Enthusiasm for small-cap stocks has reached a fever pitch as investors anticipate a promising era for this interest-rate-sensitive sector amid imminent Federal Reserve rate cuts.

The unprecedented July small-cap rally has overshadowed large caps, notably in the tech realm, previously the darling of a near-two-year bull market.

The Russell 2000 index has outshined with a nearly 9% climb month-to-date, in stark contrast to the tech-heavy Nasdaq 100’s 3.6% decline as of July 25.

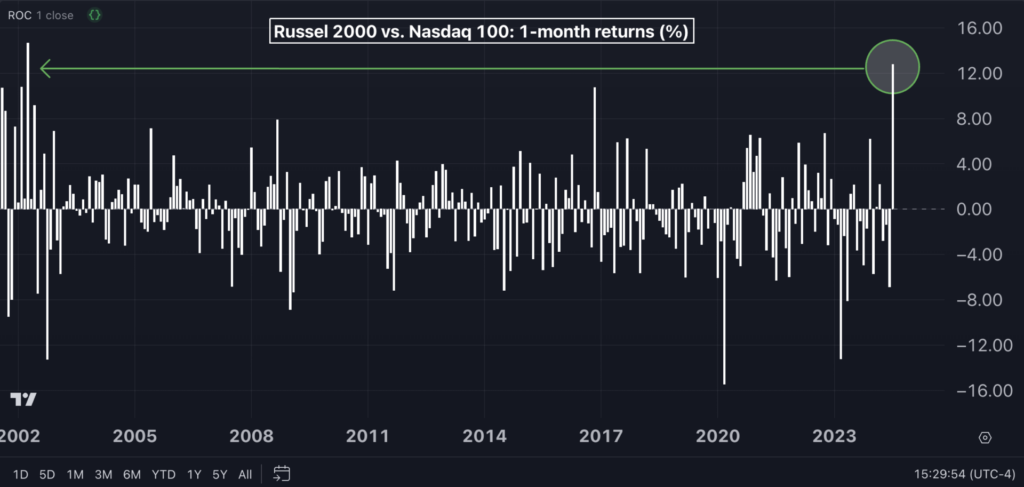

With a staggering 13-point performance differential favoring the Russell 2000 over tech, this marks the most exceptional month for the ‘long small cap, short tech’ trade since April 2002, indicative of the robust and swift market rotation in progress.

Chart: A Breakout Month For Small Caps vs. Tech Giants

Surge in Small-Cap ETF Inflows

The flourishing performance of small-cap stocks coincides with substantial influxes into major small-cap-focused ETFs.

The iShares Russell 2000 ETF (IWM), a leading U.S. small-cap index tracker, witnessed over $6 billion in net inflows this month, setting a new 2024 record, as per Etfdb.com data.

A slew of other small-cap ETFs also attracted significant investor capital in July:

- iShares Core S&P Small-Cap ETF (IJR): $645 million in net inflows

- Avantis U.S. Small Cap Value ETF (AVUV): $553.28 million in net inflows

- Invesco S&P SmallCap Momentum ETF (XSMO): $350 million in net inflows

- SPDR Portfolio S&P 600 Small Cap ETF (SPSM): $188 million in net inflows

Vanguard Small-Cap ETF (VB) and Pacer US Small Cap Cash Cows 100 ETF (CALF) have been the top choices for investors year-to-date, amassing $3.1 billion and $2.9 billion, respectively.

A Contrarian Outlook

While the Russell 2000 index flexes its muscles and small-cap ETFs bask in the limelight, some experts advocate prudence.

Wall Street veteran Ed Yardeni remains skeptical about the optimism surrounding smaller firms, especially in light of the presumed end of the Federal Reserve’s tightening cycle.

According to Yardeni, larger tech companies’ prowess stems from their vast cash reserves, enabling them to fuel extensive capital investments and R&D efforts, thus maintaining their competitive edge.

For example, Alphabet Inc., Amazon.com Inc., and Microsoft Corp. boast cash reserves amounting to billions, empowering them to undertake strategic acquisitions, as exemplified by Microsoft’s $10-billion stake in OpenAI.

Yardeni warns that the most promising companies may have already aligned with large-cap entities or private equity investors, signaling a potential return to larger-cap options in the near future.

Read Now:

Curious to delve deeper into small-cap stocks and ETFs? Keep the Benzinga Small Cap Conference on your radar for Oct. 10 in Chicago. Click here for more details.

Image generated using artificial intelligence via MidJourney.