Investors’ reliance on Wall Street analysts’ recommendations before engaging in stock transactions is standard practice. These market soothsayers, albeit capable of influencing stock prices with their rating modifications, often leave investors pondering: are these recommendations truly valuable?

Before delving into the reliability of brokerage recommendations and their strategic utility, let’s examine what the heavyweight champions of Wall Street view about Workday WDAY.

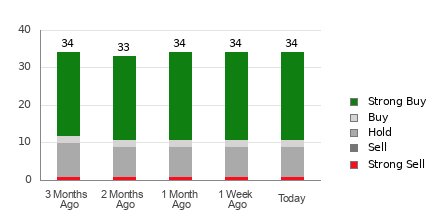

Currently, Workday boasts an average brokerage recommendation of 1.65, rated on a 1 to 5 scale (ranging from Strong Buy to Strong Sell). Computed from the actual recommendations (Buy, Hold, Sell, etc.) provided by 34 brokerage firms, an ABR of 1.65 hovers between Strong Buy and Buy.

Among the 34 recommendations factored into the current ABR, 23 are Strong Buy, while two are Buy. The Strong Buy and Buy ratings collectively make up 67.7% and 5.9% of all endorsements, respectively.

Deciphering the Trajectory of Workday’s Brokerage Recommendations

While the ABR depicts an endorsement for investing in Workday, making decisions purely based on this data warrants caution. Numerous studies have demonstrated that brokerage recommendations possess minimal efficacy in guiding investors towards stocks poised for substantial price appreciation.

But why, you may ask? The inherent bias of brokerage firms towards stocks they cover inclines analysts to provide overly positive ratings. Our research exposes a worrisome trend: for every “Strong Sell” counsel offered, brokerage firms furnish five “Strong Buy” recommendations.

Consequently, their allegiances do not consistently align with those of individual investors, offering scant insight into a stock’s future price trajectory. Therefore, it is prudent to utilize this information for corroborating personal research or as a signal to complement a reliable indicator effectual in forecasting stock price movements.

Backed by a robust external audit record, our proprietary stock rating mechanism, the Zacks Rank, categorizes equities into five tiers, spanning from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). Thus, cross-validating the ABR with the Zacks Rank could be instrumental in making astute investment choices.

Dissimilarities Between the Zacks Rank and ABR

Although both the Zacks Rank and ABR adopt a 1 to 5 scale, they are fundamentally disparate metrics.

Broker recommendations solely influence the determination of the ABR, typically represented in decimals (e.g., 1.28). Conversely, the Zacks Rank operates on a quantitative model leveraging earnings estimate revisions, displayed as whole numbers ranging from 1 to 5.

A consistent trend persists: brokerage analysts, due to their employer’s vested interests, tend to be unduly optimistic in their recommendations. This propensity results in ratings that exceed the support provided by their research, thereby leading investors astray more often than guiding them.

In contrast, the Zacks Rank is steered by earnings estimate revisions. Studies affirm a strong correlation between near-term stock price shifts and trends in earnings estimate revisions.

Furthermore, all stocks benefiting from current-year earnings estimates supplied by brokerage analysts are proportionately assigned the various Zacks Rank grades. This ensures an equitable dispersion across the five ranks.

Another salient point of deviation between the ABR and Zacks Rank is timeliness. The ABR may not always offer contemporaneous data, whereas the Zacks Rank swiftly incorporates earnings estimate revisions from brokerage analysts, thus providing timely insights into future price actions.

Assessing the Investment Appeal of Workday

Regarding Workday’s earnings estimate revisions, the Zacks Consensus Estimate for the ongoing year has ascended by 0.2% in the last month, settling at $6.97.

The burgeoning optimism exhibited by analysts towards the company’s earnings outlook, manifested in their collective fervor to revise EPS estimates upwards, may spur the stock to scale new heights shortly.

The substantial modification in the consensus estimate magnitude, coupled with other factors associated with earnings estimates, has culminated in a Zacks Rank #1 (Strong Buy) endorsement for Workday.

Therefore, the equivalence to a Buy in terms of ABR for Workday may serve as a guiding beacon for investors.

© 2024 Benzinga.com. Benzinga refrains from dispensing investment advice. All rights reserved.