A recent analysis by Deutsche Bank’s Edison Yu has set the financial world abuzz, declaring Tesla (TSLA) as his “Top Pick” within the automotive sector. Yu’s Buy rating is coupled with an ambitious price target of $295, showcasing a tantalizing 29.3% upside potential from existing levels. The crux of Yu’s stance is that Tesla transcends the traditional EV label, positioning itself as a tech powerhouse across various verticals, thereby warranting a distinctive valuation framework.

Key Factors Driving Analyst’s Positive Sentiment Toward Tesla

Yu champions Tesla’s dominance in the BEV market regarding scale and cost efficiency, bolstered by its dedicated band of loyalists. While automotive margins currently lie low, Yu anticipates an upswing, fueled by Tesla’s pipeline of new models and enhancements.

Peering into the future, Yu envisions Tesla as a frontrunner in autonomous driving, citing its upcoming robotaxi fleet and humanoid venture with the Optimus robot. These applications are hailed as prime examples of practical and appealing applications of AI. Additionally, Yu predicts a flourishing energy storage business for Tesla, with projected sales surpassing $13 billion by 2025.

Yu unequivocally positions Tesla in a class of its own, foreseeing substantial growth trajectories in the road ahead.

Insights from Varied Perspectives on Tesla

Contrasting views saturate Wall Street regarding TSLA, with a myriad of challenges and opportunities coloring analysts’ opinions. As per TipRanks’ Bulls Say, Bears Say tool, some professionals applaud Tesla’s surging revenues from the energy storage vertical, underlining its robust Q2 performance and market supremacy.

In stark contrast, Bears raise red flags over waning brand allure, sluggish EV demand, and gross margin strains, instilling a sense of caution in the Tesla narrative.

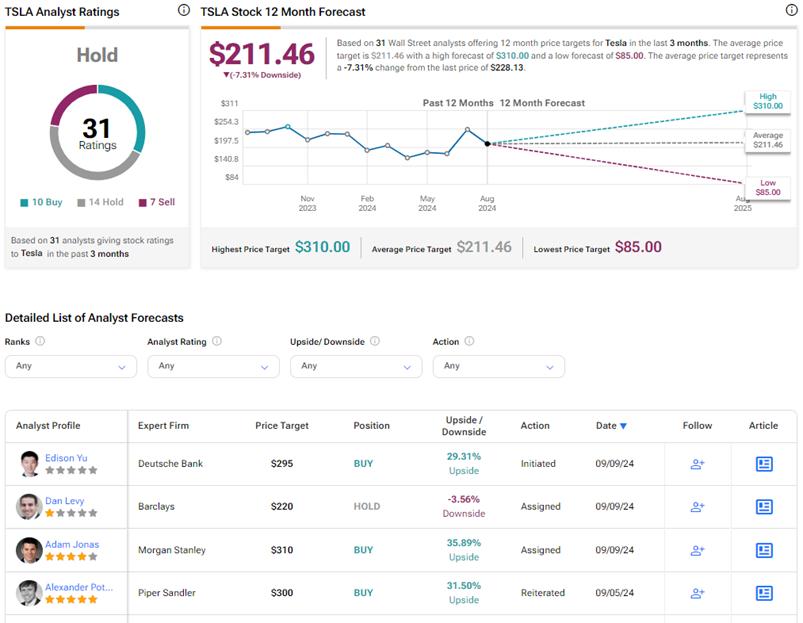

The diverging opinions among analysts have culminated in a Hold consensus rating for TSLA stock. This mosaic stems from ten Buy, 14 Hold, and seven Sell recommendations on TipRanks. The average price target for Tesla at $211.46 hints at a potential 7.3% decline from present levels. Year-to-date, Tesla shares have ebbed by 8.2% in value.

Explore further Tesla analyst ratings here