Delving into the depths of Wall Street’s bullish views is a routine exercise for discerning investors seeking wisdom on where to steer their financial sails. The limelight, at present, shines upon Agnico Eagle Mines – a glinting gem amid the flurry of market activity.

The Illusion of Brokerage Recommendations for AEM

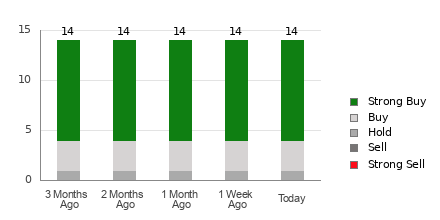

Analyst whispers often echo loud in the canyons of Wall Street, shaping narratives and nudging investors towards perceived profitability. Betwixt these murmurs lies Agnico Eagle Mines – adorned with an average brokerage recommendation (ABR) of 1.36, a beacon flirting between Strong Buy and Buy on the rating scale.

Weighting the feathers of past recommendations, Agnico Eagle Mines finds itself garlanded with 10 Strong Buy laurels and three sturdy Buy shields. A tapestry woven with affirmation and encouragement, where the winds of market fate seem inclined to favor the glittering wings of Agnico.

When lost in the tempestuous sea of stock market advice, clinging solely to brokerage recommendations might steer the ship aground. Analyst biases, entwined with vested interests, could lead astray those who trust blindly in these counsel. While the siren songs of Wall Street brokers can enchant, wisdom often lies in anchoring your decisions with powerful tools like the Zacks Rank.

The Zacks Rank, a compass calibrated by audited veracity, offers a true north in the cacophony of stock ratings. Its journey from Strong Buy to Strong Sell is grounded not in whims but in the solid earth of earnings estimate revisions. Aligning this north star with ABR could herald a lucrative port of call for investors seeking smooth waters amid the stormy seas of market uncertainty.

AEM: The Golden Fleece of Investment?

Gazing into the crystal ball of earnings estimate revisions for Agnico, one beholds a Zacks Consensus Estimate shining bright at $3.52 – up 9.8% from the recent past. Analysts, a chorus of optimism, raise their voices in unison, harmonizing their EPS estimates in symphonic crescendo.

This unanimous chant of growing faith in Agnico’s earnings potential has bestowed upon it the coveted Zacks Rank #2 (Buy). A tantalizing prospect, giving investors a golden compass rose to chart their course amidst the tumultuous tides of the market.

Divining the future remains an art rather than a science, yet Agnico’s Buy-equivalent ABR may well be the celestial map guiding investors toward the hidden treasures of the market.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.