The 2024 Q2 earnings season is well underway with a slew of crucial reports scheduled for the upcoming week. The financial landscape thus far has remained buoyant, with major banks’ results failing to spook the markets.

Looking ahead, several prominent members of the Mag 7, such as Meta Platforms, Amazon, and Apple, are set to unveil their earnings. These three stocks have been stellar performers in 2024, leaving investors pondering if their winning streak can persist.

Let’s delve deeper into how these tech giants stand as they approach their earning releases.

Apple’s China Sales in the Limelight

Apple’s stock faced scrutiny earlier in 2024 due to a sluggish start but has since gained significant momentum, boasting a 14% year-to-date increase. Concerns over China and the lag in AI innovation had initially cast shadows, but recent developments have allayed these worries.

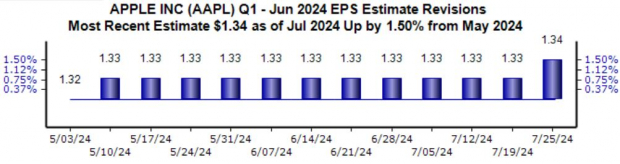

With a Zacks Rank #2 (Buy), Apple’s earnings forecast for the upcoming period has been on an upward trajectory over recent months. The anticipated $1.34 per share signifies a 6% rise from the corresponding period last year, with sales also expected to climb by 2.7% on a year-over-year basis.

Image Source: Zacks Investment Research

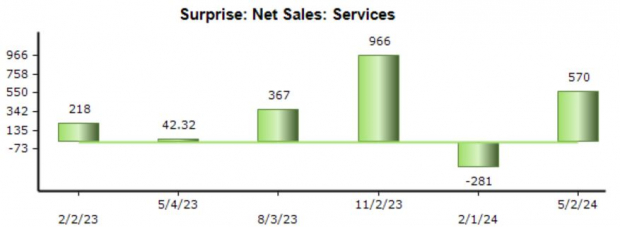

While Apple faced challenges in China during the latest period, sales mostly aligned with expectations, showing improvement compared to previous quarters. Reassuring news regarding iPhone shipments in China has emerged recently, further allaying concerns. Investors are also keen on Apple’s Services segment, which has been a robust source of growth, diminishing the company’s dependence on iPhone sales.

The chart below illustrates consistent outperformance in Apple’s Services segment, barring a single instance.

Image Source: Zacks Investment Research

Amazon’s AWS Takes the Center Stage

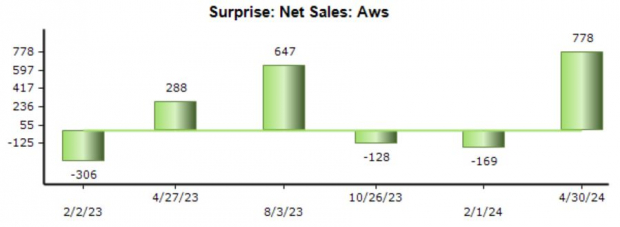

Amazon shone bright in its recent financial period, with an operating income of $15.3 billion representing a remarkable 220% year-over-year surge. Notably, AWS delivered stellar results, with net sales rising by 17% to $25 billion, breaking a streak of negative surprises in this metric.

Despite concerns of a cloud slowdown in previous periods, Amazon’s recent financial performance paints a positive picture heading into the upcoming earnings release.

Image Source: Zacks Investment Research

Earnings and revenue projections for the upcoming quarter have been somewhat subdued, but a substantial growth is anticipated, with EPS expected to rise by 63% on a 10% increase in sales. Enhanced cost management and operational efficiencies have significantly bolstered profitability, leading to considerable margin expansion.

It’s important to note that the following chart reflects data on a trailing twelve-month basis.

Image Source: Zacks Investment Research

Meta Platforms Under the CapEx Lens

Meta Platforms’ enhanced operational efficiencies have significantly boosted its bottom line in recent quarters. The upcoming report will shed light on Capital Expenditure (CapEx) trends, particularly concerning AI, an area that garnered attention in Alphabet’s recent quarterly announcement.

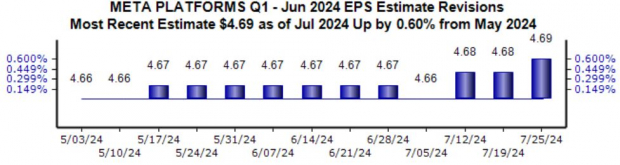

With earnings estimates on the rise in recent months, the expected EPS of $4.69 signals a robust 45% year-over-year growth.

Image Source: Zacks Investment Research

Regarding key metrics, the Zacks Consensus Estimate for Meta Platforms’ Advertising revenue stands at $37.5 billion, marking a 20% increase from the same period last year. Notably, Alphabet’s Advertising segment demonstrated strong performance, with sales climbing by 12% year-over-year to $64.6 billion.

Following a disappointing set of quarterly results, Meta Platforms’ stock took a hit, attributed to a higher CapEx guidance for the current fiscal year. This development will be closely scrutinized by investors, especially after Alphabet’s unsettling CapEx update.

Wrapping Up

The 2024 Q2 earnings season is in full swing, with a packed schedule of important reports this week. Expectations are high for another positive performance, driven by the continued strength of the Tech sector.

This week will see several Mag 7 members, including Meta Platforms, Amazon, and Apple, revealing their results. Given their impressive run in 2024, these reports are bound to receive meticulous examination, making it a pivotal week in the Q2 earnings cycle.