Warnings of a Modern Day Dotcom Bubble

JP Morgan’s recent alarm about an impending ‘Dotcom Bubble 2.0’ sent ripples across Wall Street. Drawing parallels with the ‘irrational exuberance’ of the Dotcom Bubble era, the report urged caution, citing a worrisome rise in market concentration. But is it time to hit the panic button just yet? Here are three compelling reasons why the outlook may not be as bleak as predicted:

Market Equilibrium Can Rebalance Without a Tech Plunge

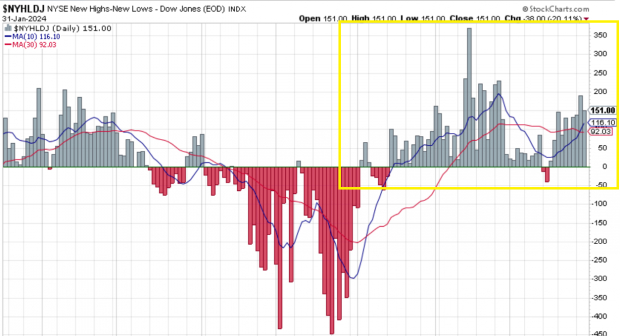

A market dominated by a handful of tech giants does not spell doom. Rebalancing can happen organically, with smaller companies and lagging segments gaining momentum to restore equilibrium. The Russell 2000 Index ETF is on the cusp of a rebound, hinting at a broader market participation. The NYSE Net New Highs Indicator corroborates this, indicating the broadening of market participation.

Image Source: Stockcharts.com

Recent Market Strength Suggests a Bullish Trend

Unlike the Dotcom Bubble, the current stock market is not overextended. Stocks have only recently begun to approach all-time highs. According to Ryan Detrick of Carson Research, the recent surge in the S&P 500 does not align with indicators of an impending bear market. Instead, it may herald the beginning of a new bullish trend.

Reading the Tea Leaves of Fed Rhetoric

Yesterday’s turbulence in the Regional Banking ETF highlighted potential cracks in the banking system. This, combined with the impending end of the Bank Term Funding Program, suggests a need for cautious optimism. While the Fed’s recent tone has been hawkish, the removal of a statement vouching for the soundness of the banking system could foreshadow rate cuts sooner than anticipated.

In Conclusion

JP Morgan’s alarm about the market’s increasing concentration is not without merit. However, a careful analysis of current market conditions raises legitimate reasons for optimism.