Investors often gauge stock performances based on analyst recommendations, but should these Wall Street evaluations be your go-to guide for investment decisions?

Before diving into the reliability of brokerage endorsements and how they can benefit you, let’s unveil what the industry stalwarts think about Micron (MU).

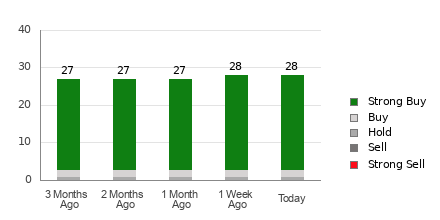

Micron currently garners an average brokerage recommendation (ABR) of 1.14 – hovering between Strong Buy and Buy on a scale of 1 to 5. This evaluation consolidates inputs from 28 brokerage firms, with Strong Buy and Buy commanding an overwhelming 96.4% of all endorsements.

Deciphering Brokerage Recommendations for MU

The ABR may flaunt a Buy tag for Micron, but solely relying on this metric could steer investors amiss. Studies indicate that these endorsements, often dictated by vested interests, fall short of predicting stocks poised for price hikes.

Why the caution? Brokerages’ inherent bias leads to an imbalanced ratio – five “Strong Buy” overpowers a solitary “Strong Sell.” This unbalanced scale reflects the divergence between institutional motives and retail investors’ interests, offering scant insights into a stock’s future trajectory.

Hence, instead of tethering your decisions solely on ABR, it might be judicious to supplement your analysis with a tried-and-tested tool instrumental in projecting stock price movements.

With an audited legacy, the Zacks Rank emerges as a robust stock rating tool, categorizing equities into five brackets, starting from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), a prudent companion in your investment journey.

Comparing ABR with Zacks Rank

While both ABR and Zacks Rank employ a 1 to 5 scale, they are distinct entities. ABR draws solely from broker recommendations, quantified in decimals, contrasting Zacks Rank that taps into earnings estimate revisions, displayed in whole numbers.

Unlike the optimism often clouding brokerage suggestions, Zacks Rank thrives on earnings estimate nuances, correlating robustly with short-term price trends.

Zacks Rank’s impartial grading extends to all stocks under the analyst radar, sustaining equilibrium among its stratified ranks, depicting a snapshot synchronized with dynamic market shifts.

Is Micron a Wise Investment?

Gauging Micron’s earnings forecast, the Zacks Consensus Estimate for the current year holds steady at $1.16 over the past month, exemplifying analysts’ resolute stance that could keep the stock sailing alongside the market.

Amid this consensus stability catapulting Micron to a Zacks Rank #3 (Hold), exercising prudence vis-à-vis the Buy-oriented ABR wouldn’t go amiss.

Showcasing an anomaly in the semiconductor realm, our top-performing chip stock, although minuscule compared to NVIDIA, promises greater potential as Artificial Intelligence, Machine Learning, and Internet of Things propel its growth amidst the soaring semiconductor landscape.

Projected to escalate from $452 billion in 2021 to $803 billion by 2028, the semiconductor sector triggers an investment journey laden with prospects and risks. Buckle up!