Amid the tumultuous landscape of Hong Kong stocks, Alibaba Group Holding Limited recently executed a share buyback totaling $5.8 billion in the first quarter of FY25, a move sparked by the stock’s downturn over the last year. Consequently, there was a 2.3% reduction in the company’s total outstanding shares. Embracing a bullish trend, Alibaba’s shares listed in Hong Kong surged by 3% in today’s trading session, reflecting the market’s favorable response to the strategic buyback.

The past 12 months have seen Alibaba’s stock encounter a 13.4% decline, indicative of the challenges faced amidst a volatile market environment.

Originating from China, Alibaba stands as a prominent technology entity renowned for its expansive online marketplace.

Deep Dive into Alibaba’s Buyback Initiative

Alibaba’s recent buyback initiative forms part of its ongoing program, which still harbors $26.1 billion and extends through Q1 2027. Noteworthy is the $5.8 billion buyback in the latest quarter, showing an uptick from the $4.8 billion repurchased earlier. During Q1 FY25, the tech juggernaut doubled its buybacks compared to the $2.9 billion repurchased in the previous quarter that ended on December 31, 2023.

Throughout FY24, Alibaba effectively repurchased $12.5 billion worth of shares, leading to a 5% reduction in its overall share count.

In a bid to fortify its buyback strategy, Alibaba recently secured $5 billion through a convertible bond issuance in May, primarily aimed at funding its share repurchase endeavors. This intricate dance of balancing substantial buybacks while nurturing investments in futuristic domains like generative artificial intelligence poses a clear challenge for the company.

Assessing Alibaba’s Investment Potential

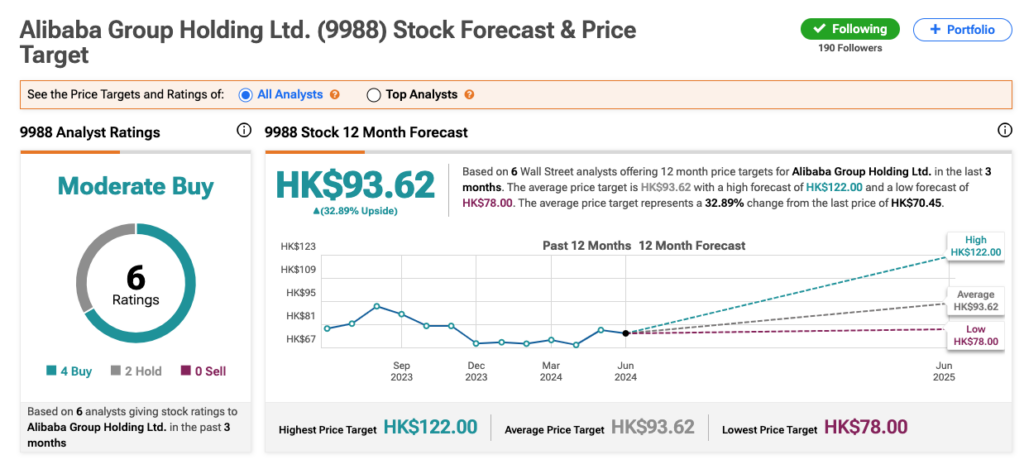

The year 2023 posed multifaceted challenges for Alibaba, ranging from declining domestic sales, intensifying market competition, to the ambiguity surrounding its business units’ spinoff plans. The stock has consistently trended downwards this year, setting a daunting path to recovery. Despite the hurdles, analysts maintain a cautious optimism towards Alibaba’s future trajectory.

Analysis on TipRanks reveals a Moderate Buy consensus rating on 9988 stock, anchored by four Buy and two Hold recommendations. The Alibaba share price target of HK$93.62 indicates a promising 33% upside potential, keeping investor optimism afloat.