Chipotle Mexican Grill’s CEO Brian Niccol made headlines this week by announcing his departure to lead Starbucks. Shareholders now ponder, as Niccol switches to Starbucks in September, which of these retail giants is a sound investment choice.

Chipotle has seen remarkable growth under Niccol’s leadership, with a stock surge of over 200% in the past half-decade, in stark contrast to Starbucks’ 2% dip. Yet, past successes do not guarantee future triumphs, leaving investors wondering where to hedge their bets.

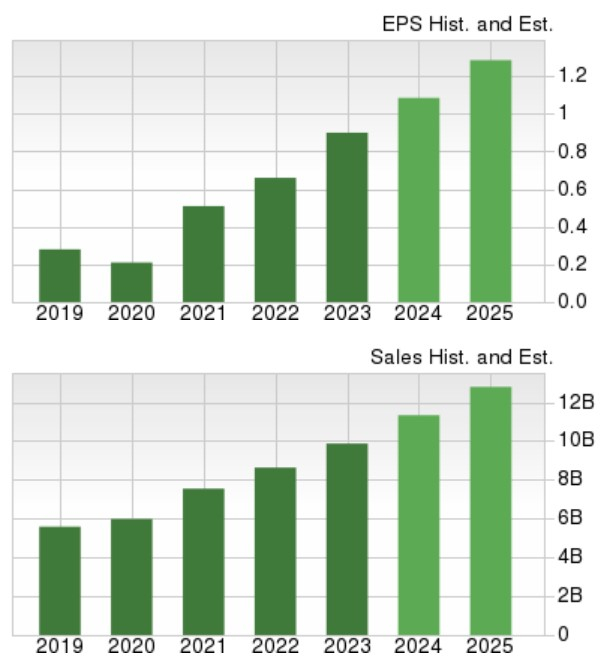

Image Source: Zacks Investment Research

Growth Prospects

Chipotle, following a significant 50-1 stock split, anticipates a 20% boost in annual earnings for 2024 to $1.08 per share. Top-line growth remains robust, with total sales projected to ascend by 15% this year and an additional 13% in FY25 to reach $12.79 billion.

Switching gears to Starbucks, the java giant foresees flat earnings in FY24, but a promising 11% uptick in FY25 to $3.94 per share. Sales are expected to climb by 1% in FY24 and a robust 6% in FY25, hitting $38.84 billion.

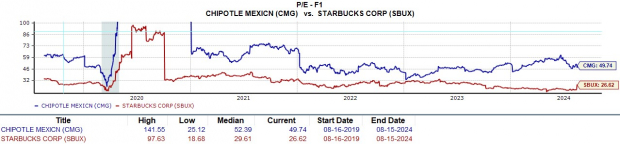

Image Source: Zacks Investment Research

Valuation Analysis

Whilst Chipotle boasts impressive growth figures, Starbucks presents a more appealing valuation. SBUX trades at 26.6X forward earnings, closely aligned with the S&P 500’s 23.3X. In contrast, CMG commands a premium, trading at 49.7X.

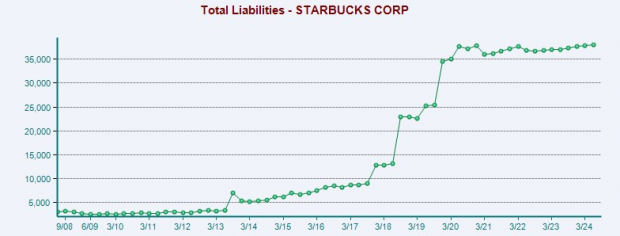

Image Source: Zacks Investment Research

Financial Health Comparison

Financial well-being is a pivotal metric for stock selection. Chipotle currently holds $1.49 billion in cash and equivalents against $8.92 billion in total assets, with total liabilities at $5.2 billion.

Conversely, Starbucks boasts $3.39 billion in cash and equivalents but bears total liabilities of $38.04 billion against total assets valued at $30.11 billion.

Image Source: Zacks Investment Research

Concluding Remarks

Despite the need for turnaround in Starbucks’ operations due to balance sheet concerns, Brian Niccol’s appointment brings hope for a resurgence. For now, both Chipotle and Starbucks carry a Zacks Rank #3 (Hold) and remain attractive long-term investments, though potential opportunities for improved entry points may arise in the future.