Investors habitually hang on Wall Street analysts’ every word when considering their investment decisions, believing that their recommendations hold the key to unlocking profitable opportunities. But do these endorsements truly hold water?

Before delving into that debate, let’s dive into the landscape of Wall Street analysis for Netflix (NFLX) and explore the intricacies of brokerage recommendations to decipher their utility in shaping investment strategies.

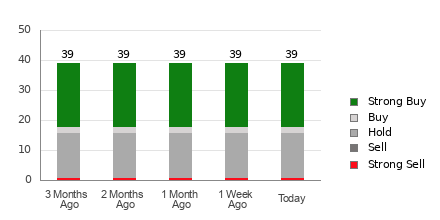

At present, Netflix garners an average brokerage recommendation (ABR) of 1.91 on a scale of 1 to 5, translating to a rating that falls between Strong Buy and Buy. This consensus is the result of assessments provided by 39 brokerage firms, showcasing 21 Strong Buy ratings and two Buy ratings. Notably, Strong Buy and Buy recommendations together constitute 59% of the total pool.

Exploring Shifts in Brokerage Recommendations for NFLX

While the ABR leans towards recommending a buy position on Netflix, prudence dictates that investors refrain from hinging their investment decisions solely on this metric. Research indicates that brokerage recommendations have shown limited efficacy in identifying stocks poised for significant price appreciation.

Wondering why? Brokerage firms, due to their vested interest in the stocks they cover, have a proclivity to favor positive ratings. For every “Strong Sell” rating, they often assign five “Strong Buy” ratings, underscoring a pronounced optimistic bias. This disparity highlights the misalignment between institutional interests and that of individual investors, offering limited insights into the potential trajectory of a stock’s price movement.

Hence, it is advisable to view brokerage recommendations as a supplementary tool to fortify one’s own analysis or to consider robust systems adept at predicting stock price dynamics.

Enter Zacks Rank, a proprietary stock evaluation mechanism boasting a verifiable track record, segmenting stocks into five strata based on performance projection—ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). Cross-referencing the ABR with the Zacks Rank could furnish investors with a potent lens for informed decision-making.

Deciphering Zacks Rank Against ABR

Although both the Zacks Rank and ABR operate within a 1-5 scale, their methodologies diverge starkly.

Broker recommendations serve as the foundational element for computing the ABR, typically articulated in decimals, whereas the Zacks Rank revolves around a quantitative model leveraging earnings estimate revisions and is presented in whole numbers.

Historically, brokerage analysts exhibit a strong tilt towards optimistic ratings, driven by institutional bias, contrary to the Zacks Rank, which centers on earnings estimate trends. Notably, empirical evidence underscores a robust correlation between earnings estimate revisions and immediate stock price variations.

Further distinguishing factors include the seamless integration of Zacks Rank updates, reflecting the latest earning estimate modifications propelling timely insights into prospective price movements compared to the possibly stale ABR assessments.

Considering Investment Prospects for NFLX

Reviewing Netflix’s earnings estimate revisions reveals a stagnant Zacks Consensus Estimate of $19.08 for the current fiscal year over the past month.

The static nature of analysts’ sentiment towards Netflix’s earnings outlook, embodied by the unchanged consensus estimate, could reasonably drive the stock’s performance in tandem with the broader market in the short term.

Bolstering this assertion is the recent Zacks Rank #3 (Hold) classification for Netflix, influenced by the modest changes in the consensus estimate alongside other earnings-related parameters. You can peruse the list of current Zacks Rank #1 (Strong Buy) stocks here.

Given these dynamics, a cautious approach towards Netflix’s buy-equivalent ABR seems prudent amidst the existing market conditions.

Curated Stock Recommendations: 7 Best Picks for the Next 30 Days

Recent recommendations spotlight seven premier stocks curated from a list of 220 Zacks Rank #1 Strong Buys, heralding them as “Most Likely for Early Price Pops.”

Since 1988, this elite list has outperformed the market twofold, boasting an annual average gain exceeding +23.7%. Hence, it is advisable to pay keen attention to these meticulously selected options. Dive in now

Seeking the latest insights from Zacks Investment Research? Access a comprehensive overview of 5 Stocks Set to Double here.

For further analysis and scrutiny of Netflix, Inc. (NFLX), refer to the detailed report on Zacks.com.

Stay updated with the financial trends by exploring Zacks Investment Research.