Keysight Technologies, Inc. KEYS has stepped into the limelight, designated by UL Solutions as the certification test partner for Thunderbolt 5 products. This partnership amplifies UL Solutions’ role as an Intel-authorized lab for Thunderbolt 5 technologies.

Thunderbolt 5 certification is pivotal, mandating strict adherence to Thunderbolt standards. Keysight, in close partnership with UL Solutions, stands firm in the commitment to uphold these requirements diligently. UL Solutions extensively utilizes a range of Keysight test and measurement products, including the Infiniium UXR B Series Oscilloscopes, the M8000 Series High-Performance BERT, and ENA Vector Network Analyzers.

Thunderbolt 5 heralds a new era of wired connectivity, flaunting data transfer speeds of up to 120 Gbps — a nearly threefold increase from Thunderbolt 4. This leap in capability not only accommodates cutting-edge display technologies but also enhances power delivery, facilitating swift transfers of large files such as ultra-high-definition videos and intricate 3D models. The end result is a streamlined workflow, heightened productivity, and an elevated user experience.

The Melodic Rise of Keysight’s Testing Solutions

Keysight is riding high on the wave of soaring demand for its electronic design and test solutions. As electronic devices continue to underpin the fabric of Internet of Things services, wireless technology, data centers, and 5G innovations, the rapid adoption of these devices acts as a catalyst for increased demand for Keysight’s electronic testing equipment.

KEYS’ Zacks Rank & Stock Price Performance

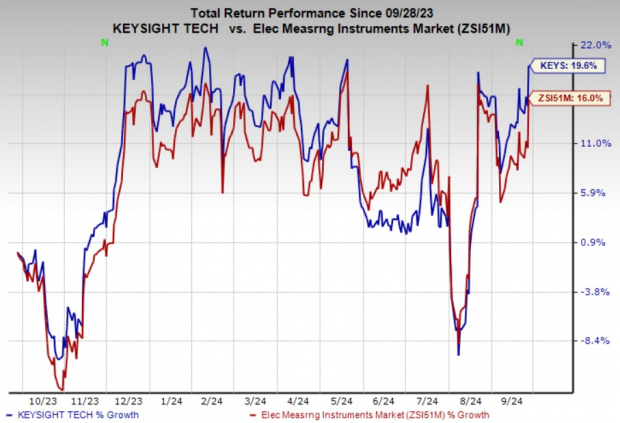

KEYS currently holds a Zacks Rank #3 (Hold). Over the past year, the company’s shares have surged by 19.6%, outpacing the sub-industry’s growth of 16%.

Image Source: Zacks Investment Research

Promising Stocks in the Horizon

Among the standout stocks in the expansive technology realm are Seagate Technology Holdings plc STX, ANSYS, Inc. ANSS and American Software, Inc. AMSWA. STX currently boasts a Zacks Rank #1 (Strong Buy), while ANSS & AMSWA carry a Zacks Rank #2 (Buy).

Seagate Technology exhibited an average earnings surprise of 80.9% in three of the last four quarters. Notably, in the most recent quarter, STX surpassed expectations with an earnings surprise of 40%. The Zacks Consensus Earnings Estimate for STX has risen by 18% to $7.41 in the past 60 days.

ANSYS delivered an average earnings surprise of 4.8% in three of the trailing four quarters. In the latest reported quarter, ANSS dazzled with an earnings surprise of 28.9%, positioning it with a long-term earnings growth expectation of 6.4%.

American Software registered a remarkable average earnings surprise of 84.5% in the past four quarters. In the latest financial result, AMSWA astounded with an earnings surprise of 71.4%. The Zacks Consensus Earnings Estimate for AMSWA has climbed by 8.6% to 38 cents in the last 60 days.