Netflix has once again proven its mettle in the streaming wars, delivering a stellar third-quarter 2024 performance that cements its position as the industry leader. The company’s impressive earnings beat and raised guidance make it a compelling case for investors looking to capitalize on the growing digital entertainment market.

In a knockout quarter, Netflix reported earnings of $5.40 per share, surpassing the Zacks Consensus Estimate by 6.09% and posting a remarkable 44.8% year-over-year increase. This exceptional growth in profitability underscores Netflix’s ability to efficiently monetize its vast content library and growing subscriber base. Revenues also impressed, reaching $9.82 billion, marking a robust 15% year-over-year increase and beating the consensus mark by 0.6%.

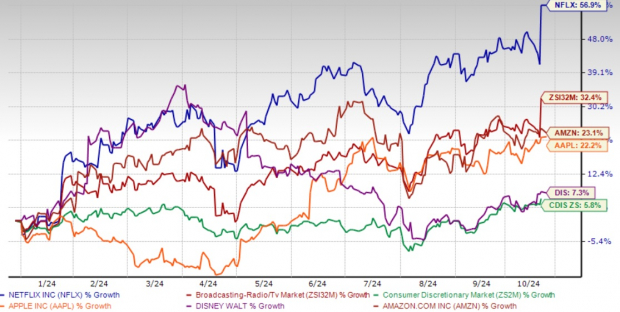

Year-to-date Performance

Image Source: Zacks Investment Research

Netflix Ascends: Surge in Users, Live Sports, and Ad Potential Ahead

Netflix’s subscriber growth remains strong, with 5.07 million new additions bringing the total to an impressive 282.72 million paid subscribers across more than 190 countries. This continued expansion, coupled with healthy engagement levels of about two hours of viewing per member per day, demonstrates the enduring appeal of Netflix’s content and service offerings.

Netflix expects paid net additions to be higher sequentially in the fourth quarter due to normal seasonality and a strong content slate. The Zacks Consensus Estimate projects substantial growth in paid subscribers, with total paid memberships expected to reach 290.54 million by the end of 2024, indicating an 11.6% year-over-year increase.

Netflix is now looking to expand into new areas, such as live events, including the Mike Tyson and Jake Paul boxing match on Nov. 15 and two Christmas Day NFL games, with the Kansas City Chiefs facing the Pittsburgh Steelers and the Baltimore Ravens facing the Houston Texans.

In the fourth quarter, members will be able to choose from hit returning series Squid Game S2, Outer Banks S4, and Love is Blind S7, as well as new dramas like Black Doves from the United Kingdom and comedies like No Good Deed and Man on The Inside. Netflix’s unscripted offerings include Aaron Rodgers: Enigma, which chronicles the life and career of the NFL legend, and the second season of the music competition series Rhythm + Flow. The company’s film slate includes action-thriller Carry-On, war drama The Six Triple Eight, and Spellbound, produced by John Lasseter.

Netflix’s advertising tier is proving to be a game-changer, with membership growing 35% quarter over quarter. The planned launch of an in-house ad tech platform in 2025 signals Netflix’s commitment to maximizing this new revenue stream, with ad revenues expected to roughly double year over year in 2025.

Financially, Netflix is firing on all cylinders. Operating income surged 51.8% year over year to $2.9 billion, with operating margin expanding an impressive 720 basis points to 29.6%. The company’s robust free cash flow of $2.19 billion, up from $1.21 billion in the previous quarter, provides ample resources for content investment and shareholder returns.

Netflix has raised its guidance for 2024, projecting revenue growth at the high end of its previous 14-15% range. The company also increased its operating margin forecast to 27%, up from the earlier estimate of 26%. For 2025, Netflix anticipates continued strong performance with revenue growth of 11-13% to $43-$44 billion and an operating margin of 28%.

The Zacks Consensus Estimate for 2024 revenues stands at $38.89 billion, indicating 15.33% year-over-year growth. The consensus mark for earnings is pegged at $19.67 per share, indicating a substantial 63.51% increase from the previous year.

Image Source: Zacks Investment Research

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

The Path Ahead: Adjustments Required for Netflix

Despite Netflix’s third-quarter 2024 earnings beat and raised guidance, the company’s subscriber growth of 5.07 million pales in comparison to the 8.76 million added in the same quarter last year, reflects the impact of the crackdown on password sharing between customers that kicked off in 2023. With total debt reaching $15.98 billion and streaming content obligations at $22.7 billion, Netflix faces significant financial commitments.

The recent surge in Netflix’s stock price has led to expanded valuation multiples, potentially limiting future upside for investors. The company’s forward 12-month sales multiple of 7.71 exceeds its five-year median of 6.44, indicating that the stock may be trading at a premium to its historical valuation. Moreover, this multiple surpasses the Zacks Broadcast Radio and Television industry’s forward earnings multiple of 2.98, suggesting that Netflix’s valuation is stretched relative to its peers.

Price-to-Sales (Forward 12 Months)

Image Source: Zacks Investment Research

Final Verdict

For investors pondering whether Netflix stock is a buy post third-quarter earnings, the answer appears to be a resounding yes. The company’s strong financial performance, subscriber growth, content success, and expansion into new revenue streams like advertising all point to a bright future. As Netflix continues to evolve and strengthen its position in the global entertainment landscape, it presents an attractive opportunity for investors looking to capitalize on the ongoing shift to digital content consumption. With its robust growth trajectory, expanding profit margins, and strategic initiatives, Netflix stands out as a compelling investment in the ever-expanding world of streaming entertainment. Netflix currently has a Zacks Rank #2 (Buy).