Ford Motor Company (NYSE: F) released its fourth-quarter sales data, revealing a record-breaking quarter for electric vehicle (EV) sales. However, this positive news is marred by significant losses in the near term. So, what does this mean for Ford and its investors?

Diving into the Data

In 2023, Ford’s U.S. sales surged by 7.1%, with nearly 2 million vehicles sold, primarily driven by robust sales of its F-Series trucks, along with commercial vehicles and a stellar performance in the EV segment.

Notably, Ford’s F-Series has maintained its stronghold as America’s top-selling truck for 47 consecutive years and the best-selling vehicle for 42 consecutive years, a feat that is unmatched in the automotive industry. This stellar performance is crucial, considering its rival, General Motors, distributes sales between two truck brands, the Chevrolet Silverado and the GMC Sierra.

Of particular interest to investors is the success of the F-150 Lightning, which emerged as the leading electric truck, and the F-150 Hybrid as the top full-size hybrid truck in the market. This development underscores Ford’s ability to transition its dominance in full-size gasoline-powered trucks to the EV segment, a vital component for long-term financial success.

Unpacking EV Sales

Ford’s EVs achieved record fourth-quarter sales, culminating in a surge of nearly 26,000 units, marking a 24% uptick from the previous quarter and an 18% increase for the full year.

The exceptional performance was primarily driven by the F-150 Lightning, witnessing a remarkable 74% surge in sales compared to the previous year’s fourth quarter, and a substantial 55% increase for the full year. Combining the success of the F-150 Lightning, Mustang Mach-E, and E-Transit, Ford secured the position as America’s second-largest EV brand for 2023.

Data source: Ford Motor Company presentation.

The Bitter Reality

However, despite the impressive sales figures, Ford continues to suffer significant cash burn for every EV manufactured. In fact, the company estimated a staggering loss of roughly $4.5 billion from its EV business unit, Model e, in 2023.

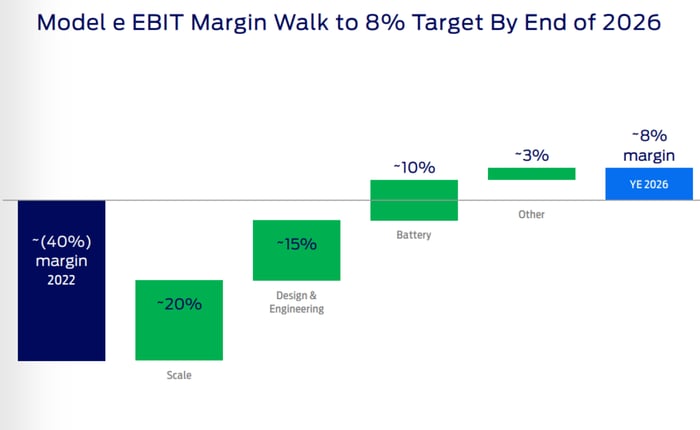

While management anticipates reducing costs and ramping up production to reverse this trend and achieve profitability by the end of 2026, the immediate consequence is a dent in the full-year earnings. Yet, these record-breaking sales are integral to the company’s path to long-term profitability, signifying short-term pain for eventual gains.

According to Ford’s presentation on its trajectory to 8% EBIT margins by the end of 2026, scaling production and sales will be the primary driver of margin gains, supplemented by aspects such as design, engineering, and decreased battery expenses.

Looking Ahead

Despite the significant losses associated with its current EV operations, Ford closed the 2023 chapter with a promising sales momentum. Management remains optimistic about the company’s prospects for growth in 2024, primarily propelled by its stronghold in the full-size truck and SUV segments. Ford is set to introduce new models such as F-150s, Rangers, Explorers, Expeditions, as well as Lincoln Aviators, Navigators, and Nautilus.

Ultimately, while media may highlight Ford’s substantial EV-related losses, the company must sustain its record-breaking EV sales to expedite the journey to profitability. This crucial period embodies the notion that short-term setbacks are instrumental in achieving long-term success.

Important Disclaimer: The Motley Fool Stock Advisor team has identified what they believe are the 10 best stocks for investors to buy now, but Ford Motor Company did not make the cut. The 10 stocks selected are predicted to yield substantial returns in the years to come.

The Stock Advisor service offers a user-friendly roadmap for investment success, featuring portfolio-building advice, regular analyst updates, and two new stock picks each month. Since 2002, the Stock Advisor has significantly outperformed the S&P 500.*

*Stock Advisor returns as of December 18, 2023

Daniel Miller has positions in Ford Motor Company and General Motors. The Motley Fool recommends General Motors and recommends the following options: long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.