$21M Bet On Comstock Resources? Check Out These 3 Stocks Insiders Are Buying

Despite the overall rise in U.S. stock values on Friday, there were several noteworthy insider transactions.

Insider acquisitions of shares often signify faith in a company’s future or belief that the stock is undervalued. While compelling, this should not be the sole basis for investment decisions, yet it can bolster the case for going long on a stock.

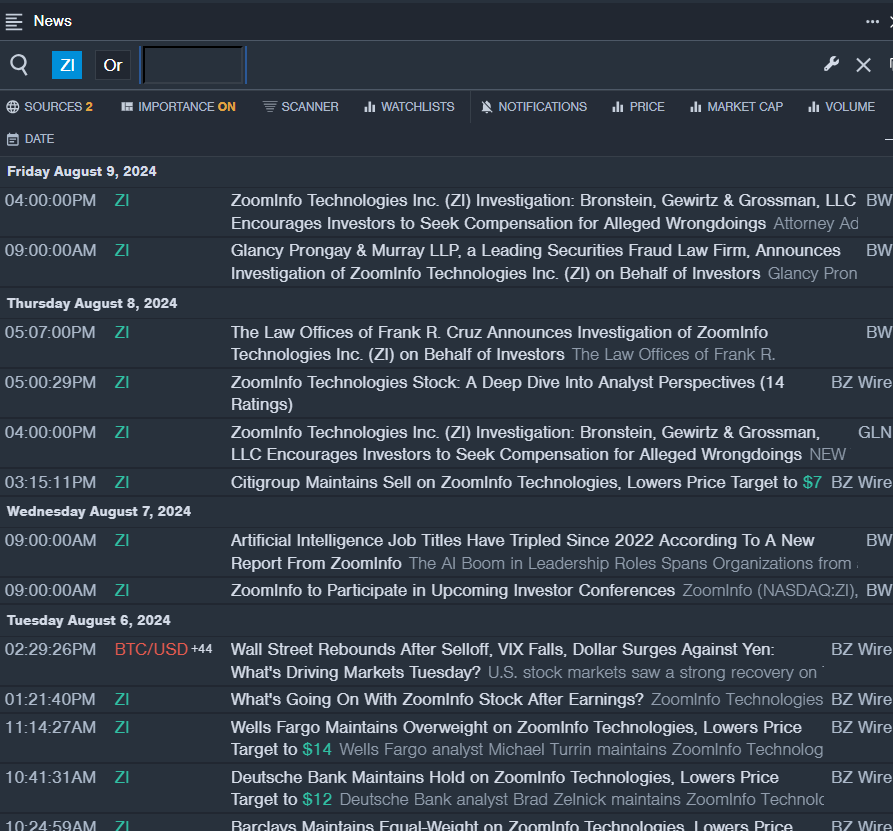

Insights Into ZoomInfo Technologies

- The Trade: ZoomInfo Technologies Inc. CEO Henry Schuck bought 1,500,000 shares at an average price of $8.49, totaling around $12.7 million.

- Recent News: On August 5, ZoomInfo’s second-quarter financials were below expectations, along with a management transition announcement.

- About ZoomInfo: ZoomInfo Technologies Inc. offers a market intelligence platform for sales and marketing teams.

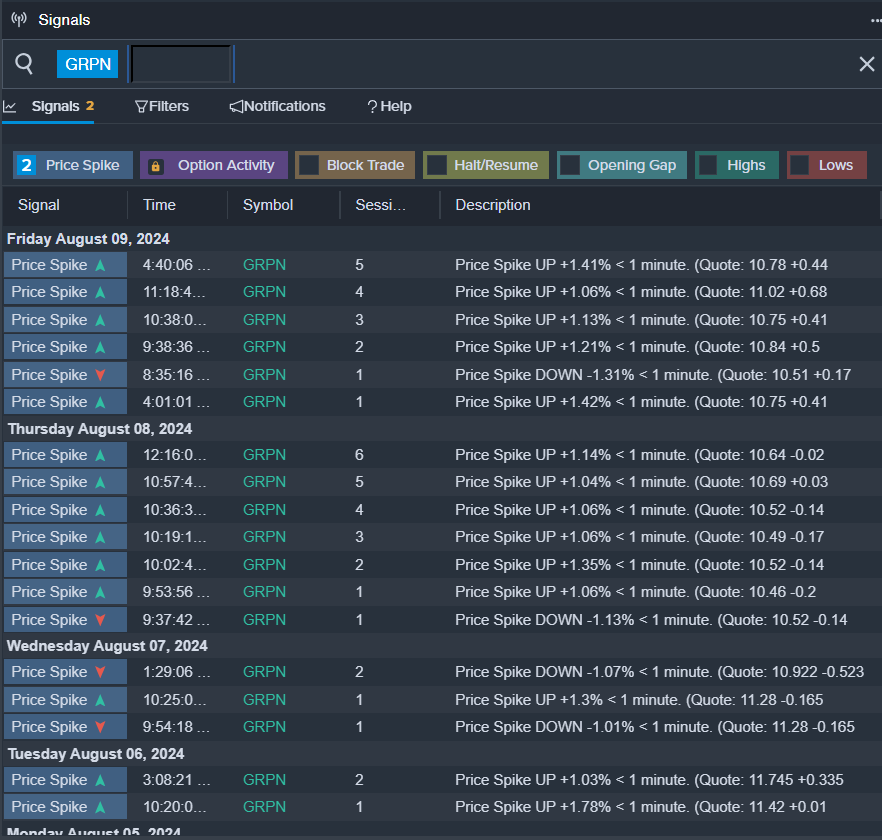

Groupon Transaction Details

- The Trade: Groupon, Inc. Director Jason Harinstein acquired 15,000 shares at an average price of $10.61, amounting to approximately $159,150.

- Recent Developments: On July 30, Groupon reported a loss in the second quarter.

- About Groupon: Groupon Inc. acts as an intermediary between consumers and merchants, providing various products and services at discounted rates through its online platform.

Disney’s Director’s Purchase

- The Trade: The Walt Disney Company Director Calvin McDonald bought 11,756 shares at an average price of $85.06, totaling about $999,994.

- Recent News: On August 7, Walt Disney reported positive quarterly earnings.

- About Disney: Disney operates in three global segments: entertainment, sports, and experiences, leveraging franchises and characters developed over a century.

Read More: