A Gem Amongst Stones

JD.com JD, the shining beacon of Chinese e-commerce, has been making waves in the market. Established back in 1998, this company is not just another fish in the pond – it’s a formidable adversary to the likes of AlibabaBABA, setting a brisk pace in the online retail realm. JD’s focus on authentic products and robust logistics has won over customers, while its foray into cloud computing and artificial intelligence sets it apart from the competition.

The murky waters of Chinese equities often deter investors, yet JD emerges as a glowing prospect. With a surge in earnings revisions, a compelling technical position, and a deeply undervalued stock, JD.com presents an irresistible opportunity to the keen-eyed investor.

A Sunrise in Earnings Revision

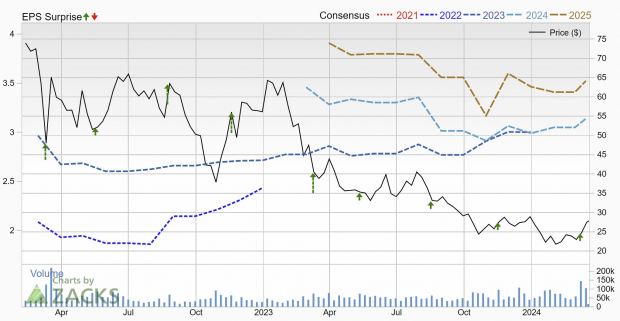

A recent upswing in earnings estimates paints a promising picture. Analysts have only just begun revising their figures for FY24 and FY25, albeit under the veil of geographical uncertainties and the prevailing bearish outlook on Chinese stocks. This lonely rise in upgrades signifies an exclusive chance for investors eyeing JD.com’s stock.

Notably, JD.com has secured a Zacks Rank #1 (Strong Buy) rating on the back of these upgrades.

Image Source: Zacks Investment Research

Diving into Deep Value Waters

JD.com isn’t just value, it’s deep value. With a forward earnings multiple of 8.9x, well below industry standards and a mere fraction of its own historical averages, JD stands out as a true bargain. Forecasted rapid growth in EPS over the next few years only sweetens the deal, with an estimated annual rate of 43.8% leading to an enviable PEG Ratio of 0.2.

Image Source: Zacks Investment Research

A Technical Symphony

JD.com’s technical landscape offers a delightful melody to investors. As the stock weaves a bull flag just below a critical resistance level, the potential for a breakout and subsequent price surge looms large. A previous double bottom formation hints at a possible turning point, favoring the bullish narrative.

Image Source: TradingView

The Golden Verdict

JD.com now stands at the intersection of perfection – boasting a top Zacks Rank, undervalued stock, and a pristine technical setup. The prevailing pessimism surrounding Chinese stocks only adds fuel to the bullish fire.

Chinese equities may come cloaked in uncertainty, but for those ready to seize the reins of risk, JD.com appears to be the epitome of opportunity.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

JD.com, Inc. (JD) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report