Essentials and Beyond

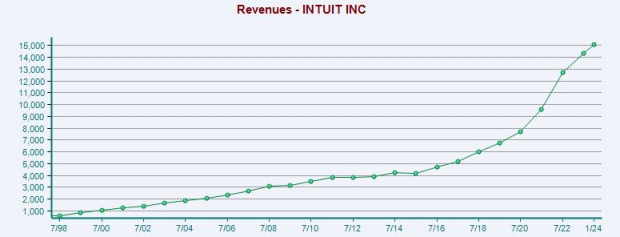

The timeless duo of ‘death and taxes’ stands as a permanent fixture in human existence. Intuit, through its innovative TurboTax software, initiated a remarkable streak of double-digit revenue growth, propelling its sales from under $1 billion in the late 1990s to over $14 billion in FY23.

Capitalizing on the Covid-induced boom, Intuit diversified its software portfolio into various segments of consumer finance, email marketing, digital advertising services, and more.

With over 100 million customers spread across TurboTax, QuickBooks, Credit Karma, and Mailchimp, Intuit’s wide array of offerings positions it to benefit from the expansion of several key economic sectors, ensuring its relevance for the foreseeable future.

Image Source: Zacks Investment Research

TurboTax, the most prominent consumer-facing aspect of Intuit, only accounts for 29% of its fiscal 2023 revenues. On the other hand, Credit Karma, offering personal finance services, constitutes 11% of its revenue.

Majorly, its small business segment dominates with 56% of FY23 sales, providing financial and business management services, payroll solutions, merchant payment processing, small business financing, and more to small enterprises.

Growth Outlook

Projections indicate Intuit is set to grow its revenue by 12% annually in both FY24 and FY25, continuing its decade-long streak of double-digit sales expansion. The firm aims to elevate its sales from $14.37 billion in FY23 to $18.00 billion in FY25.

Anticipated growth in adjusted 2024 earnings stands at 14% based on recent Zacks estimates, with an additional 15% boost expected in the subsequent year. This anticipated growth trajectory places Intuit at a Zacks Rank #2 (Buy), having surpassed EPS estimates by 16% on average in the trailing four quarters.

Image Source: Zacks Investment Research

Performance, Technical Levels & Valuation

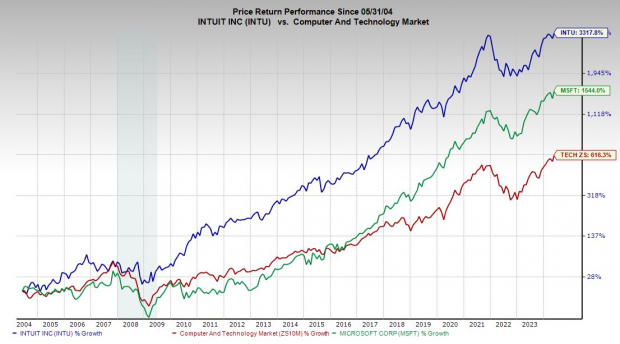

Intuit’s remarkable surge over the past two decades, outshining the Zacks Tech sector by 3,300% while doubling the growth of Microsoft and far surpassing Apple’s performance, attests to its market dominance.

Currently trading above key moving averages, Intuit’s technical indicators hint at a potential breakout to new records, contingent on its guidance following the upcoming report on May 23.

Image Source: Zacks Investment Research

Though not a conventional value stock, trading at 51.7X forward 12-month earnings, Intuit remains 40% below its 10-year highs despite a staggering 740% surge during that period. Wall Street’s willingness to pay a premium for Intuit’s consistent growth defines its standing over the last decade.

Bottom Line

Intuit’s aggressive buyback of shares with $2.7 billion remaining on its repurchase plan, endorsed by 24 out of 29 brokerage recommendations at “Strong Buy,” underscores market confidence in the stock.

The company’s recent 15% dividend increase for FY24, offering a modest 0.5% yield, complements its impressive growth trajectory, making it an enticing proposition for investors seeking stable growth.

Interested in earning potential? Download our free report on 5 Dividend Stocks to Fund Your Retirement, packed with unconventional insights and wisdom.