How much weight should we give to Wall Street analysts’ recommendations when considering investment options? Do these recommendations truly hold sway over a stock’s trajectory? These are the questions swirling around the financial world, particularly in relation to one of the most talked-about stocks, Alibaba (BABA).

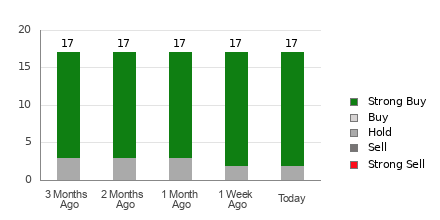

Currently, Alibaba boasts an Average Brokerage Recommendation (ABR) score of 1.24, based on assessments from 17 brokerage firms. This figure falls between Strong Buy and Buy on a scale ranging from 1 to 5. Among the 17 recommendations that contribute to this score, a staggering 88.2% are Strong Buy ratings.

Shifting Analyst Sentiments towards BABA

The numerical allure of the ABR for Alibaba may seem enticing, but history warns us against our blind allegiance. Studies have shown that while these recommendations may impact stock prices, they have a limited track record when it comes to accurately predicting a stock’s future value.

So, why the skepticism? Bias. Analysts representing brokerage firms harbor vested interests that skew their recommendations, with a tendency to shower stocks with inflated positivity. For every “Strong Sell” endorsement, there are typically five “Strong Buy” recommendations. This stark contrast in evaluations reveals a misalignment of interests between institutional analysts and retail investors.

Given this reality, it is wise to use brokerage recommendations as a supplementary tool rather than the crux of your investment strategy. Instead, consider incorporating more robust predictors, such as the Zacks Rank, to inform your decisions.

The Zacks Rank, a trusted stock rating tool, segregates stocks into five categories, from Strong Buy to Strong Sell. This tool leverages earnings estimate revisions to gauge a stock’s short-term performance, offering a more reliable compass for investors’ choices. When paired with the ABR, the Zacks Rank can imbue your investment strategy with greater certainty.

Deciphering ABR vs Zacks Rank

Although both the ABR and Zacks Rank utilize a 1 to 5 scale, their underpinnings are radically distinct.

ABR solely hinges on brokerage recommendations, displayed in decimal form. In sharp contrast, the Zacks Rank operates on a quantitative model driven by earnings estimate revisions, presented in whole numbers.

While brokerage analysts’ optimism colors ABR scores, Zacks Rank prioritizes the trajectory of earnings estimate revisions linked to stock performance.

Moreover, the dynamic nature of earnings revisions ensures the timeliness of Zacks Rank insights, providing a real-time reflection of a stock’s potential price movements.

Unlike ABR, illustrative of a static stance, the Zacks Rank remains in constant flux, mirroring market dynamics as they unfold. This adaptability, underscored by its grounding in earnings estimates, grants the Zacks Rank a leading edge in providing actionable insights for investors.

Intrigued by Alibaba’s Potential?

Recent data highlights a positive trajectory for Alibaba with a 1.9% surge in the Zacks Consensus Estimate for the current year, now standing at $8.94.

This elevation in earnings estimates signals a collective optimism among analysts, paving the way for a potential upswing in Alibaba’s stock value. This upward momentum translates into a Zacks Rank #2 (Buy) for Alibaba, further bolstering the case for investment.

For investors seeking top-performing stocks, exploring Zacks Rank #1 (Strong Buy) selections can unveil lucrative opportunities in the market landscape.

Thus, while the Buy-equivalent ABR for Alibaba beckons, harmonizing it with the insightful Zacks Rank evaluations can enhance the precision of your investment decisions.