Is it possible for a tech giant with a massive market cap exceeding $2.5 trillion to ever be viewed as an underdog? While it may seem unlikely, in the realm of the “Magnificent Seven” tech giants, Apple (NASDAQ: AAPL) stands out as a potential dark horse.

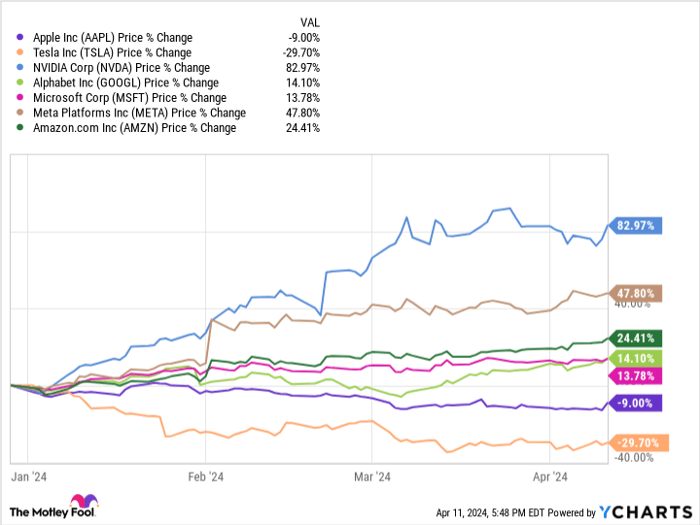

Throughout this year, Apple has faced a downward trend, with its shares experiencing a 9% decline since the start of the year. The company finds itself trailing behind its Magnificent Seven counterparts, with the exception of Tesla. Despite challenges causing concern among investors, there remains a glimmer of hope that Apple could stage a remarkable comeback, offering substantial returns in the long haul. The question arises: Is now the opportune moment to consider acquiring shares in Apple?

The Dilemma Facing Apple

Apple’s challenges have been festering long before the current year. Critics have continuously pointed out that while the iPhone remains Apple’s major revenue driver, its growth impetus has dwindled. The stark reality of this conundrum was starkly portrayed in one of Apple’s primary international markets, China, where iPhone shipments have been on a decline.

This stagnation poses a threat to Apple’s long-term trajectory. Additionally, while other tech giants are notably forging ahead in the realm of artificial intelligence (AI), Apple seems to be lagging. Given the potential that AI holds as a significant growth catalyst for tech companies, Apple’s lack of strides in this domain raises concerns, especially considering its iPhone-related setbacks.

Moreover, Apple is currently entangled in an antitrust lawsuit initiated by the U.S. Department of Justice (DOJ) and encompassing over a dozen states. The lawsuit alleges Apple’s monopolistic dominance in the U.S. smartphone market, with accusations of stifling innovation and unfairly suppressing competitors to the detriment of consumers. This legal battle could extend over an extended period, injecting an element of unpredictability into Apple’s future prospects—a factor that seldom sits well with the market.

Despite the likelihood of lackluster financial results in the immediate term, Apple’s rich history of success should not be discounted. Past performance does not guarantee future outcomes, yet the significance of adept management and a culture of innovation cannot be overstated as crucial elements propelling a company’s prosperity.

Apple has cultivated a culture synonymous with innovation, continually injecting fresh and captivating elements into existing technologies. Leveraging its robust brand identity and legion of steadfast customers, the company continues to rake in massive revenues from these ventures.

Can Apple replicate this success in the AI landscape? Reports suggest that Apple is honing its focus in this area, although specifics remain shrouded in secrecy. Recently, Apple researchers acclaimed their generative AI platform’s superior performance compared to GPT-4, ChatGPT’s latest iteration, across certain queries—a claim substantiated in a published research paper.

Investors await tangible outcomes and the implications of Apple’s AI endeavors on its financial standing. Nevertheless, placing faith in Apple’s ability to emerge as a frontrunner in this sector does not hinge on blind faith.

Furthermore, Apple continues to bolster its services segment, a small but burgeoning revenue stream for the company. In the initial quarter of fiscal year 2024, concluding on December 30, 2023, Apple’s services revenue surged by 11.3% annually to reach $23.1 billion, contrasting a mere 2% yearly growth in total net sales to $119.6 billion.

From fintech pursuits with Apple Pay to the integration of various health-centric features, Apple’s services arm carries immense potential for further advancements. But what about the looming specter of the DOJ lawsuit?

In a worst-case scenario, Apple could be compelled to fragment its operations into smaller entities. Though such an outcome remains speculative, historical antitrust litigations against major corporations have seldom resulted in such a drastic measure. Moreover, Apple’s robust cash flows provide a cushion to absorb any legal expenditures.

AAPL Free Cash Flow data by YCharts.

Despite the looming lawsuit, Apple’s innovative prowess, sturdy operational foundation, and unwavering customer loyalty, spanning a staggering 2.2 billion devices, continue to underline its appeal among investors. For investors eyeing a prolonged investment horizon of five years and beyond, a cautious optimism and strategic nibbling at Apple’s shares during its downturn could prove rewarding.

Is Apple a Viable $1,000 Investment Today?

Before plunging into Apple stock, a prudent consideration is in order:

The Motley Fool Stock Advisor analyst team has pinpointed 10 stocks they believe hold immense promise for investors, with Apple failing to make the cut. These identified stocks harbor the potential to yield significant returns in the forthcoming years.

The Stock Advisor service furnishes investors with a roadmap to success, offering guidance on portfolio construction, periodic updates from analysts, and two fresh stock recommendations monthly. Since 2002, the Stock Advisor service has surpassed the S&P 500’s returns threefold*.

*Stock Advisor returns as of April 15, 2024