Ford Motor Company (F) is making a major strategic shift by hitting the brakes on its electric vehicle (EV) ambitions. The automaker recently announced the cancellation of its plans for a large electric SUV and the delay in the launch of its next-generation pickup truck. This decision reflects Ford’s response to the slower-than-expected growth in EV demand, leading to an anticipated $1.9 billion in special charges and write-downs, as reported by Reuters.

Ford Scraps Electric SUV and Delays Pickup

As per the Wall Street Journal, Ford’s CEO, Jim Farley, articulated the rationale behind this move, stating, “Based on where the market is and where the customer is, we will pivot and adjust and make those tough decisions.” The electric three-row SUV, originally scheduled for a 2025 debut, is being scrapped due to pricing pressures and a sluggish acceptance of EVs in the market. Instead, Ford will focus on a hybrid gas-electric version for this segment. The release of the new electric pickup truck, initially planned for 2025, has now been pushed to 2027 to capitalize on more cost-effective battery technology, according to Reuters.

Ford Adapts to Market Realities

Despite these setbacks, Ford remains committed to its EV plans. The company is proceeding with other electric models, including a commercial van set to premiere in 2026 and a new mid-size electric pickup. Farley emphasized the crucial role of a talented team in California working on a new EV architecture, aiming to deliver more accessible and competitive models in the future.

Is Ford Stock a Buy Right Now?

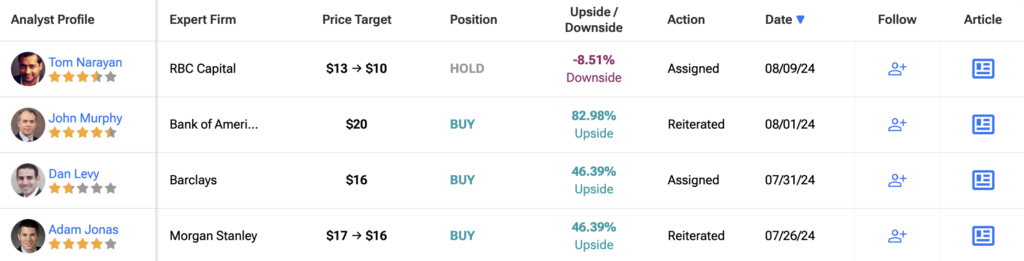

Analysts currently hold a cautiously positive outlook on Ford’s stock, with a Moderate Buy rating divided between five Buys, six Holds, and one Sell. Despite a 2% decline in Ford’s stock over the past year, the average price target of $14.20 implies a potential 30.10% upside from its current level.

Explore more F analyst ratings