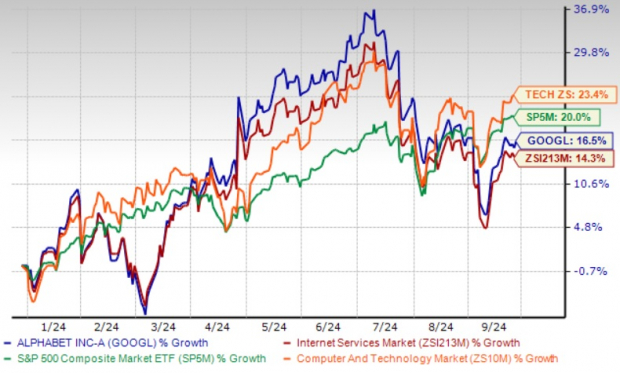

Alphabet GOOGL has been at the forefront of technological advancements, particularly in artificial intelligence (AI), search engines, and autonomous driving technology, which have not only captivated investors but also fueled optimism in its stock performance. Surging ahead with a 16.5% year-to-date (YTD) gain, Alphabet has outshone the Zacks Internet-Services industry, boasting a solid return of 14.3%.

Nevertheless, despite this commendable growth, the GOOGL stock has somewhat lagged behind the broader technology sector, which rallied by 23.4%, as well as the S&P 500 index, which recorded a gain of 20% within the same time frame.

Alphabet’s significant investments in generative AI (GenAI) technology have facilitated its dominance in the cloud computing market and search engine domain, thereby elevating search results and underscoring its merit in these spheres.

Leveraging its prowess in YouTube, along with a formidable presence in the search engine market, has played a pivotal role in driving the growth trajectory of its advertising business, while expanding its footprint in the self-driving vehicle sector through Waymo has been a strategic move.

Examining Year-to-Date Price Performance

Image Source: Zacks Investment Research

Despite its commendable growth, Alphabet faces challenges, including rising investment expenses, litigation entanglements associated with data privacy, and uncertainties in the market landscape.

In the intensely competitive GenAI market, Alphabet encounters formidable rivals like Microsoft (MSFT) and Amazon (AMZN), who are fervently enhancing their GenAI-powered offerings, posing a threat to Alphabet’s market position.

Moreover, while Alphabet boasts a first-mover advantage in the autonomous driving sphere, it contends with surging competition from players like Amazon, Baidu, General Motors, and Tesla, which could potentially undermine its market stance.

These headwinds, coupled with the prospects for growth arising from AI, search, and autonomous driving initiatives, evoke a nuanced consideration for investors evaluating Alphabet’s stock.

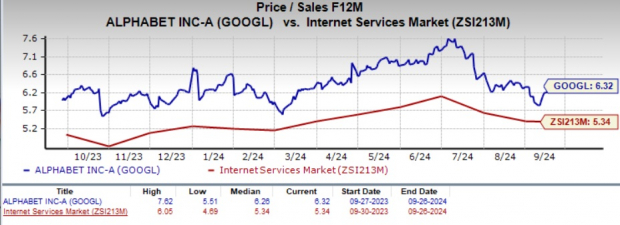

Assessing GOOGL Stock Value

The valuation of GOOGL stock appears steep, as indicated by a Value Style Score of C, signaling a slightly stretched valuation at present.

Trading at a premium with a forward 12-month Price/Sales ratio of 6.32X versus the industry’s 5.34X, Alphabet’s stock valuation suggests that potential investors might want to await a more opportune entry point.

Image Source: Zacks Investment Research

Evaluating the Role of GenAI Momentum for GOOGL

Google, a division of Alphabet, is capitalizing on the soaring demand for Large Language Models (LLM) with the introduction of its powerful AI model, Gemini.

Gemini, available in four different sizes, caters to varied use cases across data centers and devices, boasting the longest context window among large-scale foundation models to date.

The launch of Gemini Code Assist, an enterprise-focused AI code completion and assistance tool, underpins Google’s momentum among enterprises, bolstered by the traction witnessed in Google’s Vertex AI, which empowers developers to train, fine-tune, expand, and deploy applications using generative AI models.

Introducing Imagen 3, the latest image generation model in preview for Vertex AI customers with early access, as well as unveiling various open-source tools supporting generative AI projects, underscores Google’s commitment to fostering innovation.

Noteworthy additions like Gemma 2, part of the Gemma family of lightweight open models, and LearnLM, a suite of GenAI models facilitating conversational tutoring, further cement Google’s foray into the realm of AI.

Exploring the Impact of Search, YouTube, & Advertising Strength on GOOGL’s Growth

Google’s persistent innovation in AI techniques to enhance its search segment, a cornerstone of its revenue stream, continues to attract traffic to its search platform.

The seamless integration of GenAI technology into its search engine has yielded improved search results, thanks to Large Language Models (LLMs) alongside multi-search and visual exploration features.

Furthermore, initiatives like Search Generative Experience (SGE) augment the intuitiveness and naturalness of search results, enhancing user experience.

In the advertising realm, Alphabet’s dedication to delivering superior performance and profitability to advertisers, supported by foundational research models and LLMs, resonates positively, particularly through SGE’s facilitation of relevant and customized ad creation.

Continued strength in Google’s mobile search category and the proliferation of mobile-friendly algorithms and flight search capabilities complement its standing.

Driving momentum in the advertisement domain are Google Ads’ conversational experience and Performance Max, along with the improved efficacy of YouTube ads, underpinning Alphabet’s growth trajectory.

Moreover, the burgeoning user engagement in YouTube Shorts and Alphabet’s concerted efforts to bolster relationships with content creators further add to its appeal.

Unpacking the Implications of Waymo’s Expansion Efforts on Prospects

Alphabet is strategically positioned to capitalize on the burgeoning autonomous driving arena, fueled by robust endeavors to engage more customers through its cutting-edge driverless technology and expansive initiatives.

The operational prowess of Waymo in Phoenix, AZ, stands out as a commendable achievement.

Noteworthy is Alphabet’s collaboration with Uber Technologies (UBER) to offer autonomous driving services in Phoenix, AZ, aligning with its strategic focus on the region, exemplified by the launch of a rider-only service in downtown Phoenix.

Extending beyond Phoenix, the availability of Waymo One in San Francisco marks a significant expansion outside the confines of Phoenix, with regulatory nods to venture into Los Angeles and ongoing trials in Bellevue, WA, and Austin, TX, showcasing Alphabet’s ambition in this domain.