Despite the storm clouds looming over global markets, DBS shines a ray of light on the potential of Alibaba Group Holding Limited’s shares with a staggering 44% upside forecast. Following the revelation of the company’s June quarter results, the oracle-like analyst Sachin Mittal from DBS reiterated a Buy rating on the stock, underlining Alibaba’s commanding stance in the labyrinthine e-commerce cosmos and its multifaceted business portfolio. Overall, TipRanks bestows a Moderate Buy ratings on the stock.

The legendary Alibaba, akin to a modern-day Sinbad of the ‘One Thousand and One Nights,’ is a revered Chinese technology entity renowned for its digital marketplace prowess.

DBS Envisions a Rosy Path for Alibaba’s Expansion

DBS casts its prophetic eye on Alibaba’s diverse landscape that encompasses ethereal clouds of computing, digital media realms, and entertainment spheres, fortifying its revenue bastion and clinching a robust Buy rating.

Mittal’s gaze falls fondly on the global beckoning of Alibaba’s international commerce avenues like AliExpress, Lazada, and Trendyol. The June quarter spotlight shone brightly on Alibaba’s International e-commerce fiefdom, with a 32% uptick in sales year-over-year. Mittal envisions a mirage of growth at a 23% CAGR from FY24 to FY27. DBS also wagers confidently on the Cloud Computing zephyr, anticipating a 9% CAGR trajectory over the same temporal expanse.

Come September 2024, Alibaba unfurls its tapestry with a 0.6% service levy on GMV (gross merchandise value) per transaction for its gazillion merchants on Taobao and Tmall. Mittal bets on this move heralding an era of blooming customer management revenue (CMR) and earnings. A 7% CMR growth chalice is foreseen by DBS in FY25, echoing the resolute stance on Alibaba’s fortunes.

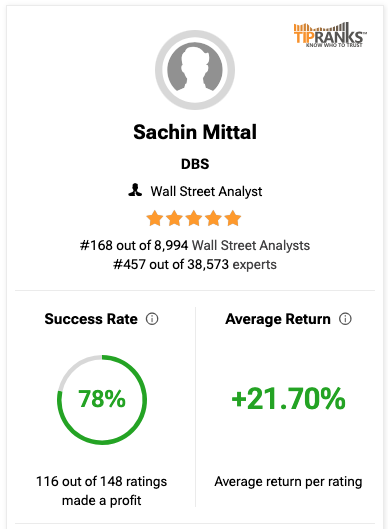

Mittal’s Acolade among the Pantheon of TipRanks

In the annals of TipRanks’ court, Mittal dons the illustrious five-star mantle, positioned at a commendable 168 among more than 8,900 sages. He regales with a 78% success parable, accompanied by an average return saga of 21.7% per oracle decree.

The fables spun by TipRanks embellish financial gurus, etching their lineage based on success rates, returns, and statistical verses. Traversing these narratives, investors unearth treasures of insight, charting new paths to financial constellations.

Alibaba’s Epic of June Quandary

Alibaba unfurled a mixed bazaar of tales for the June quarter. The Cloud business saga, a tale of valor, saw revenues ascend 6% year-over-year to ¥26.5 billion, fueled by the enchantment of artificial intelligence (AI) artifacts and robust public cloud growth. In contraposition, revenue from the e-commerce dynasty, the Taobao and Tmall Group, witnessed a 1% decline year-over-year to ¥113.37 billion.

Amidst the symphony of commerce, Alibaba’s revenue tapestry was threaded with a 4% year-over-year uptick, amounting to ¥243.2 billion. Yet, a tempest brewed with a 27% ebb in the net income to ¥24.02 billion, adding a tinge of bitter realism to the fantastical saga.

Should Alibaba’s Stock Saga be Embraced?

In the labyrinth of yesteryears, Alibaba’s stock has ascended by 7.6%.

In the palatial halls of TipRanks, 9988 stock stands adorned with three Buy and two Hold laurels. The prophetic Alibaba share price whispers of a golden HK$99.10, a mystical 22% ascendancy from the current trading tableau.