Investors often hang on the words of Wall Street analysts when making critical decisions about stock investments. The musings of these institutional forecasters have been known to sway markets, nudging prices upwards or downwards with each tweak of their ratings. But do these pronouncements carry wisdom or mere whimsy?

Before delving into the subject of Devon Energy (DVN), the reliability of brokerage recommendations will be analyzed alongside insights on leveraging these forecasts to your advantage.

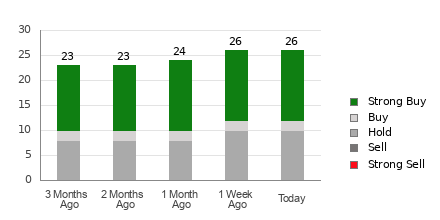

Devon Energy currently boasts an Average Brokerage Recommendation (ABR) of 1.85 on the 1 to 5 scale, signaling a consensus between Strong Buy and Buy based on the musings of 26 brokerage firms. Out of this pool, 14 exclaim Strong Buy and two vouch for Buy, ringing in at 53.9% and 7.7% of recommendations, respectively.

Understanding Brokerage Trends for DVN

The ABR gives a nod to Devon Energy, but relying solely on this numeric oracle may not be the wisest course. Research indicates that brokerage recommendations often miss the mark in steering investors to stocks offering the most potential for gains.

Why the cautionary tale, you ask? The incestuous relationship between brokerage firms and the stocks they cover often taints analyst ratings with a rosy hue. Surveys reveal that for every “Strong Sell” directive, these institutions pump out five “Strong Buy” commendations.

Thus, the interests of these firms frequently clash with those of retail investors, shedding dim light on a stock’s future trajectory. It is recommended to validate such insights with your analysis or a proven tool for anticipating price shifts.

Contrasting ABR and Zacks Rank

While both ABR and the Zacks Rank share the 1 to 5 spectrum, they epitomize contrasting philosophies.

ABR hinges solely on broker recommendations, sporting decimal points like 1.28. The Zacks Rank, conversely, operates as a quantitative model leveraging earnings estimate revisions, represented in whole numbers from 1 to 5.

Broker recommendations tend to veer towards optimism due to vested interests, serving as more of a distraction than a directive for investors. The Zacks Rank, conversely, leans on earnings estimate revisions, exhibiting a strong link with stock price movements in the short term.

The various grades under the Zacks Rank are evenly distributed across all stocks with earnings estimates from broker analysts. Thus, the tool maintains equilibrium among the five designations it assigns at any given time.

One key disparity between ABR and Zacks Rank is their currency. The ABR may lag in freshness, while the Zacks Rank, fueled by real-time earnings estimate revisions from analysts, stays nimble in predicting future price actions.

Is DVN a Diamond in the Rough?

Devon Energy’s earnings estimate for the current year, as per the Zacks Consensus Estimate, has risen by 1.4% in the past month, now standing at $5.41.

Analysts’ emerging bullishness towards the company’s earnings outlook, evident in unified upward revisions of EPS estimates, could herald an upswing for the stock in the near future.

Driven by recent estimate changes and other factors, Devon Energy flaunts a Zacks Rank #2 (Buy). For more top-ranking stocks, refer to the Zacks Rank #1 (Strong Buy) list.

Lucrative Hydrogen Investment Prospects

Envisioning a green future powered by hydrogen energy, the market projects a $500 billion demand by 2030, expected to quintuple by 2050. For prudent entrants, Zacks has earmarked three versatile juggernauts poised to spearhead the hydrogen revolution.

One has trumped markets over the past quarter-century with gains ranging from +2,400% to +380%.

Another commands $15 billion in commitments through 2027 for low-carbon hydrogen projects.

The third pick scaled 52-week peaks in Q4 2023 and boasts a decade-long annual dividend hike.

Access the free Stock Analysis Report for Devon Energy Corporation (DVN) here.