Tech Titans

As the financial sphere gears up for a crucial week in earnings, the stage is set for what is touted to be the most critical lineup of quarterly reports. Among the ‘Magnificent Seven’ stocks and the two largest American energy corporations, shareholders can anticipate a deluge of valuable economic data to guide their investment strategies.

The current earnings season has so far unfolded on a largely optimistic note, with the majority of companies surpassing both earnings and revenue projections.

Big 7 Tech Players

According to the Zacks Earnings Trend Report by research head Sheraz Mian, the technology sector is poised to lead the earnings charge. The report indicates that the total Q4 earnings for this sector are projected to surge by +18.7% from the same period last year, bolstered by a +6.8% hike in revenues. In fact, sans the substantial contribution from the technology sector, the Q4 earnings for the rest of the index would exhibit a dip of -5.9% (as opposed to the current +0.6% upturn).

The imminent Q4 results of the ‘Big 7 Tech Players’ comprising Amazon (AMZN), Alphabet (GOOGL), Apple (AAPL), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA) are expected to unveil a remarkable +38.3% surge in earnings from the corresponding period last year, supplemented by a +12.5% increase in revenues. This trajectory follows a stellar performance in 2023 Q3, wherein the group notched up a +54.2% uptick in earnings and a +12.9% rise in revenues.

The accomplishment of these tech giants is undeniably remarkable. While discussions surrounding the disproportionate dominance of mega-cap tech stocks in the S&P 500 continue to abound, their undeniable sales and earnings growth attest to their formidable prowess.

As the earnings week unfolds, investors can eagerly await the financial revelations from Microsoft MSFT and Alphabet GOOGL on Tuesday post-market close, and subsequently on Thursday, financial disclosures from Apple AAPL, Amazon AMZN, and Meta Platforms META.

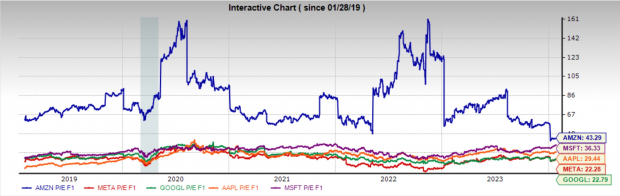

It is noteworthy that the valuations of the five tech stocks set to report next week are not as exorbitant as commonly emphasized. In fact, a couple of them present quite an enticing proposition despite their status as part of the ‘magnificent 7.’

A Comprehensive Valuation Perspective

A closer look at the valuations of the key tech players reveals that while Amazon and Microsoft boast the loftiest forward earnings multiples, Meta Platforms and Alphabet occupy the lower end of the spectrum. Apple, fittingly, falls within the middle ground. Remarkably, both Meta Platforms and Alphabet are currently trading below their respective five-year median valuations of 23.3x and 24.2x, with projections indicating annual EPS growth rates of 21% and 17% over the next 3-5 years.

On the other hand, Microsoft and Apple are trading above their five-year median valuations of 31x and 26x. Although these premiums may seem historically anomalous, they are not grossly inflated. Microsoft is forecasted to experience an annual EPS growth of 15.5% over the coming 3-5 years, while Apple is projected to trail close behind at 12.7%.

Lastly, Amazon, despite commanding the most premium valuation, remarkably rests significantly below its five-year median of 72.5x. Admittedly, Amazon’s valuation has always posed some quandary owing to the narrow margins of its e-commerce operations. However, the scale is tilted by the robust performance of Amazon Web Services, which stands as the preeminent cloud-service provider. Prospects look promising for Amazon as it anticipates an annual EPS growth of 28.5% over the next 3-5 years.

Image Source: Zacks Investment Research

In light of this data, a straightforward conclusion can be drawn: with respect to valuations, Meta Platforms and Alphabet offer an attractive allure, while Microsoft and Apple may need to shed their premium multiples to attain similar appeal. Amazon’s high earnings growth forecasts also render it an appealing proposition, despite its towering valuation.

Notably, Microsoft, Amazon, and Meta Platforms hold a Zacks Rank #2 (Buy), while Apple and Alphabet each uphold a Zacks Rank #3 (Hold) rating.

Energy Sector

In stark contrast to the exuberant tech projections, the earnings outlook for the energy sector presents a markedly divergent panorama. As delineated in the Earnings Trend Report:

“Sectors anticipated to witness the most substantial earnings downturns in Q4 comprise Autos, Basic Materials, Medical, Energy, and Transportation.”

The energy stocks have grappled with challenges over the past year, primarily attributed to the easing of oil prices. Amid the onset of the Ukraine-Russia conflict and the subsiding of inflation, the price of crude oil has steadily descended from the towering heights of $130 to its current $78, punctuated intermittently by spikes up to $95.

This pattern underscores the cyclical nature of investments in oil stocks and comes as no great surprise. However, even amidst expectations of year-on-year earnings decline, this sector continues to hold appeal and merits careful consideration as a viable investment option.

On Friday, the spotlight will shift onto the earnings reports from the US oil majors Exxon Mobil XOM and Chevron CVX before the market opens, marking a critical juncture for investors to gauge the sector’s financial pulse.