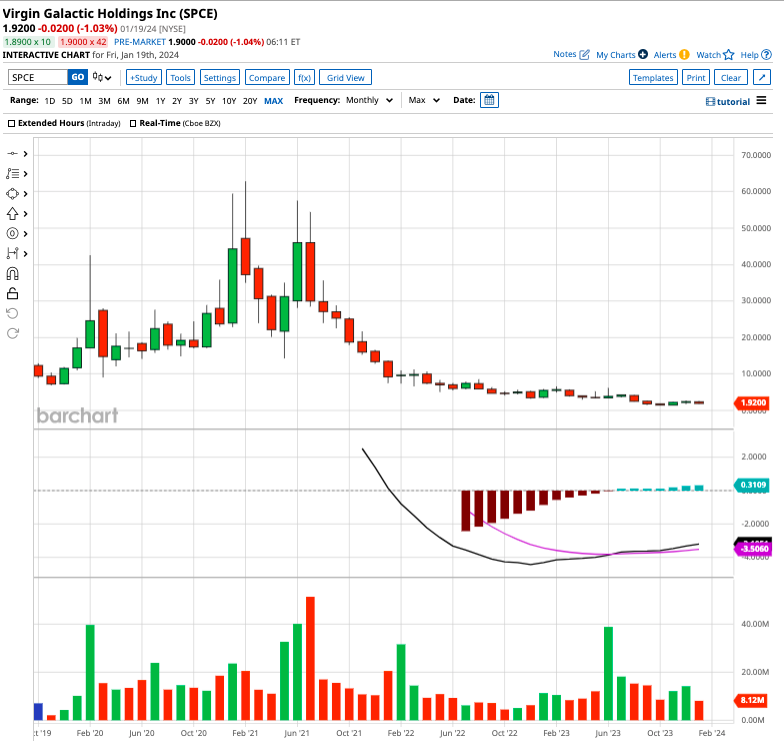

The price roller-coaster ride of Virgin Galactic Holdings (SPCE) has been nothing short of a wild intergalactic adventure for shareholders. Soaring from $7.29 in December 2019 to over $50 in June 2021, the stock has now dipped to $2.04, valuing the company at $767 million by market cap. The question on everyone’s lips is whether the space tech stock has the potential to stage a compelling comeback this year.

Assessing Virgin Galactic’s Investment Potential

Virgin Galactic, known for its aerospace and space travel endeavors, reported a remarkable surge in revenue in Q3 of 2023, soaring to $1.7 million from just $800,000 in the year-ago quarter. The uptick was fueled by commercial spaceflight and membership fees, with the company completing six spaceflights in under six months and anticipating total sales of $7 million by year-end, up from $2.31 million in 2022.

Armed with a hefty $1.1 billion in cash, the company is dedicated to reducing operational costs in a challenging macro environment, exemplified by a restructured workforce and substantial investments in the development of Delta Class spaceships.

However, the company’s Q3 net loss of $104.6 million and projected cash outflows of $135 million in Q4 indicate significant leeway for cash burn before consistent profitability. Virgin Galactic has asserted it has ample liquidity to bring its first two Delta ships into service and achieve positive cash flow in 2026.

What Lies Ahead for Virgin Galactic?

Virgin Galactic is focused on establishing a presence in space travel by venturing into the realm beyond the Earth’s atmosphere. The successful test flight in May 2023 followed by a commercial flight in late June mark key milestones in this pursuit. Subsequently, the company initiated a monthly flight schedule, leading to a surge in operating expenses to $25.6 million in the September quarter.

The development and production of the larger, revenue-generating Delta ships hold the promise of reducing operating costs and R&D expenditure. In Q3, Virgin Galactic’s R&D spending equated to $45 million, a substantial 7.5 times its sales.

Forecast for Virgin Galactic Stock

Analysts anticipate a notable uptick in sales for SPCE stock, from $2.31 million in 2022 to $11.42 million in 2024. The projected loss per share is expected to narrow from $1.89 per share to $1.12 per share over the same period.

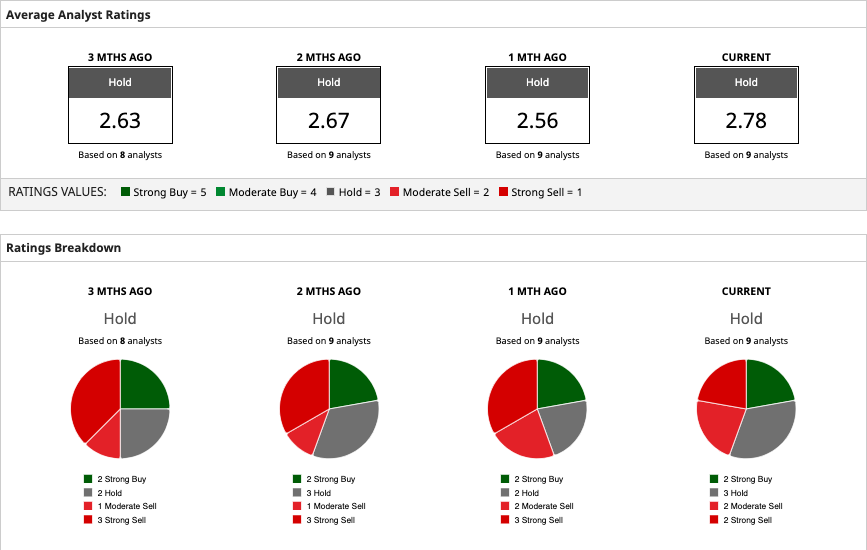

With nine analysts covering SPCE, opinions are divided: two suggest “strong buy,” three recommend “hold,” two advise “moderate sell,” and two propose “strong sell.” However, the average price target for SPCE stock is $2.88, indicating a potential upside of over 40%, with a street-high target of $5.00 – a staggering 143% premium to the current levels.

While Virgin Galactic stock holds promise, it’s essential to bear in mind its high-risk nature, marked by operating losses and lofty valuations.