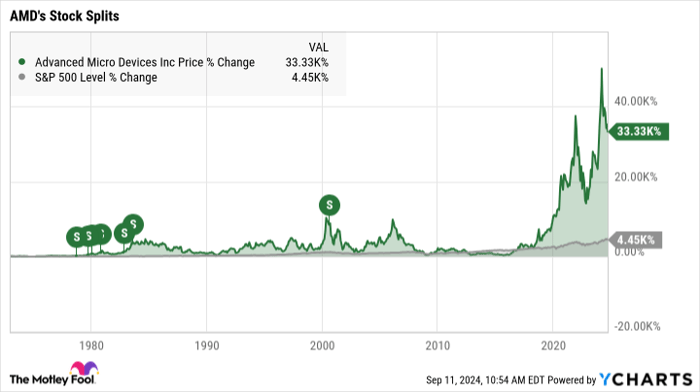

Over the past decade, Advanced Micro Devices (NASDAQ: AMD) has emerged as a formidable force in the tech world. Thriving in the realm of artificial intelligence and rivaling industry giant Nvidia in high-performance graphics processing units for gamers and designers, AMD has also been encroaching on Intel’s territory in key market segments.

This prowess has translated into a jaw-dropping 3,410% surge in AMD’s stock value, eclipsing the S&P 500’s 231% growth and Intel’s 29% decline during the same period. Noteworthy, these figures include reinvested dividends, a strategy AMD has never adopted.

AMD’s historical stock splits

With AMD’s stock price rocketing to $141 per share, speculations of a stock split have emerged. AMD has a history of splits dating back several decades, although none in recent years:

Split Date | Split Ratio |

|---|---|

October 1978 | 3-for-2 |

Data source: AMD.

These splits cumulatively amount to a 27-for-1 multiplier over 22 years. Snagging an AMD share at its IPO in 1972 for approximately $11.37 (adjusted for splits) would now result in a holding of 27 shares valued at $3,807.

The last stock split from AMD dates back to 2000, a period synonymous with cultural touchstones like PacMan, transistor radios, and VHS players.

Considering an Investment in AMD?

Contemplating a stake in Advanced Micro Devices? Here’s something to ponder:

The Motley Fool Stock Advisor team recently unveiled their top picks, excluding AMD from the lineup. These selections have the potential to yield substantial returns in the coming years.

Take, for instance, Nvidia’s inclusion in a similar list back in 2005. A $1,000 investment made then would have grown to a staggering $716,375!* Wow!*

Stock Advisor doesn’t just offer stock tips; it provides a roadmap to success, with insights on portfolio construction, regular analyst updates, and two new stock recommendations monthly. Since 2002, the Stock Advisor service has surpassed S&P 500 returns by over fourfold*.

*Stock Advisor returns as of September 9, 2024

Author Anders Bylund maintains positions in Intel and Nvidia. The Motley Fool has stakes in and endorses Advanced Micro Devices and Nvidia. The Motley Fool approves of Intel and recommends short November 2024 $24 calls on Intel. Review the Fool’s disclosure policy.