“Riding the Wave: A Reevaluation of Microsoft’s AI Prowess”

When it comes to the world of tech giants, the race for AI supremacy has been akin to a high-stakes game of poker. Microsoft, a key player in this arena, emerged early as a frontrunner, leveraging its investments in OpenAI and the integration of AI tools into Azure and GitHub to gain a competitive edge over rivals like AWS and Google Cloud.

D.A. Davidson Analyst, Gil Luria’s Call

However, according to D.A. Davidson analyst Gil Luria, the landscape has shifted. Luria argues that while Microsoft once held a clear lead, the paradigm has evolved. Competitors have caught up, eroding Microsoft’s erstwhile advantage and diluting the rationale for its premium valuation.

The Changing Tide

AWS and Google Cloud, Microsoft’s primary adversaries in the cloud services domain, have surged ahead in deploying custom silicon in data centers, a strategic move that bestows a significant competitive edge. Although Microsoft has introduced its Maia chips, it trails behind Amazon and Google in this crucial aspect, potentially setting the stage for an uphill battle.

Margin Woes and Market Realities

Compounding Microsoft’s woes is a forecasted decline in operating margins, a reversal from its previous margin expansion. Rising data center capital expenditures, coupled with an increased reliance on Nvidia, pose challenges for sustained growth. Luria notes that Microsoft’s trajectory may inadvertently shift wealth from its own shareholders to those of Nvidia.

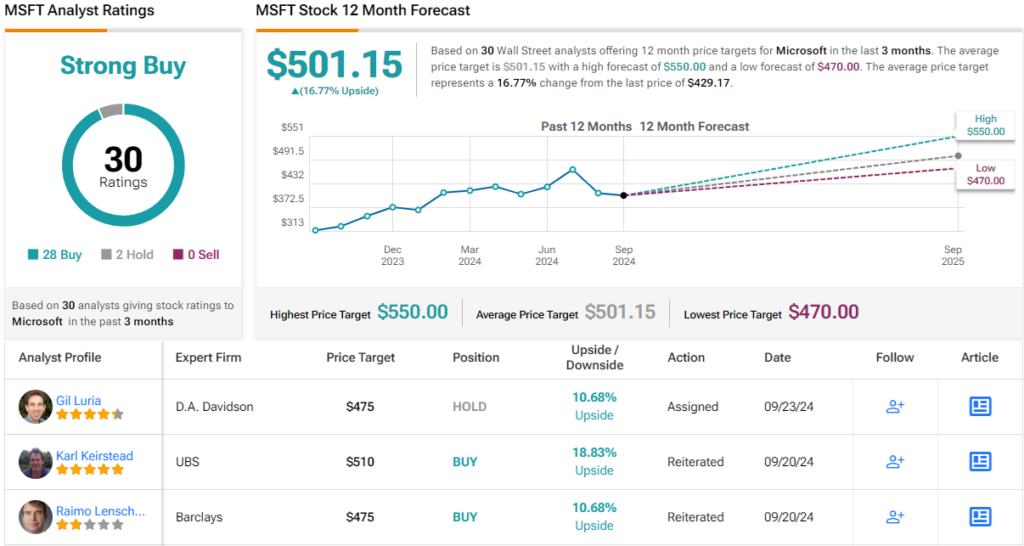

Despite Luria downgrading Microsoft’s rating from Buy to Neutral, with a price target of $475 and a potential upside of 9.5%, the majority of analysts maintain a bullish outlook on MSFT stock. With 28 analysts rating it a Buy, the consensus stands at a Strong Buy, with an average price target of $501.15, suggesting potential 12-month returns of approximately 17%.

Looking Ahead

In the ever-evolving realm of tech and AI, Microsoft finds itself at a crossroads. The once-certain path to domination now appears fraught with challenges and uncertainties. As competitors intensify their efforts and technological innovations reshape the industry, Microsoft must navigate these turbulent waters with agility and foresight.

While the tide may be turning against Microsoft, the company’s resilience and adaptability have been key attributes in weathering past storms. Whether it can overcome the current obstacles and retain its foothold in the AI landscape remains to be seen.

As investors assess the shifting dynamics of the tech sector, the fate of Microsoft’s AI ambitions hangs in the balance. Will it reclaim its position at the summit of AI innovation, or will the winds of change alter the course of tech history?

For now, analysts and investors alike watch with bated breath, awaiting the next chapter in Microsoft’s AI odyssey.