The current stock market frenzy has been akin to a fiery furnace, sending investor portfolios soaring. The S&P 500 (SNPINDEX: ^GSPC) has seen a remarkable surge of over 52% since its low point in October 2022. Meanwhile, the tech-centric Nasdaq (NASDAQINDEX: ^IXIC) has outpaced expectations with a whopping near 67% growth within the same timeframe.

In the midst of this euphoria, ominous warnings of an impending market crash have reverberated. Renowned economist Harry Dent has gone on record with Fox Business, branding the current market scenario as the “bubble of all bubbles.” Moreover, Capital Economics envisions a potential correction for the S&P 500 upon reaching the anticipated 6,500 milestone by the close of 2025.

Indeed, comparisons have been drawn between this market surge, largely driven by excitement surrounding artificial intelligence (AI), and the infamous dot-com bubble of the early 2000s. That historic downturn birthed the longest bear market trajectory in the annals of the S&P 500, instilling a sense of trepidation among investors regarding a potential repeat performance.

So, what does history teach us about navigating these turbulent market waters? While each downturn and bubble possess unique characteristics, delving into historical narratives offers insights into weathering the storm and optimizing long-term returns amidst market unpredictability.

Insights from Market Downturns of the Past

In the realm of stock market prognostication, the road ahead appears clouded with uncertainty. The crystal ball remains murky; despite grand declarations by experts regarding the commencement and severity of the next downturn, the future remains an enigma.

Yet, amidst this fog of uncertainty, a glimmer of hope emerges from historical precedent. Over the expanse of time, the stock market has displayed a remarkable resiliency, boasting a flawless track record of recovery post-downturns—a testament to its enduring nature.

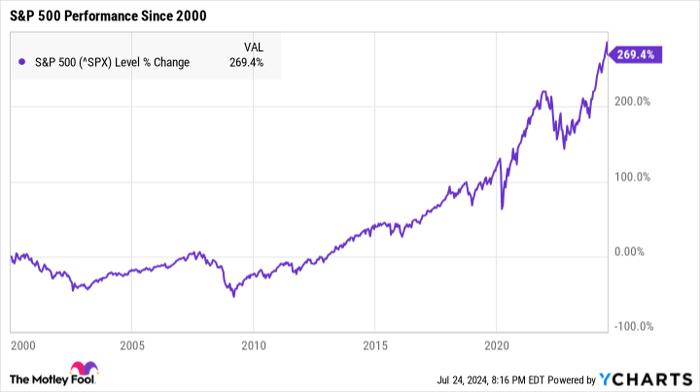

Reflecting on the past 25 years, the market has weathered some of its darkest moments, including the cataclysmic bear market following the dot-com bubble burst, the 2008 Great Recession, the 2020 COVID-19 crash, and the recent turbulent period in 2022. Despite these trials, the S&P 500 stands tall, boasting an impressive surge of over 269% since the turn of the millennium.

An important lesson from history is that downturns, regardless of severity, are transitory. Rather than playing the precarious game of forecasting the onset or duration of the next recession, it often pays greater dividends to weather the storm and await the inevitable dawn of recovery.

In times of ambiguity, the urge to take proactive measures with your investment portfolio is only natural. Many investors may feel compelled to time the market, buying or selling stocks in anticipation of the next market correction.

However, while this strategy may seem shrewd in theory, executing it in reality proves to be an arduous task. The capricious nature of the market in the short term introduces the risk of misjudging market timing and incurring substantial losses.

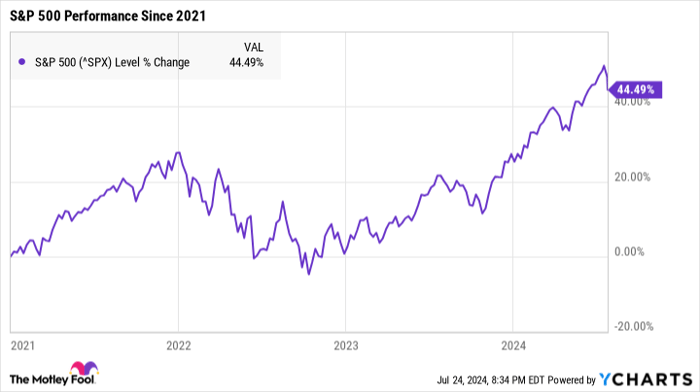

For instance, numerous economic pundits have persistently forecasted a looming recession in the U.S. Yet, since 2021, the S&P 500 has recorded a remarkable surge of over 44%. Succumbing to recession fears and halting investment would have resulted in missed opportunities for substantial stock market gains.

Regardless of the market’s short-term trajectory, its long-term growth potential remains robust. To mitigate risk and amplify earnings, strategic positioning in the market for extended durations proves to be a prudent approach—even during tumultuous times.

The crux lies in judicious investment placement. A portfolio populated with robust stocks from stalwart companies is better equipped to weather corrections and reap significant long-term growth benefits.

If you haven’t already, now is an opportune moment to conduct a thorough assessment of your investments, ensuring each stock merits its place in your portfolio. With a lineup of stocks boasting strong fundamentals, the odds of surviving even severe market downturns are substantially enhanced.

The stock market’s short-term trajectory may remain a mystery, but gazing through the lens of history reveals an immensely promising long-term horizon. By directing investments wisely and maintaining a long-term perspective, the fluctuations of days, weeks, or months ahead pale in significance.

Contemplating an Investment in the S&P 500 Index

Prior to delving into S&P 500 Index stocks, it’s prudent to consider the following:

The Motley Fool Stock Advisor analyst team has recently unveiled their selection of what they deem to be the 10 best stocks poised for significant investor growth… with the S&P 500 Index not featuring in the esteemed list. These chosen 10 stocks harbor the potential for colossal returns in the forthcoming years.

Consider the case of Nvidia’s listing on April 15, 2005…an investment of $1,000 at the time of recommendation would have burgeoned to a staggering $692,784!

Stock Advisor equips investors with a lucid roadmap to success, comprising portfolio construction guidance, regular analyst updates, and two fresh stock picks each month. The Stock Advisor service has witnessed a quadrupling of returns compared to the S&P 500 since 2002*.

*Stock Advisor returns as of July 22, 2024

Katie Brockman has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.