Broker recommendations play a crucial role in shaping investor decisions, acting as beacons in the stormy sea of the stock market. Amidst the cacophony of market dynamics, these recommendations offer a semblance of direction, but are they truly reliable?

Let’s embark on a journey to unravel the mysteries behind brokerage evaluations, focusing our magnifying glass on Vistra Corp. (VST) and the current sentiment among Wall Street giants.

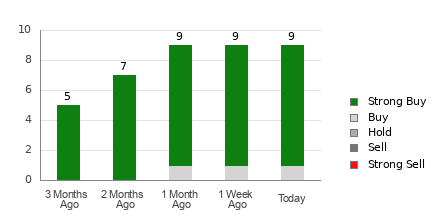

Vistra currently wears the badge of an average brokerage recommendation (ABR) at 1.11, nestled delicately between the realms of Strong Buy and Buy on a scale ranging from 1 to 5. This ABR of 1.11 blossoms from the whispers of nine brokerage firms, with the majority chanting hymns of Strong Buy, while the whispers of Buy echo in the background.

Broker View on Vistra (VST)

Peering into the ABR may tempt one to paint a rosy picture of Vistra, but tread with caution. History whispers tales of limited success when hinging investment choices solely on brokerage endorsements. These whispers grow louder, revealing a bias that shrouds brokerage ratings in a veil of optimism.

The allure of validation lures investors towards the Zacks Rank, a trusted oracle in the realm of stock ratings. Unlike the ABR, this mystical tool dances to the tune of earnings estimate revisions, a melody that resonates with stock price movements.

ABR vs. Zacks Rank: Unraveling the Mystery

While the ABR basks in the glow of brokerage whispers, the Zacks Rank stands firm on the pillars of earnings estimates, offering investors a pathway lit by quantitative projections rather than sentimental musings.

Analysts cloaked in brokerage attire have been known to don the garb of optimism, swaying investor decisions with their silver-tongued recommendations. In contrast, the Zacks Rank marches to the steady beat of earnings revisions, a rhythm that often leads to profitable tunes.

As the sun sets on the horizon of stock ratings, the Zacks Rank emerges as a beacon of hope, offering a timely and refreshing perspective on the ever-changing landscape of investments.

Is Vistra (VST) a Gem Worth Unearthing?

Recent whispers in the wind speak of a 1% increase in the Zacks Consensus Estimate for Vistra, painting a tapestry of optimism around the company’s earnings prospects. Analysts harmonize their melodies, projecting a symphony of growth that could propel the stock to new heights.

This crescendo of consensus estimates has bestowed upon Vistra the coveted Zacks Rank #1 (Strong Buy), a badge of honor that few stocks can adorn. The stage is set, the lights gleam bright, beckoning investors to take center stage in this melodious journey of stock selection.

A chorus of optimism surrounds Vistra, serenading investors with promises of prosperity. Will you heed the siren call of brokerage whispers, or dance to the rhythm of earnings forecasts?

The Infrastructure Stock Symphony Sweeping America

A chorus of rebuilding echoes through the air, heralding the dawn of a new era in U.S. infrastructure. A symphony of trillions awaits, promising fortunes for those who join the harmonious crescendo.

As the curtain rises on this grand performance, will you seize the opportunity to dance with the stars of construction and repair, or will you be left in the shadows as the orchestra of infrastructure stocks takes center stage?

Zacks offers a backstage pass, a Special Report to guide you through this transformative symphony of infrastructure spending. Discover the hidden gems poised to shine amidst the construction cacophony, and claim your seat at the table of prosperity.