’s path.

In stark contrast, the Zacks Rank waves the flag of earnings estimate revisions, with tangible evidence underscoring a robust correlation between these revisions and short-term stock price shifts.

A distinctive facet separating ABR and Zacks Rank is the element of timeliness. While ABR lumbers with dated recommendations, the Zacks Rank dances nimbly with fresh insights, swiftly incorporating analysts’ whispers regarding evolving business landscapes into its predictions of future market movements.

When evaluating TJX through the lens of earnings estimate revisions, the Zacks Consensus Estimate steadfastly stands at $4.09 for the current year, unchanged over the past month.

Amidst the unflinching analyst consensus on the company’s earnings potential, as evidenced by a stagnant consensus estimate, TJX finds itself perched at a cautious Zacks Rank #3 (Hold).

With this revelation in mind, prudence beckons investors to approach the seemingly seductive siren song of the Buy-endorsed ABR for TJX with cautious optimism.

© 2024 Benzinga.com. Benzinga, ever the herald of financial insights, abstains from offering personalized investment advice. All rights rigorously preserved.