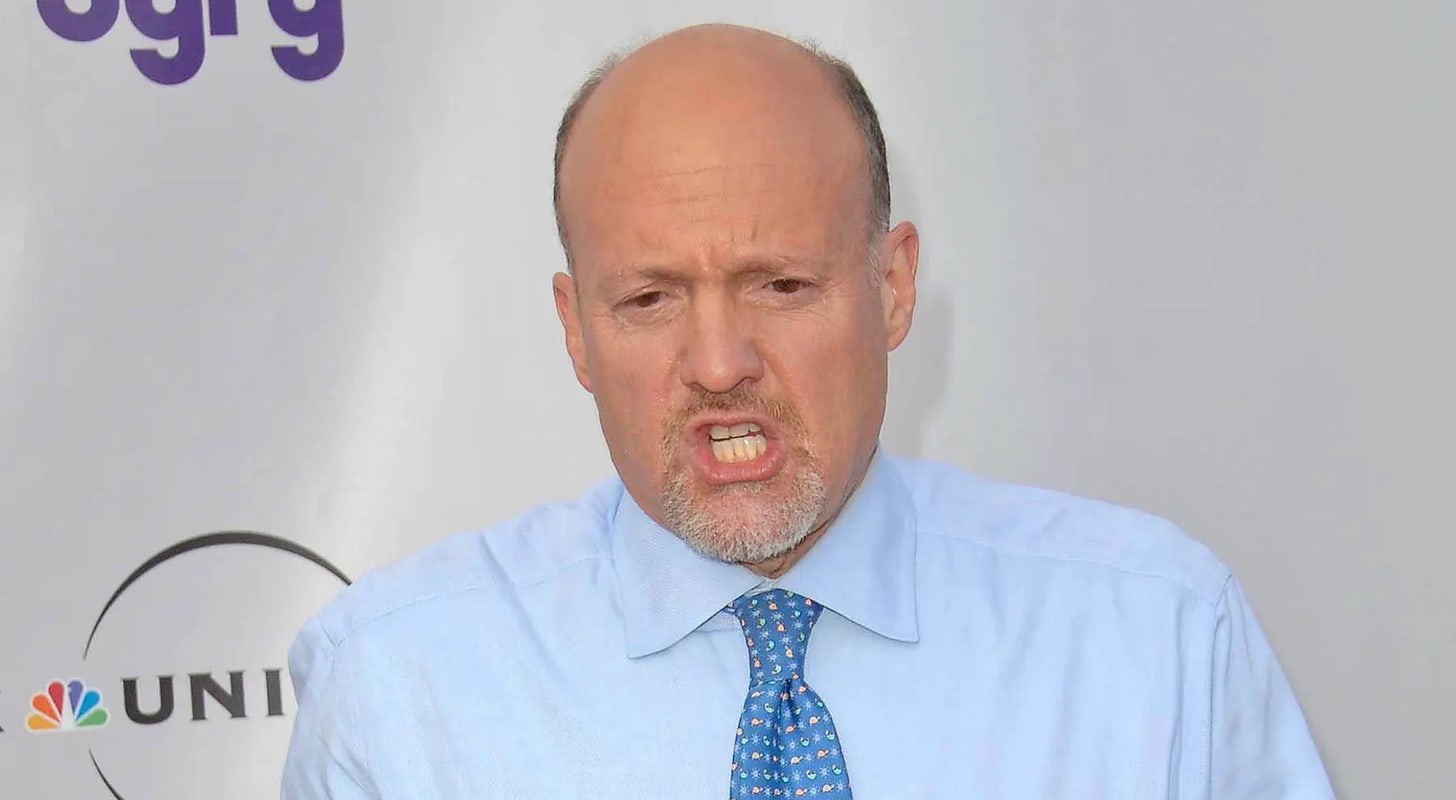

Host of CNBC’s “Mad Money Lightning Round,” Jim Cramer expressed his enduring affinity for Woodward, Inc. WWD.

Woodward’s first-quarter financial results outperformed expectations with adjusted earnings of $1.45 per share, surpassing the market estimate of $1.10 per share. The company reported quarterly sales of $787.00 million, exceeding forecasts of $748.29 million.

On the topic of Starwood Property Trust, Inc. STWD, Cramer challenged the dire forecast of CEO Barry Sternlicht. Sternlicht’s recent prediction estimated office real estate losses to reach $1 trillion.

Starwood Property Trust is set to release its fourth quarter and full year 2023 financial results on Feb. 22, 2024, before the opening bell.

Referring to Simpson Manufacturing Co., Inc. SSD, Cramer described it as a “classic stock to own.”

Ahead of its fourth-quarter financial results report scheduled for Feb. 5, 2024, Simpson Manufacturing carries Cramer’s stamp of approval.

When asked about Super Group (SGHC) Limited SGHC, despite his curiosity about the company, Cramer remained resolute in his support for DraftKings Inc. DKNG.

Super Group reported a 16% increase in third-quarter revenue to €356.9 million in November.

“It’s too low,” proclaimed Cramer when discussing Devon Energy Corporation DVN. “Buy Devon at $40.”

On Jan. 24, Raymond James analyst John Freeman maintained Devon Energy with an Outperform rating while lowering the price target from $53 to $52. Piper Sandler analyst Mark Lear also maintained the stock with an Overweight rating, with a decreased price target from $61 to $59.

Price Action:

- Devon Energy shares dropped 3% to close at $42.02 on Wednesday.

- Super Group shares fell 2.5% to $3.13 on Wednesday.

- Simpson Manufacturing shares declined 3.9% to settle at $180.99 in Wednesday’s session.

- Starwood Property Trust shares decreased 3.2% to close at $20.33 on Wednesday.

- Woodward shares fell 2.6% to settle at $137.77.

Image: Shutterstock