China Stock Surge: A Spectacle to Behold

The fervor gripping the world of finance recently has been the meteoric rise of Chinese stocks. A simple glance at the charts of Chinese ADRs would make the Empire State Building look like a mere stoop. Noteworthy examples include the iShares China Large Cap ETF (FXI), soaring approximately 30% over two months, while smaller names like Futu Holdings (FUTU) and UP Fintech Holding (TIGR) catapulted by a staggering 63% and 89%, respectively.

Image Source: Zacks Investment Research

Delving into the Significance of Market Moves

Citing the words of trading luminary Jesse Livermore, “There is nothing new in Wall Street. There can’t be because speculation is as old as the hills.” Whether one partook in the awe-inspiring surge of Chinese stocks or not, it presents an invaluable case study for future opportunities that warrant attention.

The Resurgence of Chinese Stock Valuations

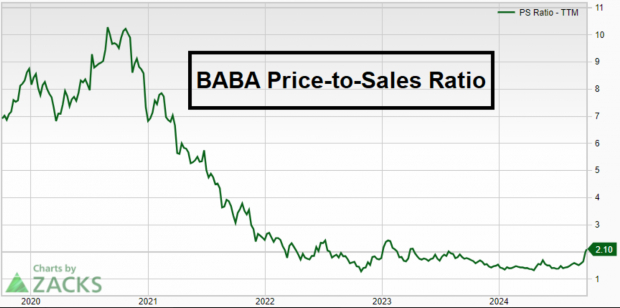

Prior to the rally, the valuations of top Chinese stocks had hit historic lows. Take Alibaba (BABA) as an example – its price-to-sales ratio nosedived from 10x in 2021 to a modest <2x, setting the stage for a remarkable resurgence.

Image Source: Zacks Investment Research

Insight from the Elite: Smart Money’s Involvement

Examining 13F disclosures offers retail investors a peek into the actions of astute investing minds. Visionaries like Michael Burry and David Tepper were seen accumulating holdings in stocks like JD.com (JD). Of note, David Tepper’s penchant for leveraged, high-conviction bets holds a track record of substantiated success.

Kindling the Fire: Central Bank Liquidity

Amidst mounting pessimism, soaring short interest, and bargain valuations, the Chinese government unleashed an unexpectedly robust stimulus package, exceeding Wall Street’s expectations. The outcome has already etched its place in history books.

The verdict remains crystal clear – whether one rode the wave of Chinese stocks or not, revisiting this phenomenon is a prudent move. Understanding the interplay of undervaluation, shrewd investments, and a dash of liquidity is a vital lesson for all investors to internalize for future pursuits.