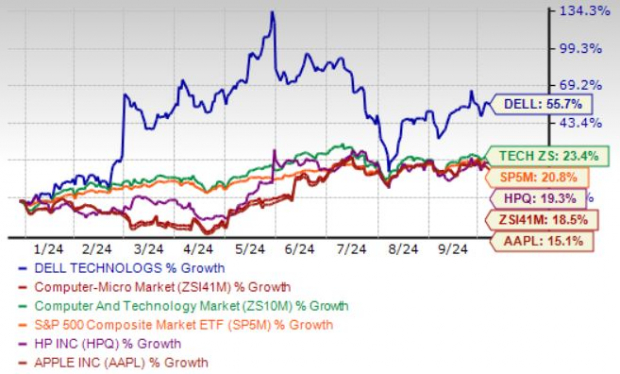

Dell Technologies DELL shares have soared 55.7% year to date (YTD), outpacing the broader Zacks Computer & Technology sector’s return of 23.5%. DELL stock has also outperformed the Zacks Computer – Micro Computers industry along with competitors HP HPQ and Apple AAPL. Amid this, shares of HP and Apple have seen returns of 19.3% and 15.1% respectively, marking a stellar industry appreciation of 18.5% YTD.

Delving deeper, DELL’s remarkable performance is driven by the insatiable demand for AI servers, spurred by the ongoing digital metamorphosis and a growing fascination with generative AI (GenAI) applications.

Year-to-Date Performance

Image Source: Zacks Investment Research

In light of this AI-driven surge, can DELL’s stock ascend further heights?

Dell Stock Rides on Strong Portfolio, Partner Base

Embarked on a voyage to success, Dell Technologies is reaping the rewards of an expanding partner ecosystem. Trailblazing collaborations with NVIDIA NVDA have been the cornerstone in the establishment of the Dell AI Factory. This union integrates Dell Technologies’ arsenal with NVIDIA’s AI Enterprise software platform and Tensor Core GPUs, amplifying computational capabilities and streamlining AI application development and deployment for accelerated value realization.

The advent of the Dell AI Factory has proven instrumental, harmonizing Dell Technologies’ offerings tailored for AI workloads and fostering an inclusive partner ecosystem including NVIDIA, Meta Platforms, Microsoft, and Hugging Face.

In tandem with NVIDIA, Dell is revolutionizing telecommunication networks through cutting-edge AI solutions. This synergy empowers communication service providers to implement AI-centric technologies that optimize network performance, enrich customer experience, and curtail operational expenses.

The collaborative efforts of DELL and NVIDIA extend to facilitating AI implementation at the edge of telecom networks through the PowerEdge XR8000 server, fortified with NVIDIA L4 Tensor Core GPUs. This amalgamation not only bolsters computational prowess but also simplifies AI application development and deployment, catalyzing value enhancement.

DELL Offers Positive View for 2H25

The prophecy laid forth by DELL suggests a flourishing AI hardware and services market, forecasted to burgeon to $174 billion by 2027, showcasing a robust CAGR exceeding 22% between 2023 and 2027. Fueled by ardent AI demand, Dell Technologies is fortifying engineering capabilities like data center networking and design to underpin its AI-centric endeavors.

An optimistic outlook looms for fiscal 2025’s latter half, envisioned to be a period of robust AI demand propelling substantial top-line growth. Furthermore, a resurgence in PC shipments is anticipated in the fourth quarter of fiscal 2025, heralding an era of growth.

For fiscal 2025, Dell envisions revenues to fall within the bracket of $95.5 billion to $98.5 billion, indicating a 10% year-over-year growth at the mid-point of $97 billion. An approximate 30% growth trajectory for the Infrastructure Solutions Group, nurtured by AI, is also anticipated.

Earnings are poised to rise to $7.80 per share (+/- 25 cents), marking a 9% upsurge at the midpoint for fiscal 2025.

Earnings Estimate Revisions Trend Higher for DELL

The Zacks Consensus Estimate for Dell’s fiscal year 2025 earnings stands at $7.85 per share, up by a penny over the last 30 days, painting a scenario of 10.1% year-over-year growth.

The revenue forecast aligns with Dell, set at $97.5 billion, signaling a year-over-year growth of 10.26%. Armed with a track record of surpassing earnings estimates across the last four quarters, DELL consistently exhibits an average positive surprise of 16.32%.

Dell Technologies Inc. Price and Consensus

Dell Technologies Inc. price-consensus-chart | Dell Technologies Inc. Quote

The market depicts Dell Technologies shares as cost-effective, underscored by a Value Score of A. DELL stock trades at a substantial discount with a forward 12-month P/E ratio of 13.16X, contrasting the sector’s value of 26.49X.

DELL’s P/E Ratio (F12M)

Image Source: Zacks Investment Research

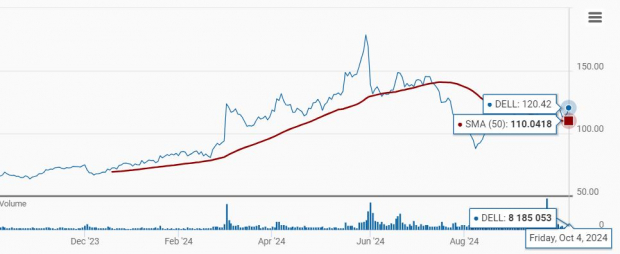

Further buoying the DELL narrative, the stock competently traverses above its 50-day moving average, indicative of a bullish trajectory.

Image Source: Zacks Investment Research

Dell’s repertoire of a robust portfolio and expanding partner network augur well for long-term investors, painting a promising outlook. However, a projected contraction in fiscal 2025 gross margin by approximately 180 basis points, triggered by inflational woes impacting costs, intense market competition, and an increased mix of low-margin AI optimized servers, poses a challenge. Lingering frailty in the consumer segment of the PC market adds to the mix of concerns.

At present, DELL carries a Zacks Rank #3 (Hold), indicating that investors may contemplate awaiting a more opportune entry point in the stock for favorable positioning. For investors seeking guidance, the complete list of today’s Zacks #1 Rank (Strong Buy) stocks offers a treasure trove of opportunities.

7 Best Stocks for the Next 30 Days

Embark on an adventure of discovery as experts distill 7 elite stocks from the current array of 220 Zacks Rank #1 Strong Buys. These handpicked tickers, characterized as “Most Likely for Early Price Pops,” have collectively outperformed the market with an average annual gain surpassing 23.7% since 1988. With such promising prospects, these 7 stocks warrant immediate exploration.