When it comes to investing, the swirling opinions of Wall Street analysts can sway the tide of stocks. But, do these analyst recommendations sing a trustworthy tune or are they just background noise?

Before plunging into the choppy waters of financial forecasts, let’s decode the symphony of thoughts echoing from Wall Street regarding Deckers (DECK).

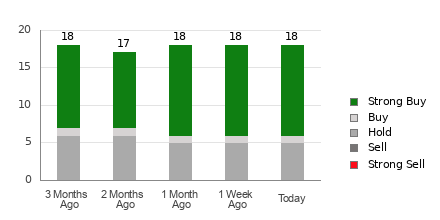

Deckers is currently adorned with an Average Brokerage Recommendation (ABR) of 1.61, perched between a Strong Buy and Buy on a scale ranging from 1 to 5. This golden number is a fusion of recommendations from 18 brokerage firms.

Among these 18 voices, 12 confidently chant “Strong Buy”, while one softly whispers “Buy”. This chorus of support paints a picture where enthusiasm outshines skepticism, with the bullish tunes chiming in at 66.7% and 5.6% respectively.

The Playing Field for DECK Recommendations

However, don’t bet the house solely on this virtuous song. History whispers stories of brokerage recommendations falling short in predicting the stock price tango. These analysts often paint stocks with rose-colored glasses, with “Strong Buy” recommendations flowing freely than “Strong Sells”.

So, rather than dancing to their tune, consider using their notes as an accompaniment to your own investment melody or seek a more reliable fortune-teller for stock trends.

A radiant star in the dark sky of uncertainties is the Zacks Rank, a beacon that shines light on stock performance. Ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), this seasoned navigator possesses a track record worth its weight in gold.

ABR vs Zacks Rank

While ABR might whisper sweet nothings based on brokerage whispers, Zacks Rank sings a different tune. It’s a chorus powered by earnings estimates revisions rather than brokerage melodies, offering a more harmonious prediction with a proven track record.

Unlike ABR’s occasional stale notes, Zacks Rank serenades you with real-time melodies, mirroring analysts’ latest forecast twists in stock prices. It’s a trustworthy fortuneteller in the unpredictable realm of investments.

Is DECK a Diamond in the Rough?

Peeking into Deckers’ crystal ball of earnings estimate revisions, the Zacks Consensus Estimate for this year holds steady at $30.59, unveiling a tale of stability.

With analysts maintaining a steady gaze at the company’s financial horizon, marching in unison with unchanged estimates, Deckers is bestowed with a Zacks Rank #3 (Hold), poised to sway in sync with the market’s heartbeat.

So, should you dance with delight to the Buy-equivalent ABR for Deckers? Exercise a tad of caution, for the market’s music can sometimes sway without warning.