ANSYS Inc ANSS is gearing up to unveil its second-quarter results on Jul 31, following the close of the market.

Analysts expect an EPS of $1.94, a figure untouched for the last 60 days, marking a robust 21.25% surge from the same period last year.

Revenue estimates stand at $550.8 million, indicating a 10.91% increase from the prior-year quarter.

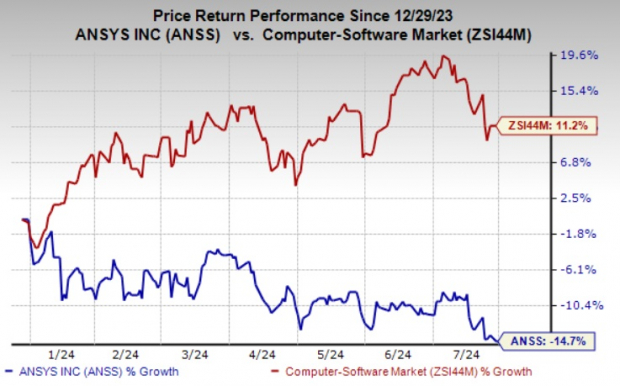

While ANSS fell short of the Zacks Consensus Estimate in the previous quarter, it outperformed in the three preceding quarters, with a minor average surprise deficit of 0.5%. Yet, its shares have lagged behind the sub-industry’s growth of 11.2% and the S&P 500’s 14.8% rally this year.

Image Source: Zacks Investment Research

Exploring Influential Factors

ANSYS continues to witness robust demand for its simulation solutions in crucial sectors like aerospace & defense, high tech, automotive, industrial equipment, and energy.

Amid a thriving A&D industry spurred by space exploration advancements and digital evolution, ANSS is expected to see growth. In the automotive sphere, the surge in electric vehicle demand and advanced driver assistance systems are likely to bolster its revenue.

The company’s foray into artificial intelligence and machine learning is enhancing its simulation software capabilities, opening up new avenues for expansion. The ongoing AI developments in the high-tech sector also serve as a pivotal growth driver.

However, challenges like geopolitical uncertainties, currency fluctuations, and global economic fragility loom over ANSS’ prospects.

Following the Synopsys acquisition announcement earlier this year, ANSYS no longer provides specific guidance. However, it anticipates varying ACV and revenue growth rates throughout 2024, influenced by comparisons to the previous year’s performance.

Recent Strides

On Jul 18, 2024, ANSS expanded its collaboration with NVIDIA and Supermicro to introduce turnkey hardware solutions that significantly boost Ansys Multiphysics simulation capabilities, heralding a seismic advancement.

Moreover, on Jul 9th, Ansys System Tool Kit hit the AWS Marketplace, offering cutting-edge engineering software for digital mission analysis, while on Jun 20th, ANSS rolled out Ansys ConceptEV – a state-of-the-art SaaS solution revolutionizing EV powertrain design.

Expert Insights

The predictive model does not unequivocally forecast an earnings beat for ANSYS this quarter. While an upbeat Earnings ESP alongside a Zacks Rank #1, #2, or #3 typically spells good news, such is not the case this occasion.

With an Earnings ESP of 0.00% and a current Zacks Rank of #3, ANSS’s prospects are poised delicately. For timely investment decisions before earnings reports, ensure to leverage critical insights.

Stocks of Interest

Highlighted below are some stocks worth considering based on their favorable predictive elements suggesting they might surpass estimates in the upcoming reports.

Apple AAPL and Marriott International, Inc MAR boast promising attributes, with KGC, Kinross Gold Corporation, also appearing primed for a strong performance.

Always stay ahead of earnings announcements by referencing the Zacks Earnings Calendar.