JD.com, with its remarkable 60% surge in stock value over the past year, has captivated the interest of investors. This Chinese e-commerce giant is strategically positioned to carry forward its momentum into the crucial holiday season. Against the backdrop of a recovering retail environment, as illustrated by the recent September Commerce Department report showing a 0.4% increase in retail sales, JD.com stands tall.

The macroeconomic climate has shifted positively since the hurdles of 2023, particularly highlighted by the Federal Reserve’s recent 50-basis point rate cut – the first since March 2020. This development marks a stark departure from the previous tightening cycle, which witnessed rates climbing 525 basis points to a 23-year peak. Lower interest rates, combined with a decrease in gasoline prices, are empowering consumers to spend more freely on discretionary goods, presenting an opportune setting for retailers like JD.com.

Looking forward to the holiday season, prospects appear especially bright for JD.com. Adobe Analytics projects online sales to hit $240.8 billion during this holiday season, marking an 8.4% year-over-year ascent. Additionally, mobile shopping is anticipated to reach a record $128.1 billion, a 12.8% surge from the previous year – a trend that perfectly complements JD.com’s robust digital infrastructure and innovative technological solutions.

JD.com’s Stellar 1-Year Performance

Image Source: Zacks Investment Research

JD.com Redefines Retail With AI & Omnichannel Strategy

The comprehensive e-commerce business model of JD.com remains a cornerstone of strength, offering a wide array of products from electronics to home appliances. Strategic alliances with renowned international brands like French luxury fashion group SMCP (showcasing brands such as SANDRO, MAJE, and CLAUDIE PIERLOT) highlight JD.com’s ability to draw and retain upscale retailers on its platform.

JD.com’s strong partnership with Walmart is worth noting, providing support for Walmart and Sam’s Club Flagship Stores on its platform while furnishing them with fulfillment solutions.

An essential competitive advantage for JD.com lies in its advanced supply chain and logistics network, powered by cutting-edge technology in AI, big data analytics, and cloud computing. This technological prowess has allowed JD.com to construct a smart supply-chain platform overseeing processes from manufacturing and procurement to final-mile delivery. Through its majority-owned subsidiary, Dada, in collaboration with JD Logistics, the company offers efficient on-demand and last-mile delivery services, particularly for grocery and fresh items via JD Daojia.

JD.com’s omnichannel strategy distinguishes it from competitors like Alibaba and PDD Holdings. The launch of JD MALL, an offline store providing over 200,000 items from 200 brands, signifies a significant step towards blending online and offline retail experiences. The company’s foray into the offline fresh food market through 7FRESH further underscores its dedication to delivering comprehensive shopping solutions, especially relevant as Cyber Week sales are forecasted to climb 7% year over year, touching $40.6 billion and constituting 16.9% of total holiday season sales.

Upward Estimate Revision Signals Bright Future for JD.com

JD.com’s robust relationships with suppliers, brands, and partners position it for sustained growth. The company’s nationwide fulfillment infrastructure ensures swift, efficient, and dependable delivery services, enhancing customers’ overall shopping experience.

The Zacks Consensus Estimate for 2024 revenues stands at $159.34 billion, reflecting a 4.7% year-over-year advance. The consensus mark for 2024 earnings sits at $3.97 per share, indicating a year-over-year growth of 27.2%.

Image Source: Zacks Investment Research

JD.com Stock: An Undervalued Gem in E-commerce Sector

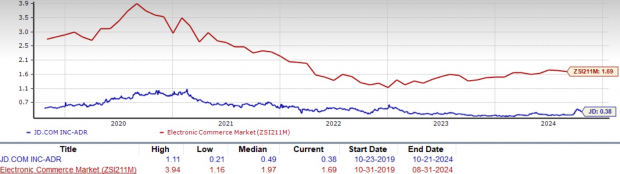

JD.com is currently trading at a discount, boasting a forward 12-month Price/Sales of 0.38X vis-à-vis the Zacks Internet – Commerce industry’s 1.72X. This discrepancy suggests that the stock is notably undervalued, potentially offering an attractive investment prospect for individuals seeking value in the e-commerce domain. The substantial valuation gap indicates that the market may not be fully acknowledging JD.com’s sturdy fundamentals, robust logistics infrastructure, and growth potential, especially in anticipation of the promising holiday season.

Price-to-Sales Ratio (Forward 12 Months)

Image Source: Zacks Investment Research

Conclusion: JD.com Primed for Exceptional Performance

For investors evaluating JD.com, the convergence of favorable macroeconomic conditions, robust e-commerce growth projections, and the company’s technological and operational prowess presents a compelling investment opportunity ahead of the holiday season. The company’s holistic retail approach, integrating advanced technology, resilient logistics, and strategic partnerships, indicates its readiness to leverage the anticipated upsurge in holiday shopping while upholding its competitive stance through continual innovation and service excellence.

Endowed with a Zacks Rank #1 (Strong Buy) and a Growth Score of A, JD.com offers substantial investment promise. Interested investors can explore the full list of today’s Zacks #1 Rank stocks here.

Infrastructure Stock Boom to Sweep America

A colossal endeavor to revamp the dilapidated U.S. infrastructure is imminent. It’s bipartisan, urgent, and certain. Trillions will be invested, fortunes will be amassed.

The only query remains – “Will you engage with the right stocks early, when their growth potential is at its zenith?”

Zacks has unveiled a Special Report aimed at aiding you in exactly that, and today, it’s complimentary. Uncover 5 exceptional companies poised to soar.